Analyzing Tuesday's trades:

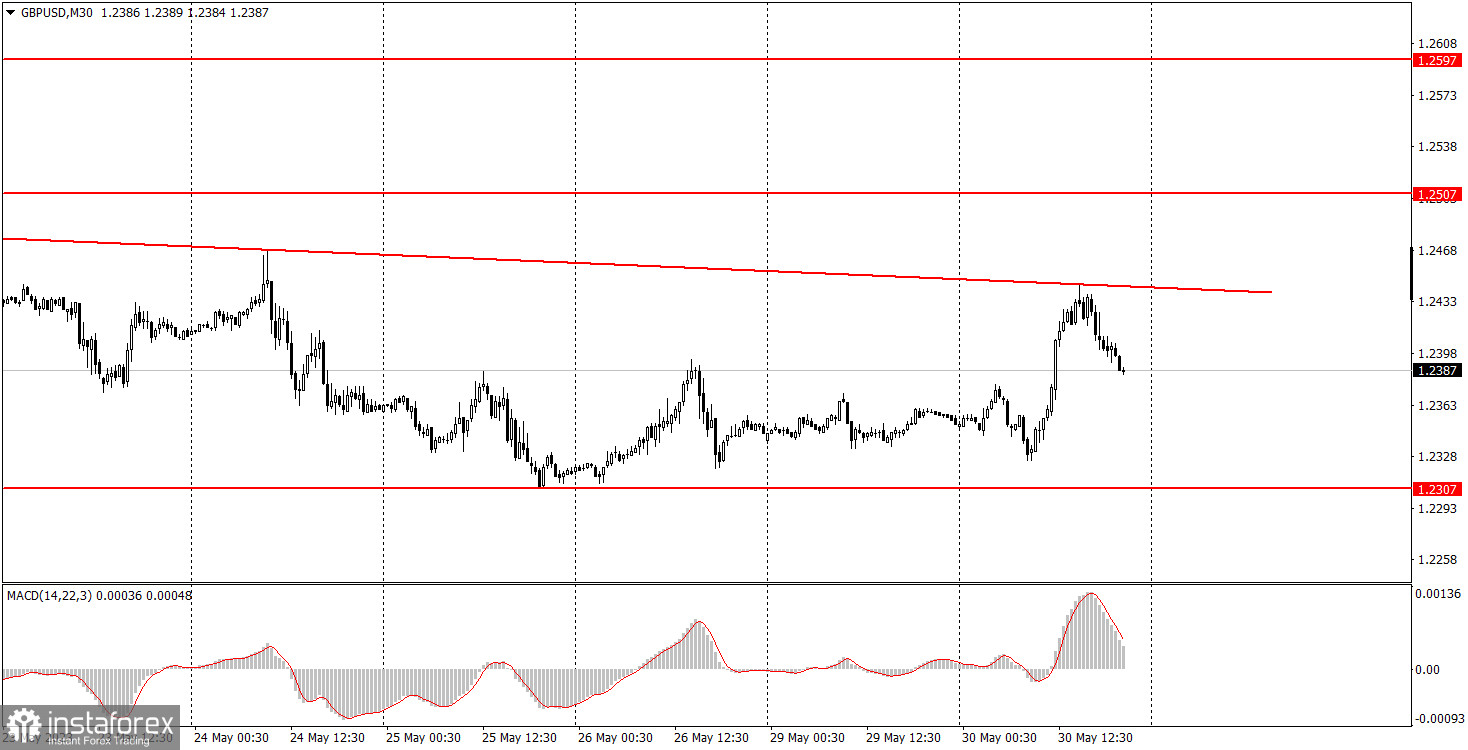

GBP/USD on 30M chart

On Tuesday, the GBP/USD pair displayed a significant rebound, which is difficult to explain from a fundamental or macroeconomic perspective. In addition, a new descending trendline has formed, which clearly passes through the three recent price peaks. Thus, despite the British currency's growth, the downtrend persists. There was no macro data or fundamental background in either the UK or the US. Therefore, it is quite difficult for us to explain what caused the dollar's decline. However, technical corrections are still relevant, so the sudden growth shouldn't be that surprising. So far, nothing bad has happened to the downtrend. The pound may fall as early as Wednesday, especially considering that the pair has already started to fall by the end of Tuesday. Moreover, there will be significant events and reports in the last three days of the week, which may prompt traders to buy the dollar again, regardless of their positions.

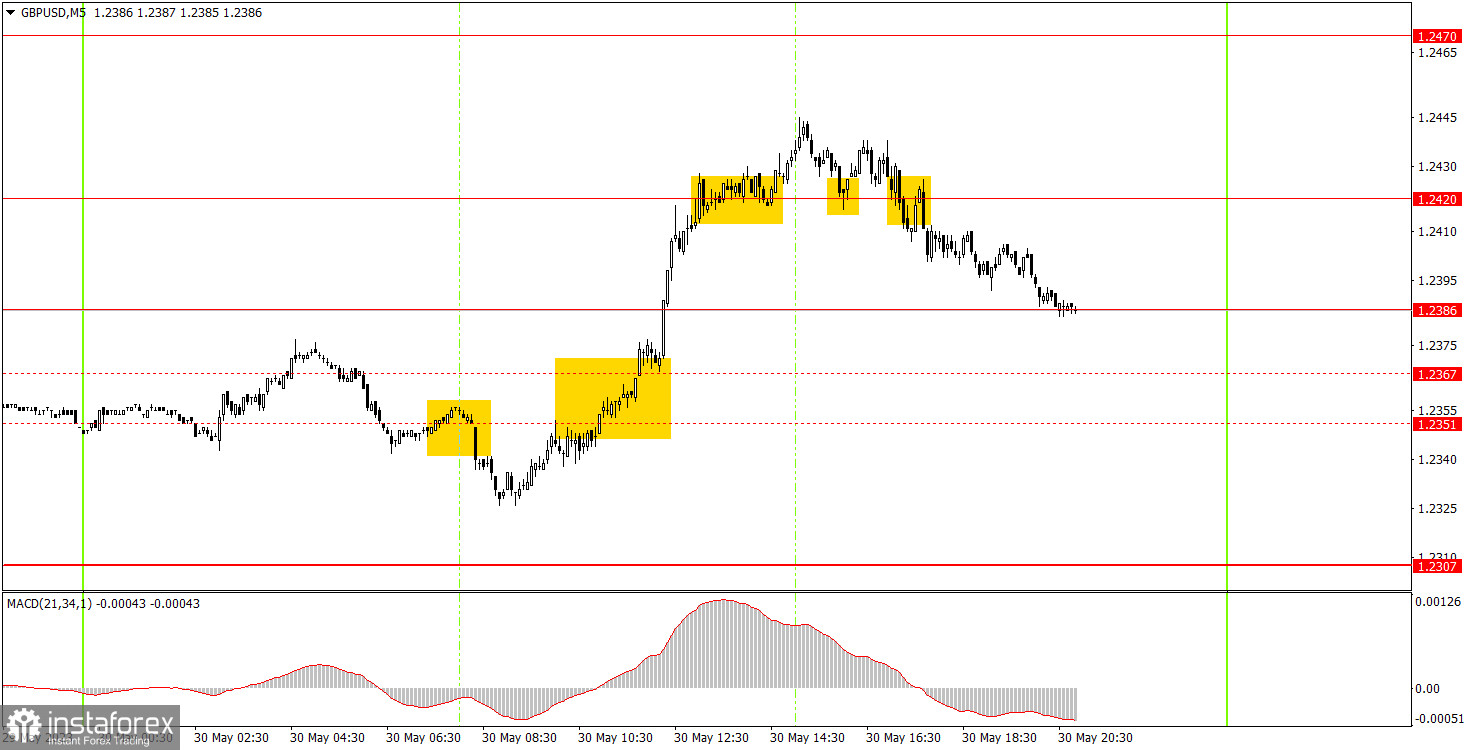

GBP/USD on 5M chart

Several trading signals were formed on the 5-minute chart on Tuesday. The levels 1.2351 and 1.2367 will be removed from the charts. The levels 1.2307 and 1.2386 have been added, but they were not included in the signal formation process. The first sell signal was near the 1.2351 level. The pair managed to move down by only 15 pips, resulting in a loss when the price settled above the 1.2367 level. This same signal should have been executed using long positions, and the pair subsequently rose to the 1.2420 level and settled above it. The long position should have been closed when the price settled below this level. Immediately after that, short positions should have been opened, which should have been manually closed closer to the evening. As a result, the first trade ended in a loss, but the other two were profitable. Overall, novice traders made a profit.

Trading tips on Wednesday:

As seen on the 30M chart, the GBP/USD pair is generally moving down, but over the past week, we have seen more of a flat than a trend-driven movement. I expect the pound to fall further since it has not fallen enough yet. Breaking the new trendline may temporarily change market sentiment to bullish. The key levels on the 5M chart are 1.2171-1.2179, 1.2245, 1.2307, 1.2386, 1.2420, 1.2470, 1.2507-1.2520, 1.2597-1.2616. When the price moves 20 pips in the right direction after opening a trade, a stop loss can be set at breakeven. On Wednesday, there are no important events or reports scheduled in the UK, while the US will release the JOLTS report on job openings. The market will only react to this report if the actual value significantly deviates from the forecast.

Basic rules of the trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.