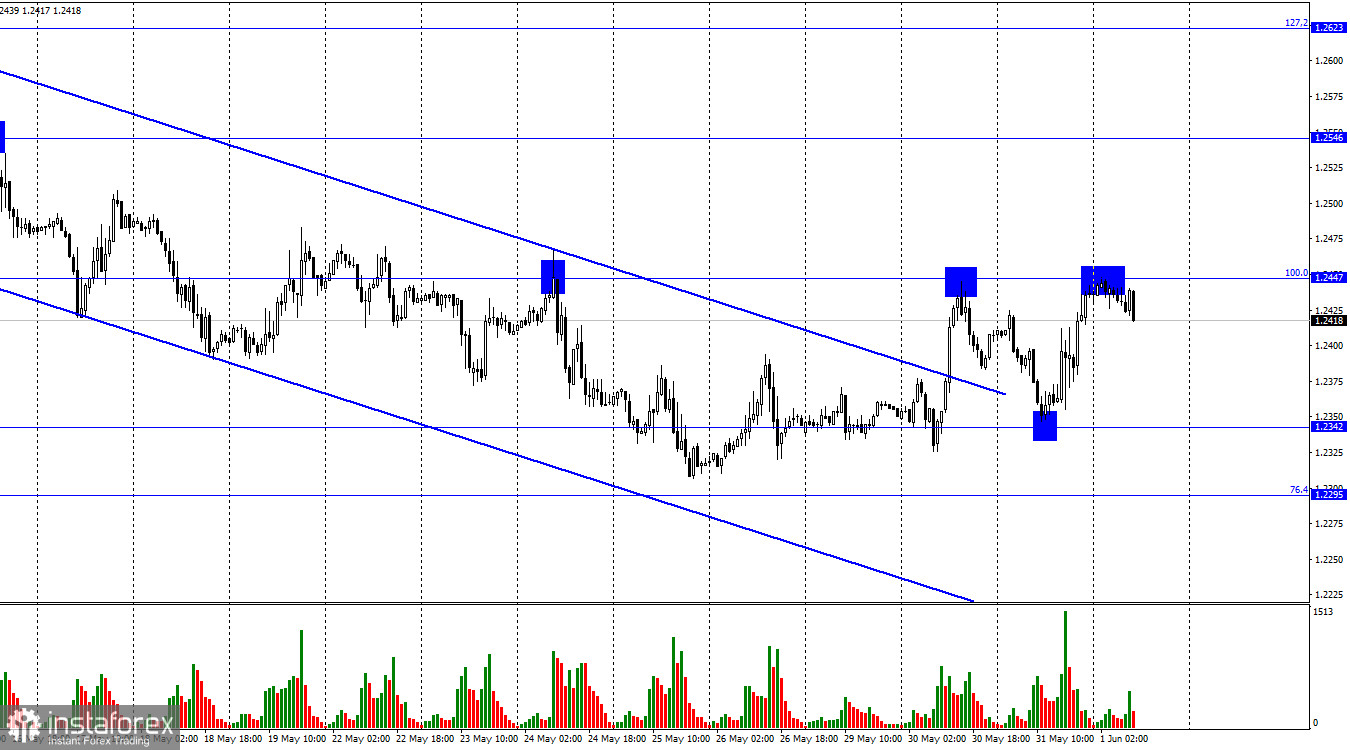

Hi, dear traders! On the H1 chart, GBP/USD rebounded from 1.2342 on Wednesday, reversed upwards, and rose to the Fibonacci level of 100.0% at 1.2447. It later bounced off this level and moved downwards, suggesting that it could decline towards 1.2342. If the pair closes above 1.2447, its further growth towards the next target level at 1.2546 will become more likely.

Yesterday was an interesting day for traders not only because of data releases in the EU and the US but also because of remarks by Fed policymakers Patrick Harker and Philip Jefferson. Harker stated that the Fed might consider pausing the rate hike cycle in June, but the hikes should be continued as inflation is not declining at a sufficiently high pace. Philip Jefferson stated that a pause in June does not mean that the process of tightening monetary policy is complete. Some may have interpreted these statements as dovish since they mentioned a pause, but personally, I consider them hawkish as both officials emphasized the need to continue hiking interest rates. This was also stressed by several members of the Federal Open Market Committee (FOMC) who hinted that interest rates might be increased at the June meeting, which would take place in two weeks. Thus, the opinions of policymakers are divided between a very hawkish stance and a hawkish one. The former suggests a 0.25% rate hike in June, while the latter suggests the same move should occur in July instead.

I believe that the FOMC has already somewhat overachieved its plan, and each new rate hike can be considered an additional step. Any further tightening will continue to support the pound sterling bears as they are also bullish on USD. Overall, if the US labor market, unemployment, or business activity data do not turn out to be clearly negative today and tomorrow, the US dollar is likely to rise further.

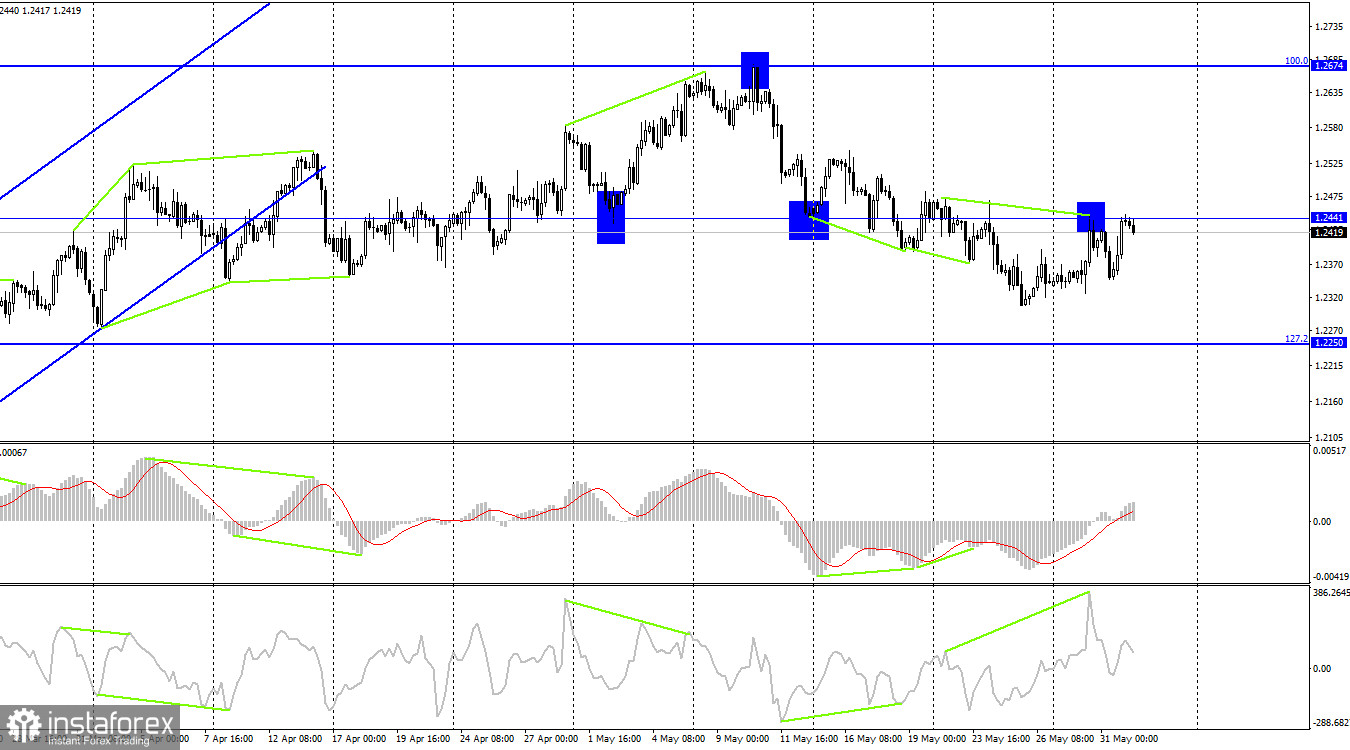

On the H4 chart, the pair rebounded from the level of 1.2441 yesterday, and experienced another rebound today, which suggests it might continue to decline towards the next correction level of 127.2% at 1.2250. The bearish CCI divergence also indicates that the pair is likely to slide down further. A rebound of GBP/USD from 1.2250 would result in some gains for the pound sterling , while closing below this level would make a decline towards 1.2008 more likely.

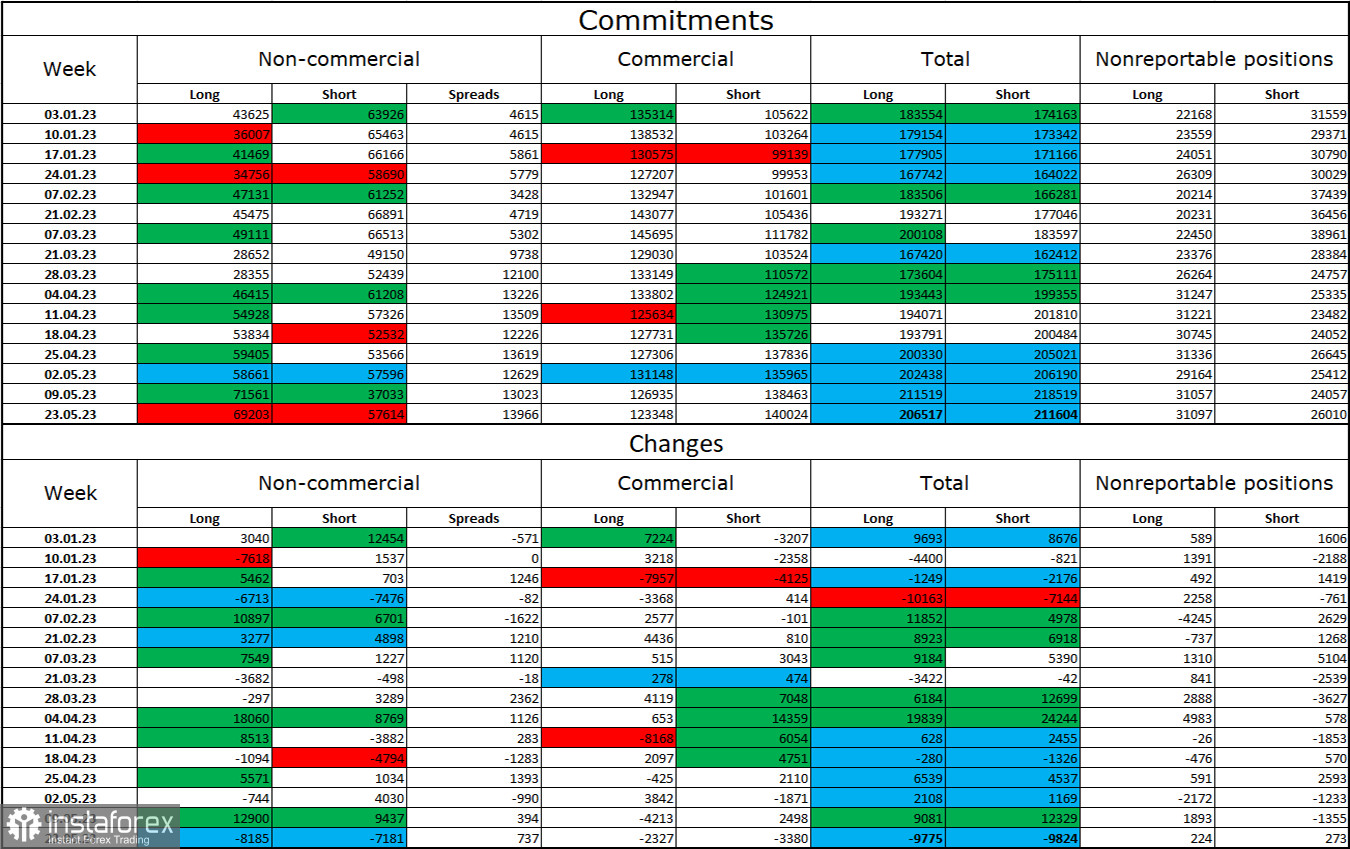

Commitments of Traders (COT) report:

The sentiment of non-commercial traders became slightly less bullish during the last week covered by the report. The number of long positions decreased by 8,185, while the number of short positions declined by 7,181. The overall sentiment of major players remains predominantly bullish. It had been bearish for a long time, but now the number of open long and short positions is almost equal, standing at 69,000 and 57,000 respectively. In my opinion, the pound sterling has a good chance of resuming its uptrend, but the current events do not favor both USD and GBP. The pound sterling has been rising for a long time, and the net position of non-commercial traders has also been growing for quite a while, but it all depends on whether the long-term support for the British currency will be maintained. I believe that the uptrend is unlikely to continue at this point.

US and UK economic calendar:

UK - Manufacturing PMI (08:30 UTC).

US - ADP Non-Farm Employment Change (12:15 UTC).

US - Initial Jobless Claims (12:30 UTC).

US - ISM Manufacturing PMI (14:00 UTC).

There are several important events on Thursday, including the business activity data in the UK. They may have a significant impact on the pair's performance throughout the rest of the day.

Outlook for GBP/USD:

New short positions can be opened after GBP/USD rebounds off 1.2447 on the H1 chart, with targets at 1.2342 and 1.2295. Due to several bearish signals and the latest news from the US, going long on the pound sterling is currently not recommended.