Trading recommendations

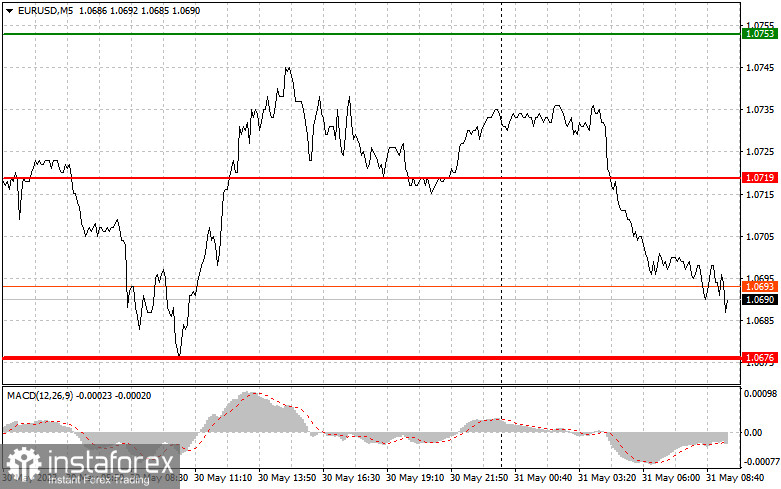

In the first part of the day, the price tested 1.0709 when the MACD indicator was considerably above the zero level. This capped the upward potential of the pair. For this reason, I did not buy the euro. The eurozone lending data disappointed. However, traders were still focused on the fact that the US debt ceiling issue was resolved and there were only a few days left until the bill was signed. In the second half of the day, there were no signals as the pair did not reach the levels I had indicated.

Early today, a lot of news is released in Germany. This could determine the direction of the euro. Traders are expecting the labor market figures. If the data disappoints, yesterday's situation of reaching a new monthly low may repeat. That is why I advise buying, relying on the implementation of scenario No. 2. We are waiting for the data on the number of unemployed and the unemployment rate in Germany. The German consumer price index and the ECB report on financial stability can also lead to a surge in volatility, encouraging buyers of the euro. Traders will also wait for the speech by ECB President Christine Lagarde.

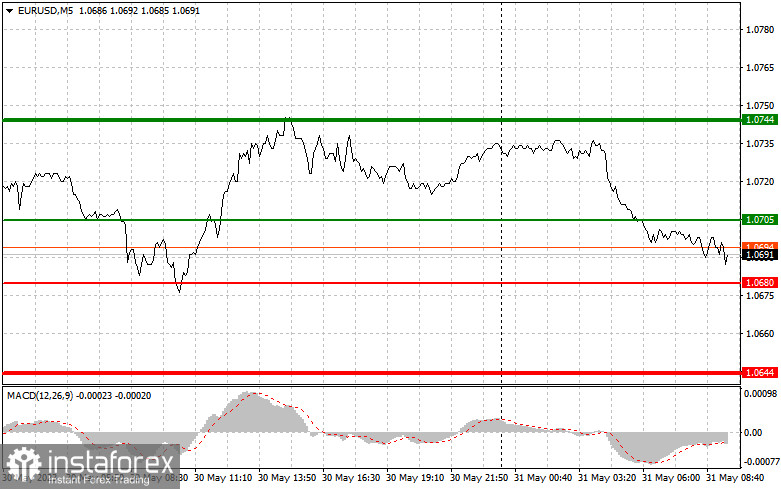

Signals to buy EUR

Scenario #1: Today, you can buy the euro when the price reaches 1.0705 (green line on the chart) with the target at 1.0744. At the level of 1.0744, I recommend exiting the market and selling the euro, expecting a movement of 30-35 pips from the entry point. You can see the pair rise during the continuation of the uptrend. Important! Before buying, make sure that the MACD indicator is above the zero mark and is just starting its rise from it.

Scenario #2: Today, you can also buy the euro, if the price tests 1.0680 twice at a time when the MACD indicator will be in the oversold area. This will limit the pair's downward potential and lead to an upward market reversal. You can expect a rise to 1.0705 and 1.0744.

Signals to sell EUR

Scenario #1: You can sell the euro after reaching the 1.0680 level (red line on the chart). The target will be at 1.0644, where I recommend exiting the market and buying the euro, expecting a movement of 20-25 pips in the opposite direction from the level. Pressure on the pair will return amid a deterioration in the labor market situation in Germany. Important! Before selling, make sure that the MACD indicator is below the zero mark and is just starting its decline from it.

Scenario #2: Today, you can also sell the euro, if the price tests 1.0705 twice at a time when the MACD indicator will be in the overbought area. This will limit the pair's upward potential and lead to a downward market reversal. You can expect a drop to the opposite levels of 1.0680 and 1.0644.

What we see on the trading chart:

A thin green line is a key level at which you can place long positions on EUR/USD.

A thick green line is the target price since the quote is unlikely to move above it.

A thin red line is a level at which you can place short positions on EUR/USD.

A thick red line is the target price since the quote is unlikely to move below it.

A MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions to enter the market. Before the release of important reports, it is better to stay out of the market to avoid sharp fluctuations in the price. If you decide to trade during the news release, place stop orders to minimize losses. Without stop orders, you can lose the entire deposit, especially if you do not use money management and trade large volumes.

Notably, for successful trading, it is necessary to have a clear trading plan. Rash trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.