In addition to inflation data in Germany and the number of job openings in the United States, there was a speech by European Central Bank Vice President Luis de Guindos in the European Union. He stated that inflation data in the largest economies of the EU, such as France, Germany, and Spain, have been positive, but victory over inflation is not there yet. Indirectly, de Guindos indicated the need to continue raising interest rates.

According to Governing Council member Madis Muller, the ECB is likely to continue raising rates at least two more times. He noted that core inflation shows no signs of slowing yet, which undoubtedly disappoints ECB bankers. Muller also mentioned that it is probably too optimistic to see the ECB rate cut in early 2024, and inflation will decrease slowly. As we can see, the opinions of the ECB officials differ slightly. This is due to the fact that the inflation situation in different countries of the European Union is starting to differ significantly...

Germany's Consumer Price Index slowed down to 6.1% YoY in May. The deceleration was significant, but the current inflation level remains high. In Italy, inflation dropped from 8.2% to 7.6%, in France from 5.9% to 5.1%, and in Spain from 4.1% to 3.2%. Spain has already come close to the ECB's target mark of 2%, but many other countries are still far from it. Consequently, representatives of central banks in countries where inflation is approaching the target may oppose further tightening of policies, while others may support additional rate hikes.

It is difficult to say how the ECB will address this issue. Based on the comments of de Guindos and Muller, the interest rate will continue to rise, putting pressure on the economy and inflation. However, with Spain's current CPI value of 3.2%, such a high rate is no longer needed. But the central bank of Spain cannot start lowering the rate on its own, so inflation in this country risks falling much below the target level. For the ECB, the average value across the entire European Union is important, not in individual countries.

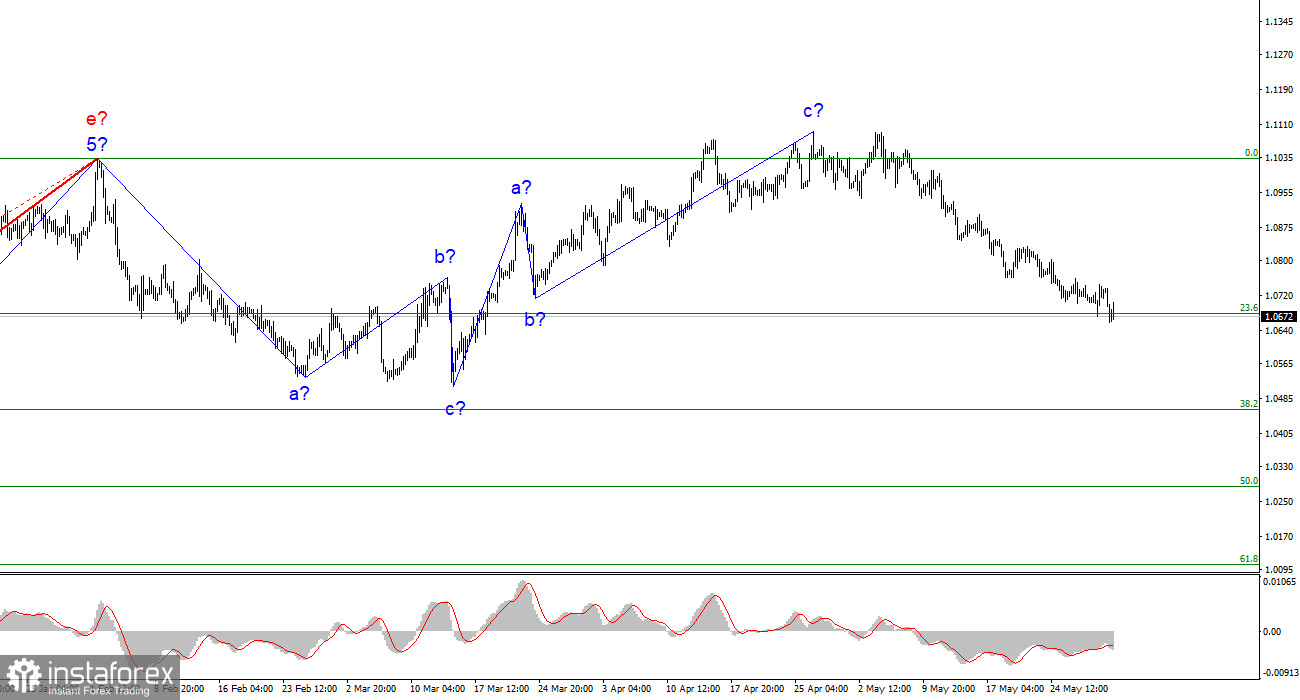

Since the demand for the euro has been declining for a month now, I can confidently say that a potential 50 basis points rate hike by the ECB does not impress buyers. The demand for the EU currency continues to decrease, aligning with the current wave pattern. We can see that the instrument has decreased again, despite attempts to build an upward wave during the day. Therefore, the market is geared towards building a downward wave set and is ready to ignore bullish news for the euro.

Based on the analysis conducted, I conclude that the uptrend phase has ended. Therefore, I would recommend selling at this point, as the instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave may start from the 1.0678 level, so you can consider short positions if the pair surpasses this level.

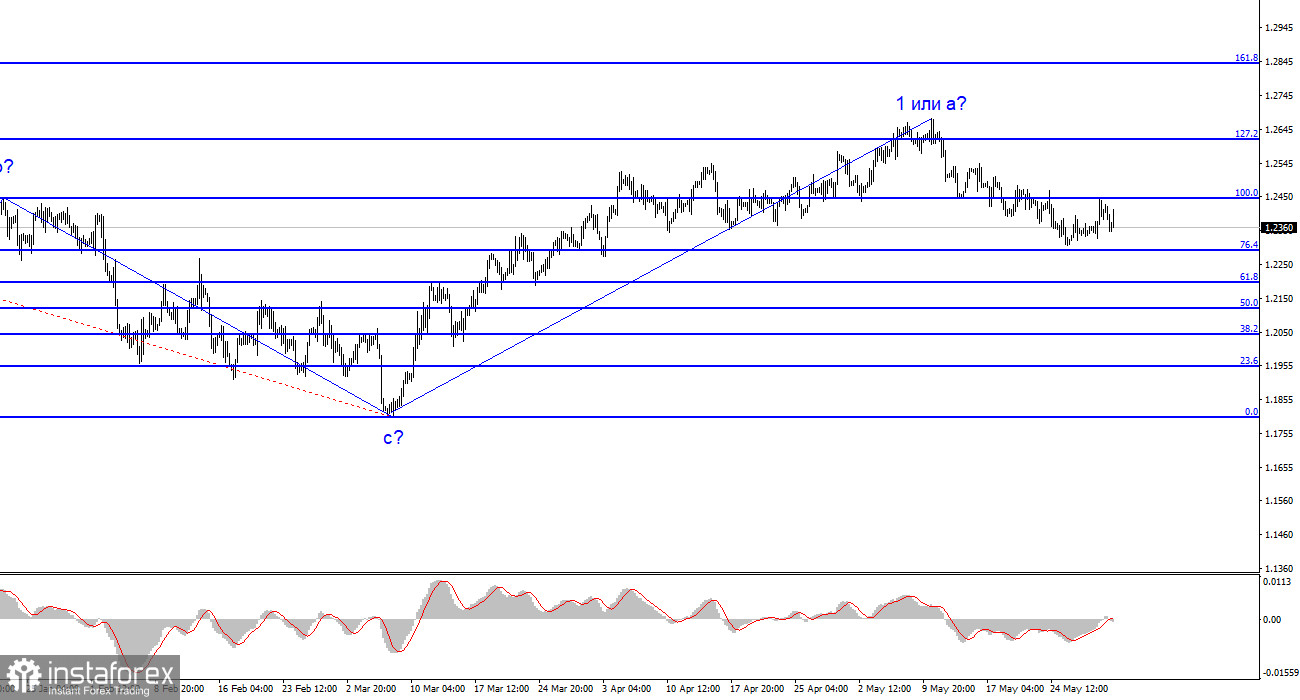

The wave pattern of the GBP/USD pair has long indicated the formation of a new downtrend wave. Wave b could be very deep, as all waves have recently been equal. A successful attempt to break through 1.2445, which equates to 100.0% Fibonacci, indicates that the market is ready to sell. I recommend selling the pound with targets around 23 and 22 figures. The instrument can fall even deeper.