Negotiations on the US debt limit are ongoing, but there has been no progress. The lack of progress as the "D-day" approaches has affected risk sentiment, with the US stock market losing an average of over 1% at the close, followed by stock markets in the Asia-Pacific region and Europe entering the red zone.

As warned by JPMorgan in a statement published on Monday, the US stock market risks facing a sharp sell-off if no agreement is reached on the debt limit, as an actual US economic default could occur on June 1.

Oil prices rose over 1% after Saudi Arabia's Minister of Energy Prince Abdulaziz bin Salman on Tuesday told market speculators to "watch out," and tell them to "be careful". It seems that OPEC+ is preparing another surprise.

NZD/USD

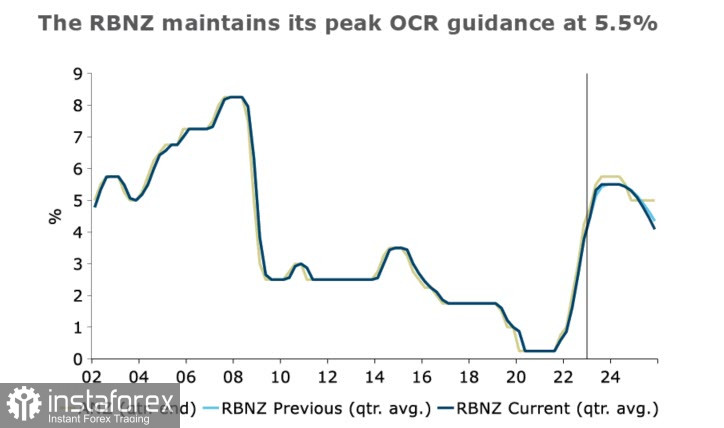

As expected, the Reserve Bank of New Zealand (RBNZ) raised the official cash rate (OCR) by 25 basis points to 5.50%, but overall, the tone and OCR forecast were not as hawkish as anticipated.

The rate forecast is almost identical to February's, with a peak at 5.5% and the beginning of rate cuts in the second half of 2024. Not everyone shares the same view. For example, ANZ Bank sees a higher rate and argues its forecast based on several observations, such as the likelihood of housing price growth, high migration rates, and a low unemployment level that could persist for a long time.

It appears that the RBNZ no longer sees the task of cooling the economy as a necessary factor in lowering inflation. Forecasts show the mildest recession: GDP declines by 0.2% in the second quarter and 0.1% in the third quarter. The peak unemployment rate is 5.4% instead of 5.7%.

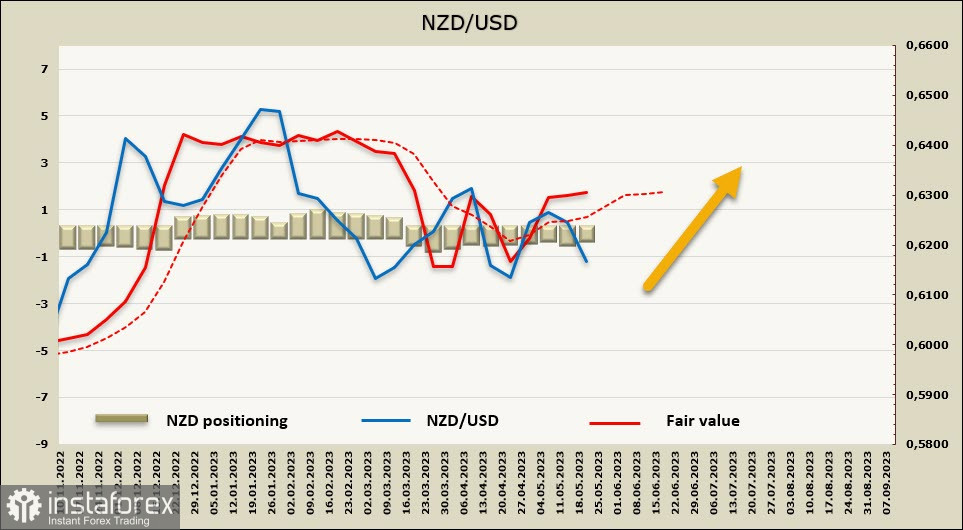

The markets interpreted the RBNZ's decision as a willingness to go below expectations and reacted with kiwi sell-offs and lower bond yields. It seems that the kiwi will fall from the range it has been in since February. This means that it will break through the range downwards and not up.

The NZD futures market positioning remains neutral, with net short positions decreasing by 0.2 billion to -0.13 billion during the reporting week. The calculated price is still above the long-term average, but in light of the outcome of the RBNZ meeting, we can expect a downward reversal.

Last week, we expected the NZD/USD pair to try and break out of the range upwards; however, the RBNZ's decision completely changes all forecasts. The driver that could strengthen the bullish sentiment has disappeared, and now the probability of testing the support level of 0.6079 and further decline towards the technical level of 0.6020 looks more convincing.

AUD/USD

Australia's PMIs reflect the global trend for most developed countries - the manufacturing sector is slowing down, while growth is supported by the services sector. The manufacturing index remained in contraction territory at 48.0, while the services sector showed growth, at 51.8 in May compared to 53.7 in April.

Wage growth in Australia as a significant factor for inflation has decreased to 3.4% YoY, which can be considered a positive factor. However, in its latest review, the NAB Bank draws attention to the fact that there was no growth in labor productivity in 2022 and calculates that wage data is underestimated by at least a third, as seasonal factors are not fully taken into account.

As a result, a sharp surge in wage growth is possible in the second quarter, which will increase inflation expectations and compel the Reserve Bank of Australia (RBA) to revise its inflation forecast. Currently, the RBA expects inflation to slow down to 3% by mid-2025, but only if productivity returns to pre-pandemic levels.

Here's how it looks - while the growth in nominal wages was only 3.3%, the growth in unit labor costs was 7.1%, the highest among English-speaking countries with developed economies.

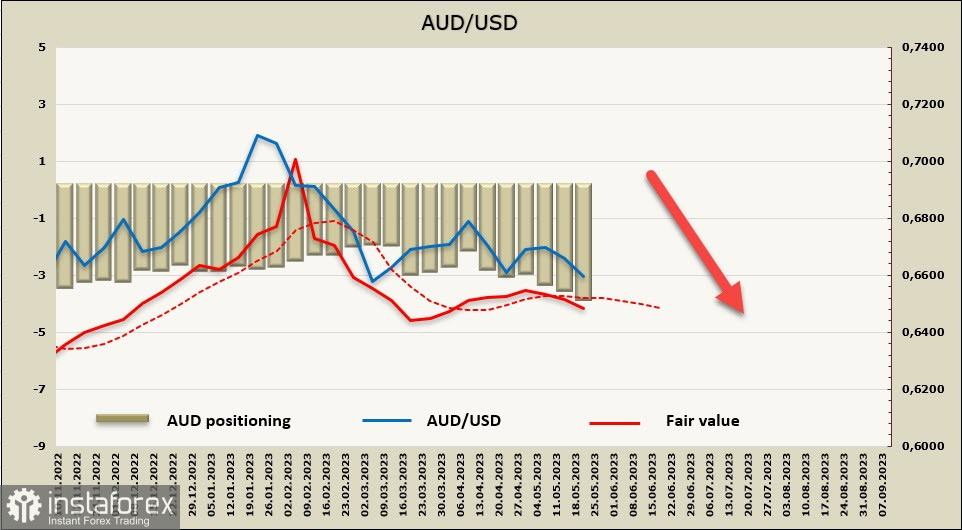

These factors will play a role in the future and may prompt the RBA to raise rates more aggressively. For now, however, the markets focus on current data, the peak RBA rate appears lower compared to other central banks, and the Australian dollar lacks a driver for growth, at least at the moment.

Speculative positioning in AUD remains consistently bearish, with net short positions increasing by 0.2 billion to -3.6 billion during the reporting week. The calculated price is below the long-term average and is directed downwards.

The aussie (AUD) has retraced towards the support level at 0.6565/75 and is likely to move lower. The main target is the technical level of 0.6466.