The number of continuing jobless claims fell by only 5,000 instead of the expected 9,000. However, the number of initial jobless claims increased as predicted. Not by 3,000, but by 4,000. The increase in initial claims was offset by a downward revision of the previous data by 17,000. Therefore, the labor market appears to be in relatively good condition. The problem is that the dollar has almost nowhere to grow, due to its excessive overbought condition.

The market clearly needs a correction, and today's reason for that could be the durable-goods orders data. The volume of orders is expected to decrease by 1.1%, which is quite significant. Moreover, this report is a leading indicator for retail sales, which serves as a gauge for the services sector, accounting for 80% of the US economy. Therefore, the threat of a decline in retail sales is a negative factor, and the dollar's excessive overbought condition will amplify the effect.

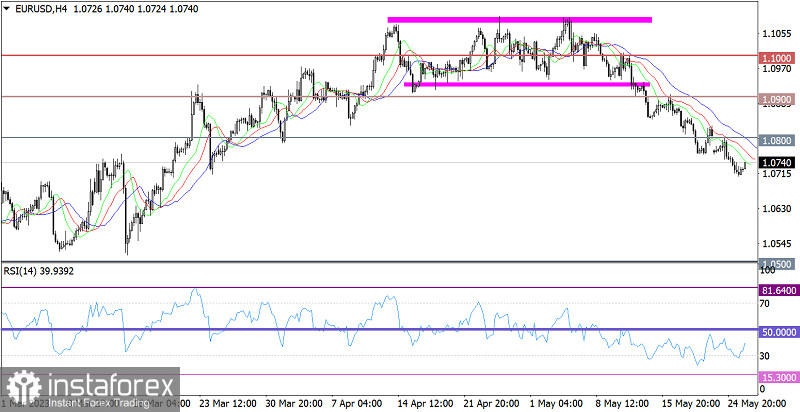

The EUR/USD pair continued to trade lower, reaching levels not seen since March of this year. Such intense movement is classified in the market as momentum-driven, ignoring several technical signals.

On the four-hour chart, the RSI has left the oversold area, but there is no clear signal yet that the ongoing corrective movement has ended.

On the same time frame, the Alligator's MAs are headed downwards, confirming the corrective movement.

Outlook:

Due to the overheating of short positions on the euro, we can expect a full-scale technical retracement, potentially bringing the price back to the 1.0800 level. However, as mentioned earlier, speculators are ignoring the technical signal that points to the euro being oversold and the US dollar as overbought. Thus, keeping the price below the 1.0700 level may prolong the current movement.

A comprehensive analysis of indicators in the short-term suggests a possible retracement, while in the intraday period, a downward signal persists due to the ongoing corrective move in the market.