Analysis of macro data:

There will be quite a few macro data on Friday, but almost all of the reports will be of secondary importance. The day will start with the release of the UK Retail Sales report. It is expected to increase by 0.3%, but the actual value may be lower, as has been the case with many other recent reports. After that, all the other reports will come from the United States.

The first report will be Personal Income and Spending. Then, there will be Durable Goods Orders, Producer Price Index, and the University of Michigan Consumer Sentiment Index. You can highlight the Durable Goods Orders report among the list, but collectively, they can still trigger a market reaction. However, it is impossible to predict the nature of the reaction based on just five reports, as they can vary significantly. Therefore, there will be many reports, but they are unlikely to drastically change trader sentiment or break the downtrend in both instruments. Also, take note that the market often uses Friday as a day for corrections.

Fundamental events:

There will be virtually no fundamental events on Friday. The only notable event is the speech by European Central Bank Chief Economist Philip Lane. He is an important figure in the Bank, so his speech is worth listening to. However, we have heard enough speeches from ECB and Federal Reserve representatives recently, and none of them have triggered an immediate market reaction. And now we also have a good understanding of which direction the market is looking at and what decisions it expects from the central banks.

General conclusions:

Friday will bring us many reports, but few of them are significant. There will be one speech by a high-ranking official, which is unlikely to generate any interest among traders. We lean towards the idea that, as before, everything will depend on the general sentiment of traders and the current technical trend. Correction is possible but not guaranteed. Volatility may remain low. The nature of the pair's movement with multiple retracements may persist.

Basic rules of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

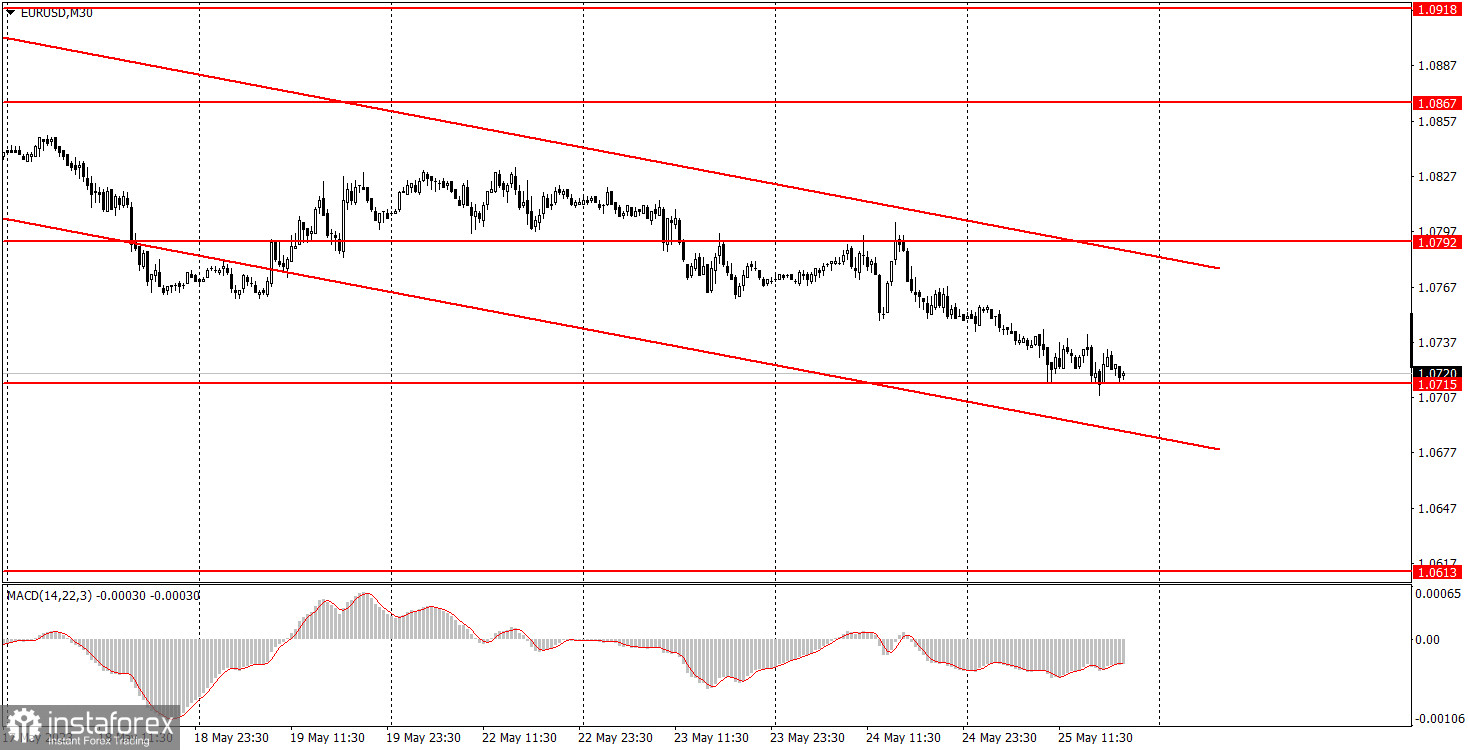

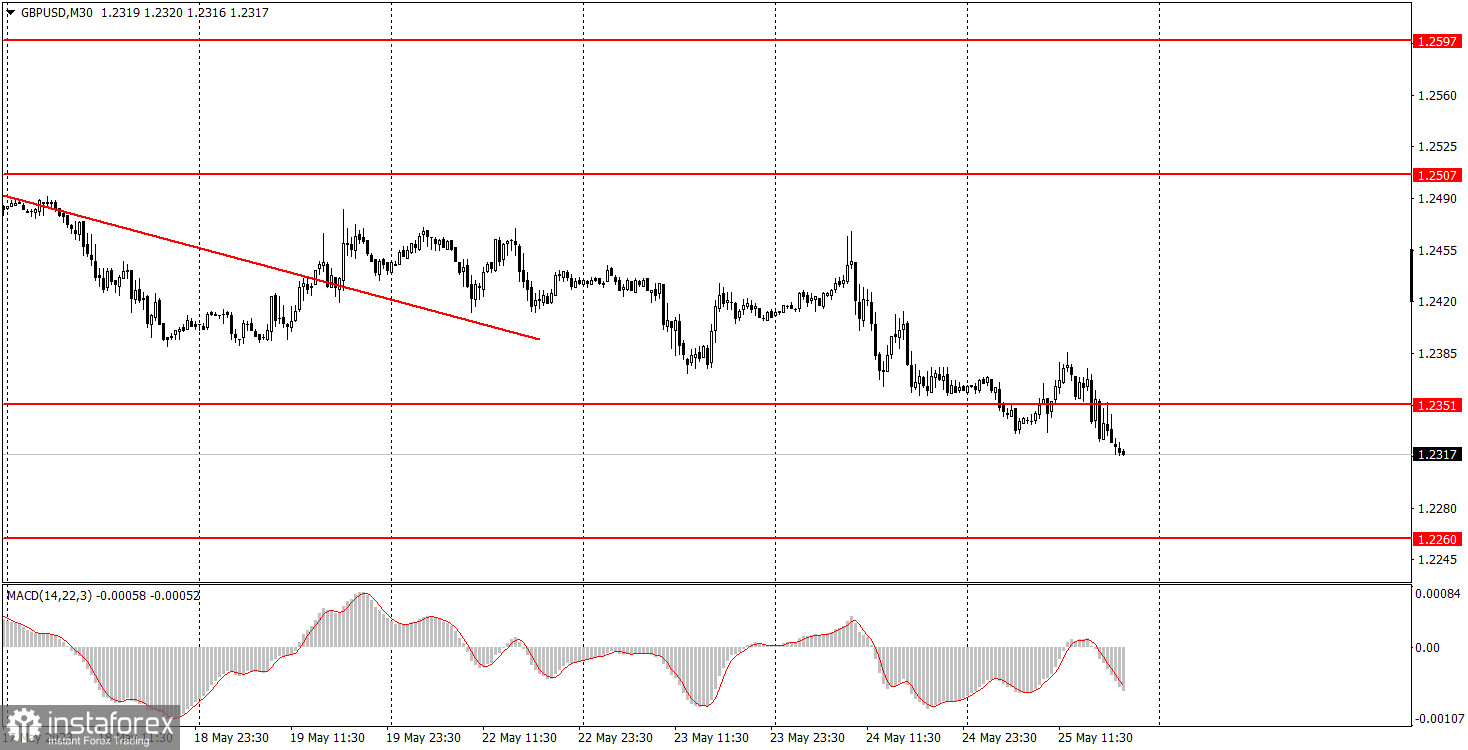

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.