Gold refuses to fall, despite the swift rally in Treasury bond yields and the strengthening of the U.S. dollar. Contrary to the hawkish comments from FOMC officials, who do not rule out raising the federal funds rate above 6%. Contrary to the surge in U.S. business activity in May to a 13-month high, indicating economic strength. It would seem that the precious metal has entered an unfavorable environment. Urgent disposal of it is required. But investors are not in a hurry to do so.

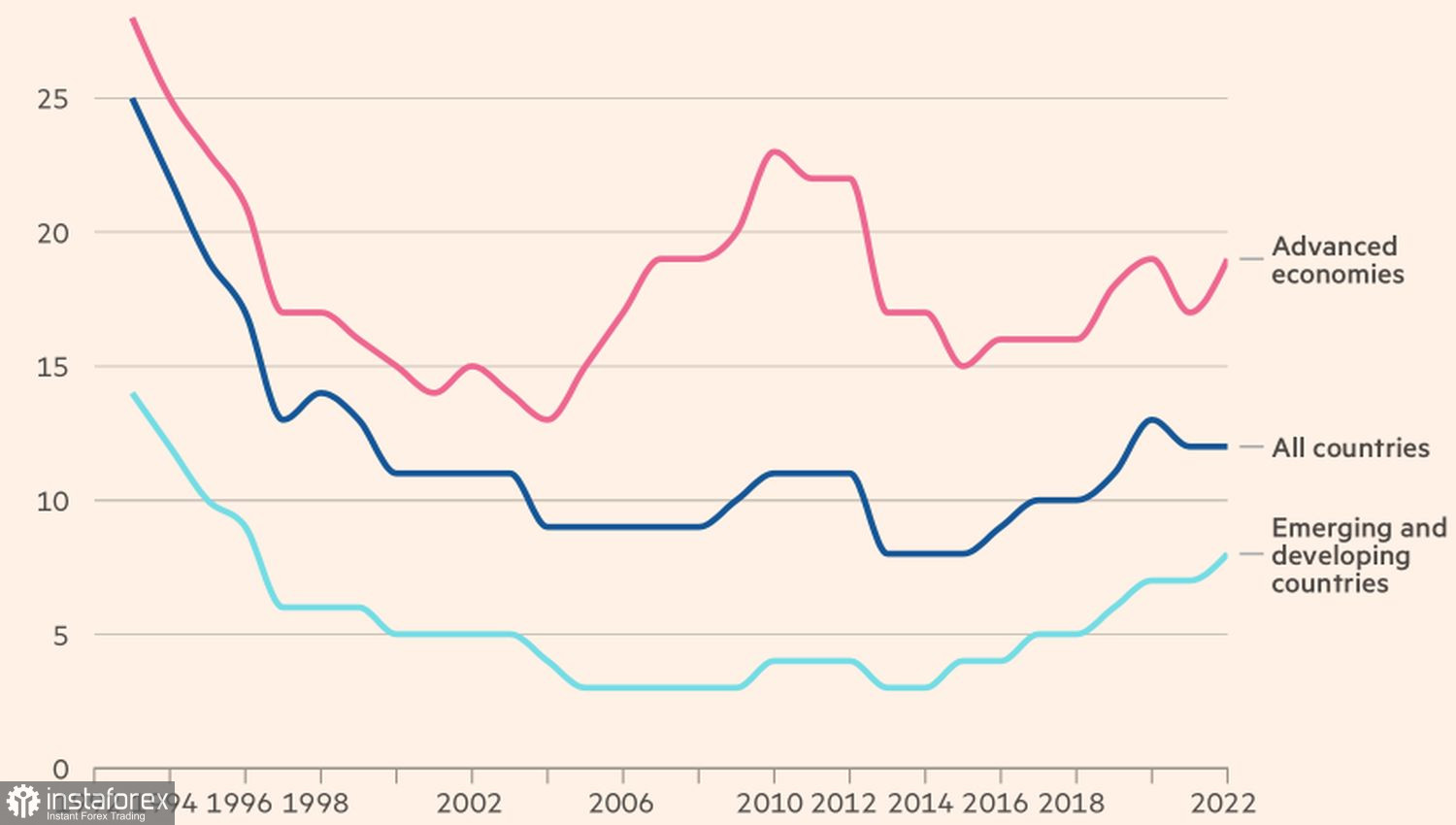

For centuries, gold has been a refuge from various kinds of shocks. The pandemic, the armed conflict in Ukraine, geopolitical tensions, inflationary concerns, growing global debt, high interest rates and the banking crisis have allowed it to shine again. Central banks bought gold in 2022 like never before. Fearing the freezing of American assets in Russia's gold and currency reserves worth $300 billion, states rushed to gold. Its share in the reserves of both developed and developing countries is increasing unlike the declining share of the U.S. dollar.

Dynamics of the share of gold in reserves

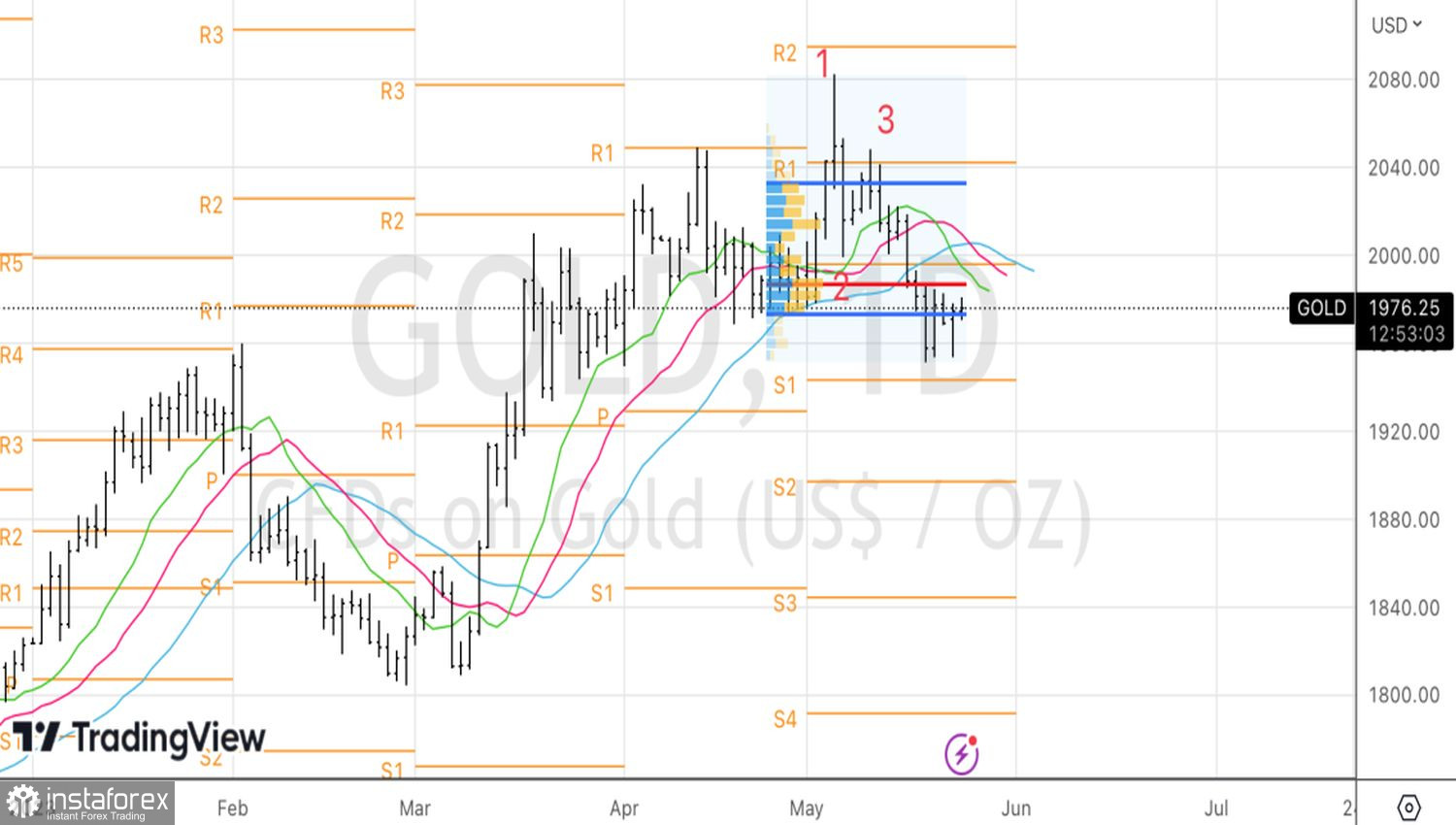

The sharp increase in interest in the U.S. dollar after the statistics on the American labor market for April increased chances of a federal funds rate hike to 50%, and the rally in Treasury bond yields forced XAU/USD to retreat from record highs. But it was an orderly retreat. Not a flight.

People understand perfectly well that in the event of a default, gold will be the best option for investing money. This is indicated by the MLIV Pulse survey of professional investors. This is evidenced by the increased share of the precious metal in JP Morgan's portfolio. The company is getting rid of securities and energy commodities, recognizing the heightened risks of a debt ceiling deal not being reached.

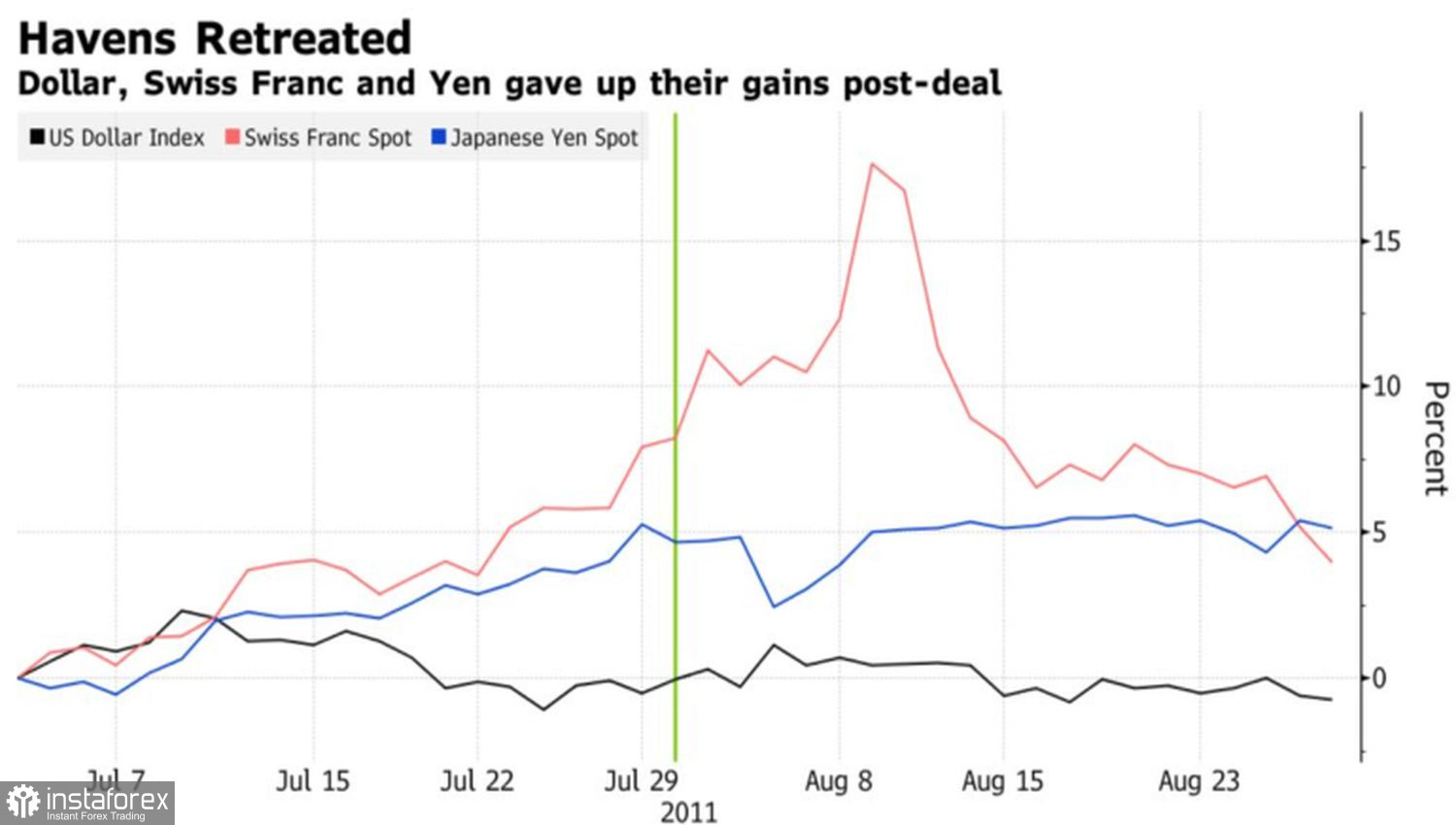

In the end, history shows that in the event of missing the "X date," the U.S. dollar will lose to other safe-haven assets such as the Japanese yen, Swiss franc, Treasury bonds, and gold. Just as it did in 2011.

Reaction of safe-haven currencies to the 2011 debt ceiling crisis

Thus, XAU/USD's unwillingness to fall, despite strong headwinds, is due to investors' firm intention to hedge themselves against the impending default.

Missing the "X date," presumably June 1st, is fraught with serious disruptions in financial markets and a return of the precious metal above the psychological mark of $2,000 per ounce. According to Janet Yellen, it is in early summer when the government will run out of money. It will be unable to meet its obligations. The threat of default will become real, and gold will be the main beneficiary. So isn't it better to keep it in your portfolio?

Technically, the formation of a pin bar with a long lower shadow indicates that the gold bulls have not lost their strength yet. If they manage to push prices back above the fair value of $1,987 per ounce, gold will come back into play. This will be the basis for forming long positions.