On Wednesday, the inflation report for April was released in the UK, which left a very strange aftertaste. Recall that inflation has two main indicators - headline and core. The headline inflation considers all prices, while the core inflation excludes food and energy prices. As a result of April, headline inflation decreased by 1.4% annually, while core inflation increased by 0.6%. Both of these changes can be considered "significant," it turns out that in the same month, one inflation decreased significantly, while the other increased significantly.

A day earlier, the Governor of the Bank of England, Andrew Bailey, stated that the tightening of monetary policy would continue. Many economists believe inflation remains at record levels due to the labor shortage caused by Brexit and historically high food inflation. Andrew Bailey stated yesterday that the decline in gas and food prices would exert strong pressure on inflation but did not specify which one exactly. As we can see today, excluding gas and food, inflation continues to rise. And taking into account these "variables," it is falling. But what is the overall conclusion? Which inflation does the Bank of England "value more" and base their interest rate changes on?

Finance Minister Jeremy Hunt also spoke on Wednesday. He stated that the central bank and the government must achieve a decrease in inflation at all costs to proceed with tax reductions. Here, again, it is necessary to recall that with the arrival of Sunak and Hunt in power last year, some taxes in the country were increased due to a huge budget deficit. There was a choice: take out loans, reduce expenses, or increase Treasury revenues. Taxes increased precisely because of Jeremy Hunt's plan after Liz Truss failed. However, dissatisfaction among the British population grew every month due to falling real incomes, the rising cost of living, and high taxes. Jeremy Hunt stated that he understands the situation of many citizens, especially those of the least protected segment of the population, but believes that inflation must be reduced first to reduce taxes.

After today's data, Hunt was disappointed and said it was not yet time to relax. He looks optimistically at the plan to halve inflation by the end of the year and considers this method the best way to "increase people's incomes." "It would be wrong to lower taxes at this time," Hunt believes.

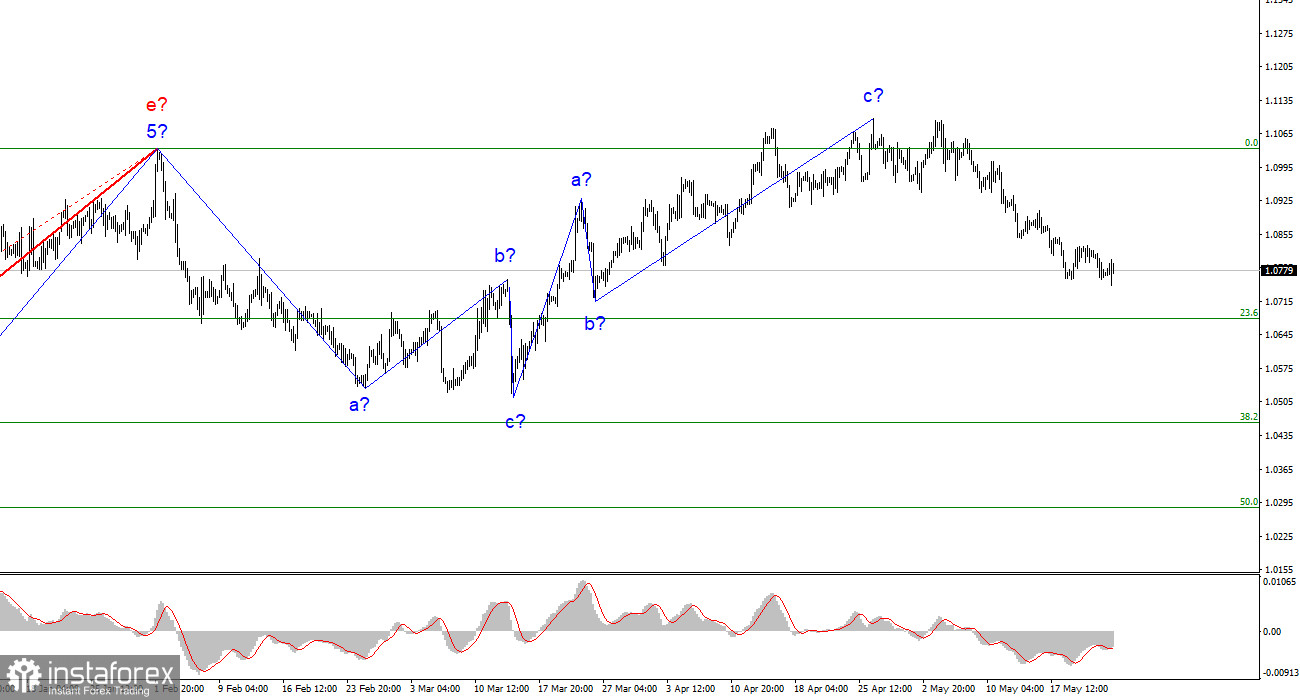

The demand for the pound steadily decreased on Wednesday, which is justified. The inflation report can be considered negative for the British currency, and the current wave pattern is of great importance now and implies a further decline of the pair.

Based on the analysis, the upward trend segment has been completed. Therefore, selling can be advised now, and the pair has ample room for decline. Targets around 1.0500-1.0600 can be considered quite realistic. With these targets in mind, I recommend selling the pair.

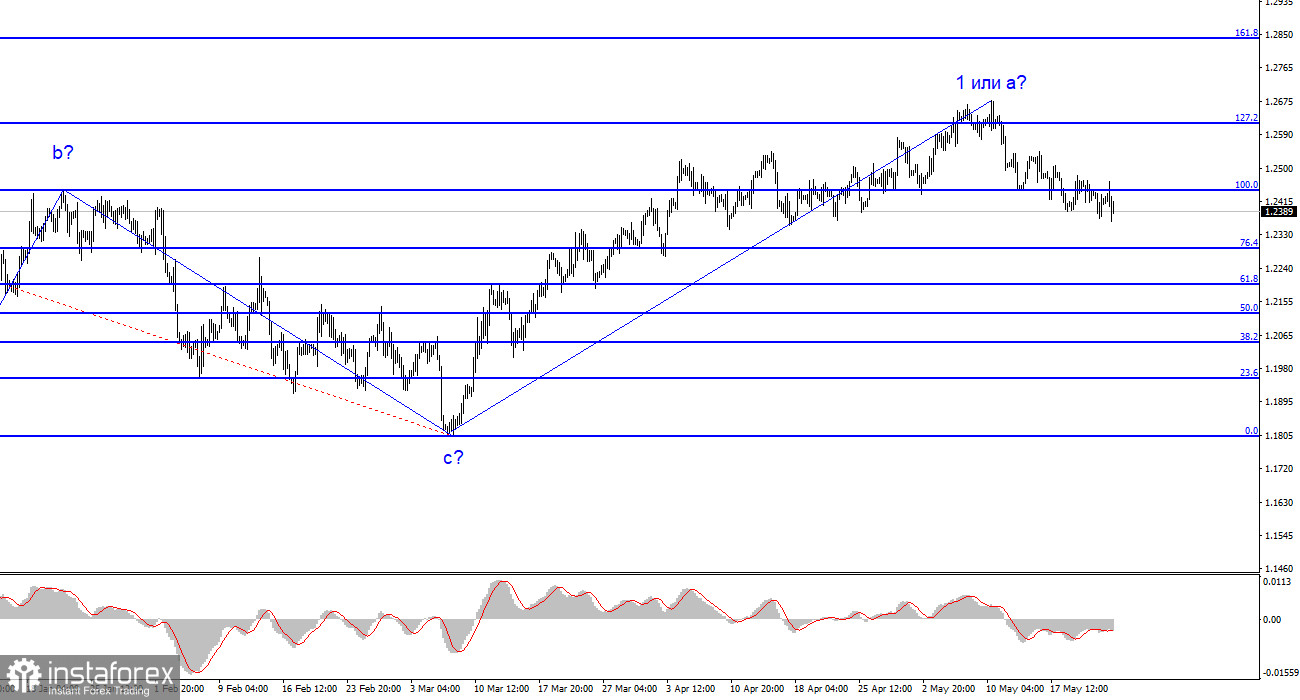

The wave pattern of the pound/dollar pair has long suggested the formation of a new downward wave. Wave b can be very deep, as all recent waves are approximately equal. The unsuccessful attempt to break through the level of 1.2615, which corresponds to 127.2% Fibonacci, indicates the market's readiness for sales. In contrast, the successful attempt to break through the level of 1.2445, which equates to 100.0% Fibonacci, confirms this signal. I recommend selling the pound with targets around the 23 and 22-figure levels.