Trend analysis:

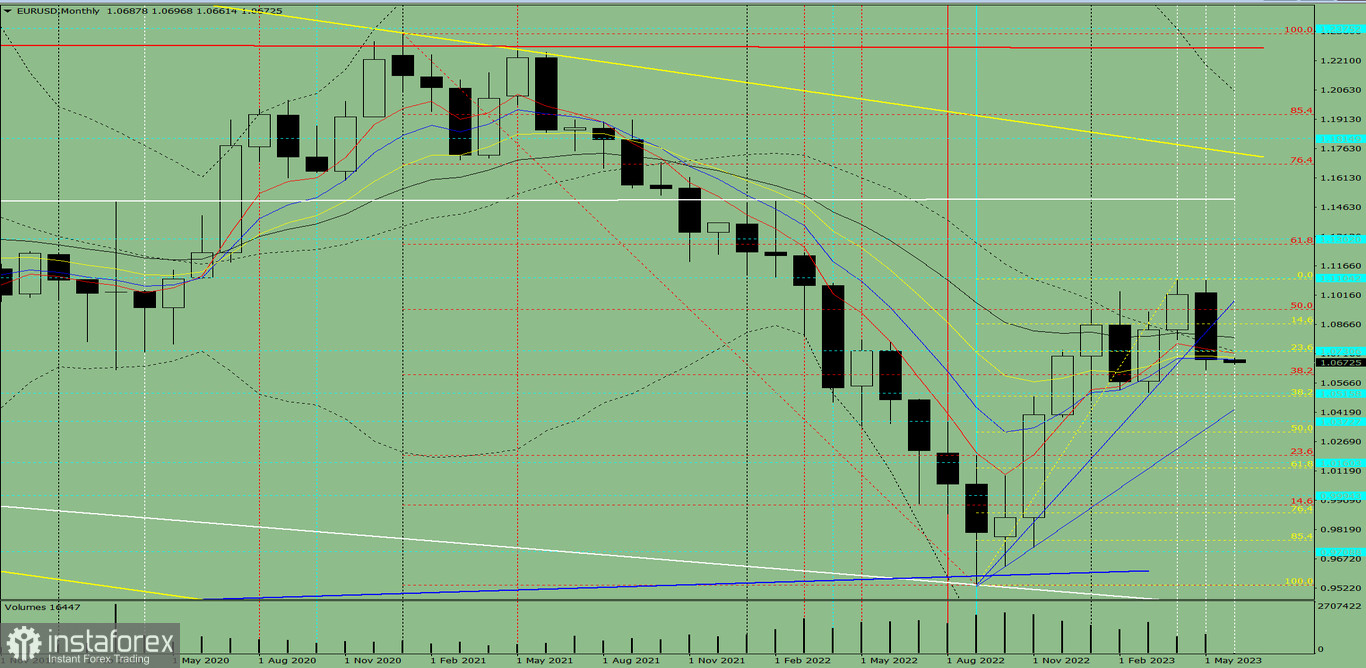

EUR/USD will probably move downwards in June, starting from the level of 1.0688 (closing of the May monthly candle) to the 38.2% retracement level at 1.0609 (red dashed line). Upon testing this price, the pair will bounce up to the 50% retracement level at 1.0941 (red dashed line).

Fig. 1 (monthly chart)

Comprehensive analysis:

Indicator analysis - uptrend

Fibonacci levels - uptrend

Volumes - uptrend

Candlestick analysis - uptrend

Trend analysis - uptrend

Bollinger bands - uptrend

The indicators show that a bullish scenario will unfold in EUR/USD.

Conclusion: The pair will have an upward trend, with a first lower shadow on the monthly white candle (the first week of the month is black) and no second upper shadow (the last week is white).

So, throughout the month, quotes will dip from 1.0688 (closing of the May monthly candle) to the 38.2% retracement level at 1.0609 (red dashed line), and then bounce up to the 50% retracement level at 1.0941 (red dashed line).

Alternatively, euro could decline from 1.0688 (closing of the May monthly candle) to the 38.2% retracement level at 1.0499 (yellow dashed line), and then turn around and climb upwards to the 50% retracement level at 1.0941 (red dashed line).