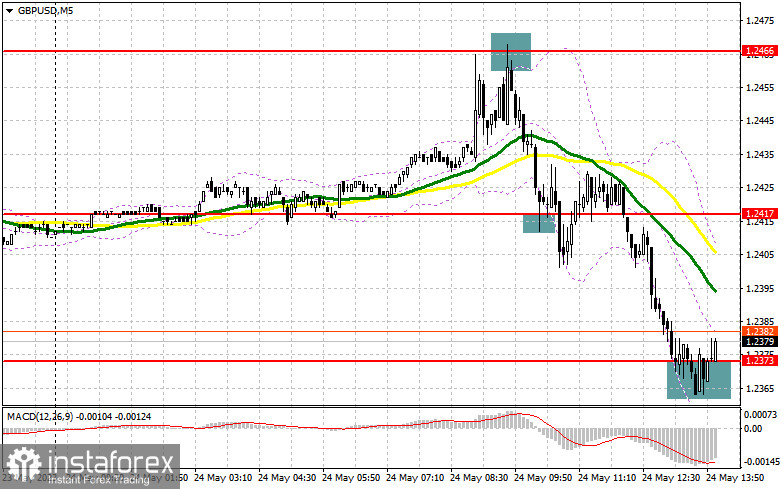

In my morning forecast, I highlighted the level of 1.2466 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The rise and formation of a false breakout after the release of data indicating high inflation in the UK resulted in a sell signal, leading to a decline in the pair by more than 50 points.

To open long positions on GBP/USD, the following is required:

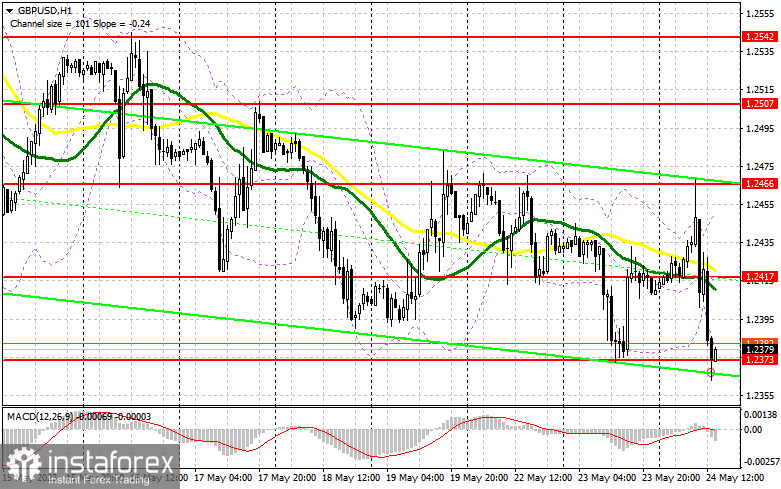

Considering that the inflation situation in the UK will force the Bank of England to continue raising interest rates, bulls decided to take advantage of this moment. However, there were significantly more sellers because serious problems with US debt maintained demand for safe-haven assets. Taking advantage of good prices, bears pushed GBP/USD back to monthly lows, and the decline is likely to continue in the second half of the day. Considering that speeches by US Treasury Secretary Janet Yellen and FOMC member Christopher Waller are expected, the pound has little chance of rising. The publication of the FOMC meeting minutes can also favor the US dollar.

Only after another false breakout around 1.2373, similar to what happened this morning, can we receive a buy signal, leading to a surge in the pair towards 1.2417, where the moving averages are located, playing in favor of sellers. A breakthrough and a reverse test of this range from top to bottom will form an additional buy signal and strengthen the presence of bulls in the market, pushing towards 1.2466. The ultimate target will be around 1.2507, where I will make a profit. In the scenario of a decline toward 1.2373 and a lack of activity from buyers, which would be the third test, I will postpone purchases until the next update of the monthly low at 1.2325. I will also consider opening long positions there only on a false breakout. I plan to buy GBP/USD immediately on a rebound only from the minimum at 1.2275, targeting a correction of 30-35 pips within the day.

To open short positions on GBP/USD, the following is required:

Sellers have accomplished their tasks, and now it is crucial not to miss the level of 1.2417, which acts as a midpoint within the intraday sideways channel. It is there that I expect the involvement of major players. A favorable selling scenario would be a false breakout at 1.2417 with a downward move toward support at 1.2373. A breakthrough and a reverse test from the bottom to the top of this range will strengthen the bearish trend, forming a signal to open short positions with a decline towards 1.2325. The ultimate target remains the minimum at 1.2275, where I will take profit. In the event of GBP/USD rising and a lack of activity at 1.2417, buyers will return to the market. In that case, I will postpone selling until a test of the upper boundary of the sideways channel and resistance at 1.2466, where the pound has already experienced a significant drop today. A false breakout there will be the entry point for short positions. If there is no downward movement from 1.2466, I will sell GBP/USD on a rebound from 1.2507, but only with the expectation of a pair correction downwards by 30-35 pips within the day.

Indicator signals:

Moving Averages:

Trading is below the 30-day and 50-day moving averages, indicating a continuation of the bearish market.

Note: The author considers the period and prices of the moving averages on the H1 hourly chart, which differ from the general definition of classical daily moving averages on the D1 daily chart.

Bollinger Bands:

In the case of an upward movement, the upper boundary of the indicator around 1.2450 will act as resistance.

Description of indicators:

- Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

- Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

- MACD indicator (Moving Average Convergence/Divergence, measures the convergence and divergence of moving averages). Fast EMA period 12. Slow EMA period 26. SMA period 9.

- Bollinger Bands. Period 20.

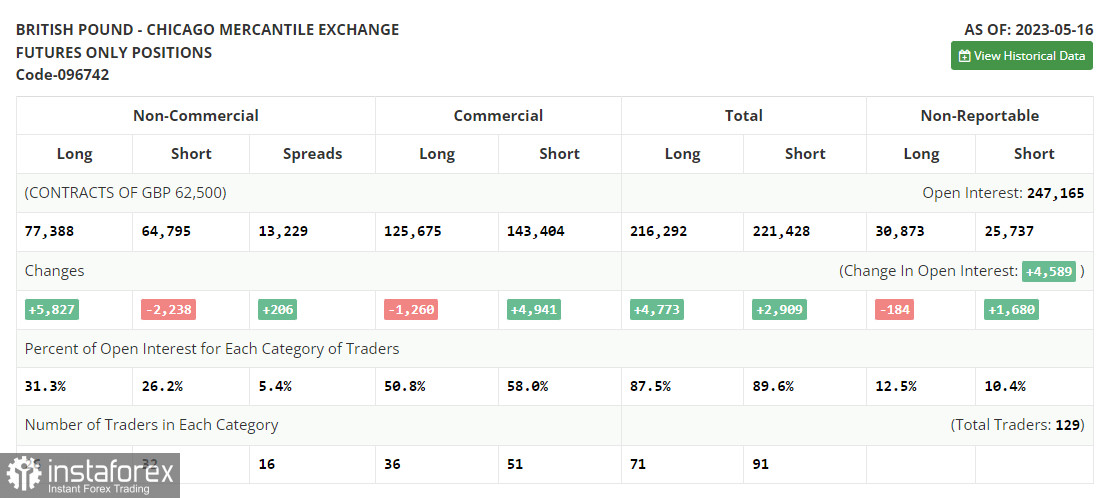

- Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- The non-commercial net position is the difference between non-commercial traders' short and long positions.