GBP/USD:

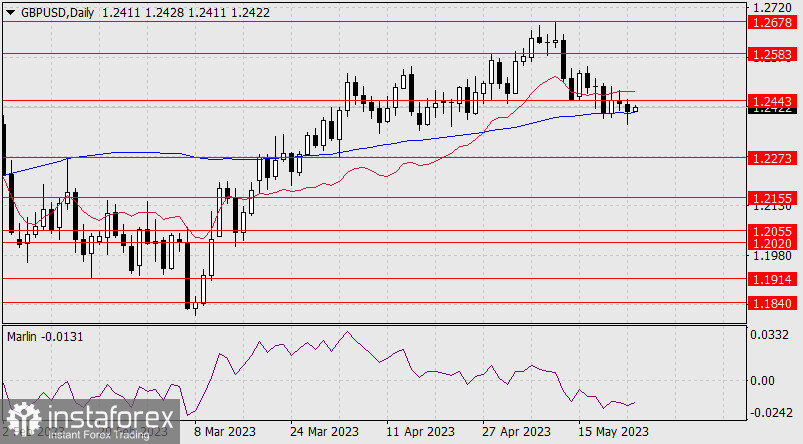

Yesterday, the British pound struggled to fall below the support of the MACD indicator line on the daily chart, but was prevented by related currencies that did not want to yield to the dollar "ahead of time". As a result, the price continues to consolidate between the MACD line and the level of 1.2443. The Marlin oscillator evaluates the current situation as a correction, as it turns upwards.

Since the situation is moving towards growth, the role of our recent positioning increases: "Price consolidation above 1.2443 can give new strength to the bulls, but it may not be enough for the price to advance towards the high of 1.2583, as there are many intermediate levels formed since April along this path."

On the 4-hour chart, a double convergence of price with the oscillator has formed. Marlin is already in positive territory. Climbing above the nearest resistance at 1.2443 will open the target at 1.2480, which is the MACD indicator line. To build a downward movement and strengthen it, the price needs to settle below yesterday's low at 1.2372. In this case, the convergence will be broken (the signal line will move below the forming line).