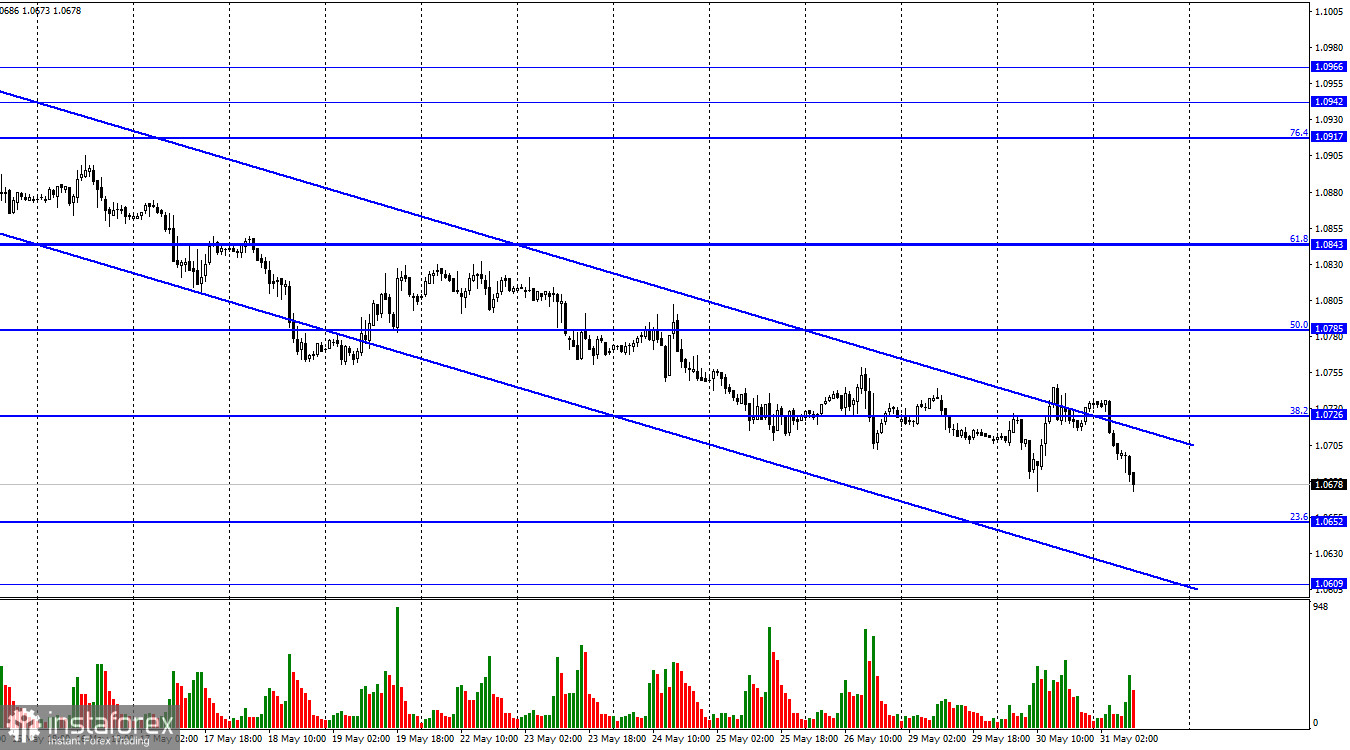

The EUR/USD pair reversed in favor of the American currency on Wednesday and resumed its downward movement toward the corrective level of 23.6% (1.0652). The descending trend corridor has maintained its integrity after yesterday's attempt to close above it. A rebound from the 1.0652 level will allow traders to expect some growth in the pair toward the 1.0726 level. At the same time, a consolidation below 1.0652 will increase the probability of further decline toward the next level at 1.0609.

Throughout the day yesterday, none of the reports in the calendar could interest traders. They were all insignificant, and the most important day (or night) event was not even present in the calendar. Federal Reserve Bank of Cleveland President Loretta Mester stated in an interview that the Fed might go for another rate hike in June. According to her, there are no convincing reasons for a pause, and there is no point in waiting to gather more evidence for the obvious thing - tightening monetary policy is still needed as inflation is too high. Mester also stated that the only reason for a pause when further tightening is required could be a market shock or significant volatility. "I think we need to move forward," Mester said.

Mester's statements were unexpected and even somewhat shocking to traders. The bulls attempted to push the pair slightly higher yesterday, but Mester's speech disrupted their plans. Mester's rhetoric can be characterized as "hawkish." And most importantly, few people expected such a statement from the head of the Federal Reserve Bank of Cleveland in the style of James Bullard. The probability of a rate hike in June is still below 50%, but it is increasing and may continue to rise. If other FOMC members support Mester, the US dollar may continue its ascent, as the market did not anticipate such a development.

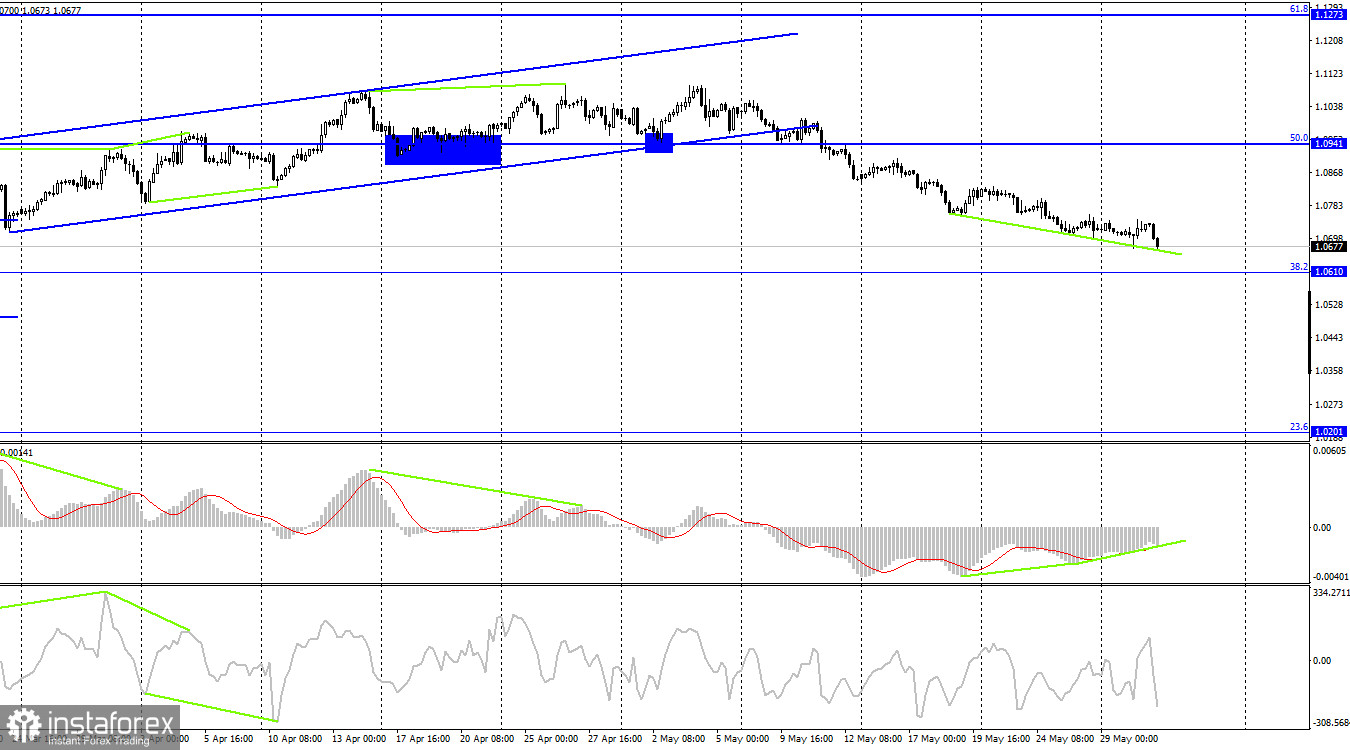

On the 4-hour chart, the pair continues downward toward the corrective level of 38.2% (1.0610). The emerging "bullish" divergence on the MACD indicator suggests some minor growth but has not fully formed yet. A rebound of the pair's rate from the 1.0610 level will favor the euro and indicate some growth. Closing below 1.0610 will increase the likelihood of further decline toward the next Fibonacci level at 23.6% (1.0201).

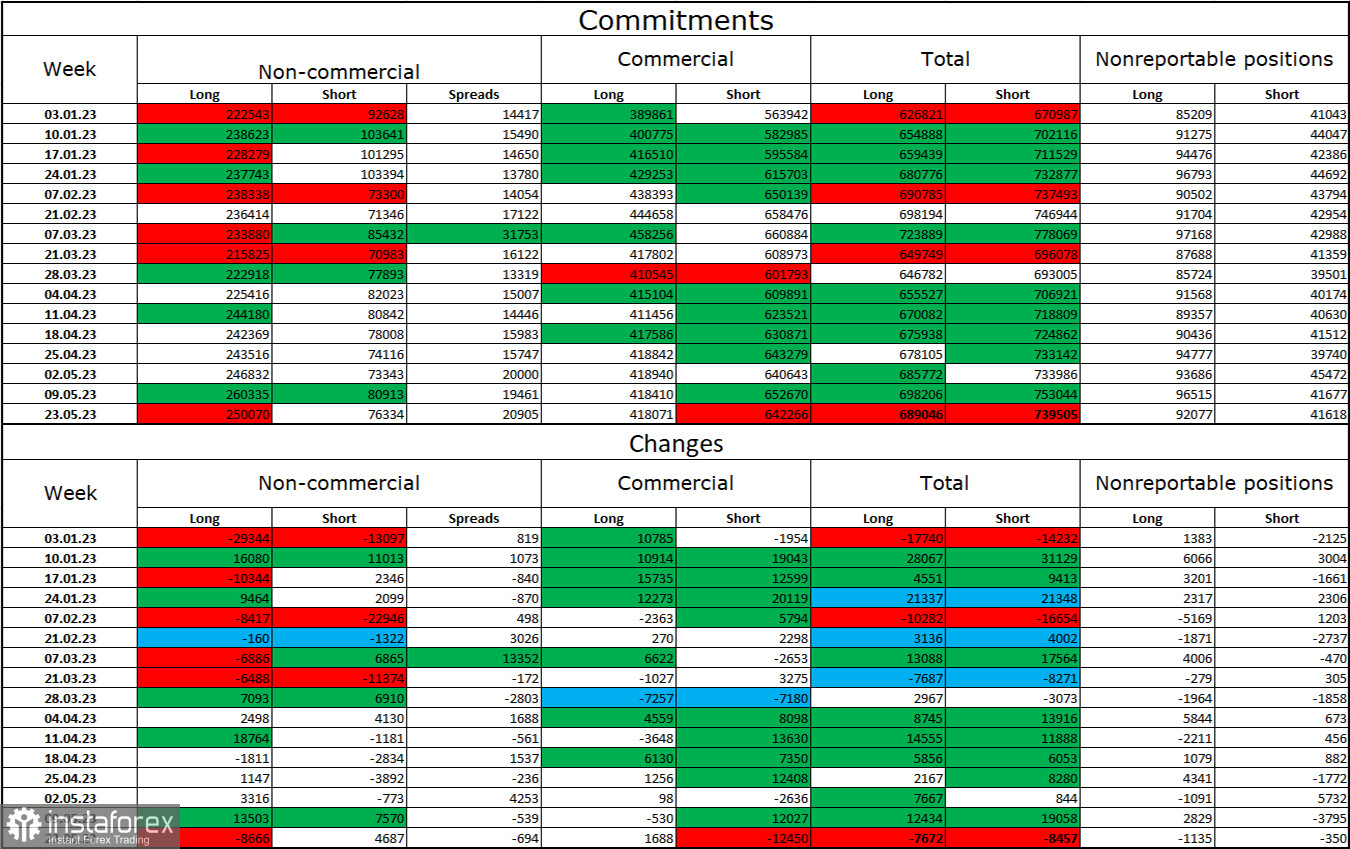

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 8,666 long contracts and opened 4,687 short contracts. The sentiment of major traders remains "bullish" and continues to strengthen overall. The total number of long contracts held by speculators now stands at 250,000, while short contracts amount to only 76,000. Strong bullish sentiment is still intact, but the situation will change soon. The European currency has already begun to decline. The high value of open long contracts suggests that buyers may close them soon (or have already started, as indicated by the latest COT report). There is currently an excessive skew towards bulls. The current figures indicate a decline in the euro soon. I would also like to note that a larger number of contracts are held by the "Commercial" group, which means they have a greater influence on the pair's exchange rate.

Calendar of news for the United States and the European Union:

Germany - Change in the number of unemployed (07:55 UTC).

Germany - Unemployment rate (07:55 UTC).

Germany - Consumer Price Index (CPI) (12:00 UTC).

European Union - ECB President Lagarde will give a speech (12:30 UTC).

USA - Job Openings and Labor Turnover Survey (JOLTS) (14:00 UTC).

USA - Federal Reserve's Beige Book (18:00 UTC).

On May 31st, the calendar of economic events contains many interesting entries. The speech by Christine Lagarde stands out among others, but the rest of the events are not secondary. The impact of the information background on traders' sentiment today can be quite strong.

Forecast for EUR/USD and trader advice:

New pair sales could be opened on a rebound from the upper line of the corridor on the hourly chart with a target of 1.0652. I advise against buying until the pair closes above the descending trend corridor on the hourly chart, with targets at 1.0785 and 1.0843.