The gold market is delivering losses to investors for the third consecutive week.

According to the weekly gold survey, sentiments on Wall Street have been divided regarding whether the gold decline has ended.

Optimistic macroeconomic data and higher-than-expected inflation figures have prompted the markets to reassess their expectations of the Federal Reserve rate hike.

After the bearish sentiment of the previous week, Wall Street has diverged in opinions on whether there will be a continuation of the gold price decline.

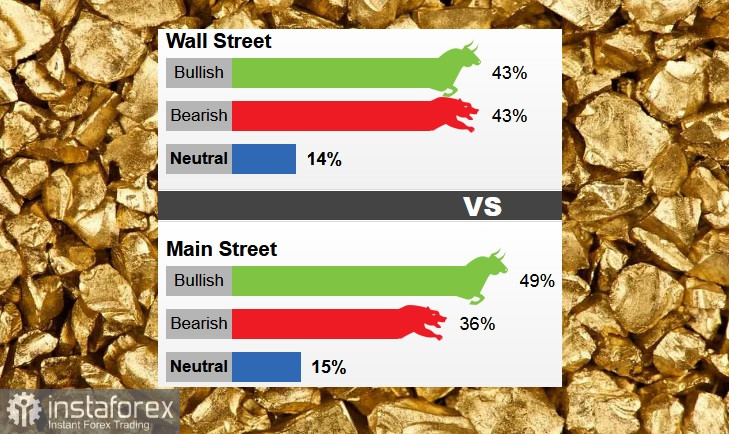

Of 14 analysts, 43% held an optimistic outlook, an equal number held bearish sentiments, and only 14% remained neutral.

The Main Street side remained bullish. Out of 762 retail investors participating, 49% expected higher prices, 36% predicted a decrease, and 15% remained neutral.

The average target price for gold by the end of the week, according to retail investors' forecasts, is $1,981 per ounce.

Many analysts predicting price declines cited technical reasons.

According to Colin Cieszynski, chief market strategist at SIA Wealth Management, considering the U.S. holiday on Monday, gold may continue to decline sluggishly as it doesn't appear oversold.

Those with an optimistic outlook expect the debt ceiling drama to escalate, leading to price increases. According to Edward Moya, senior market analyst at OANDA, debt ceiling negotiations are likely to be challenging, and the X-date will probably be postponed