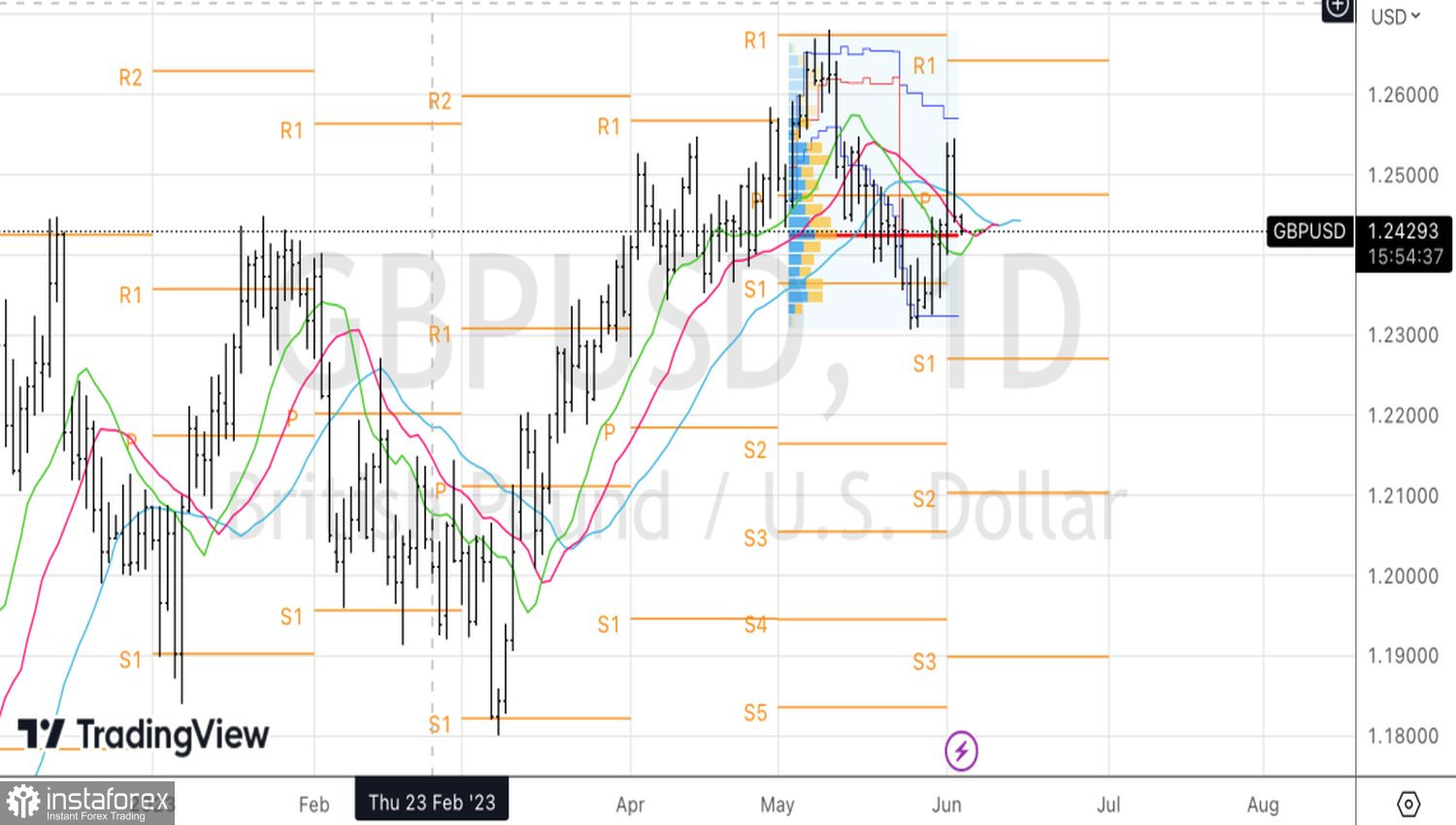

Everything hidden becomes evident. A real puzzle for investors was why the higher yield of British bonds compared to American ones and the expectations of a 100 bps increase in the repo rate to 5.5% did not lead to an increase in GBP/USD. The pair was only able to recover after hints from FOMC members about a pause in the process of tightening monetary policy by the Fed in June. However, the May employment report in the U.S. changed everything. The pound is facing downward and risks falling even further.

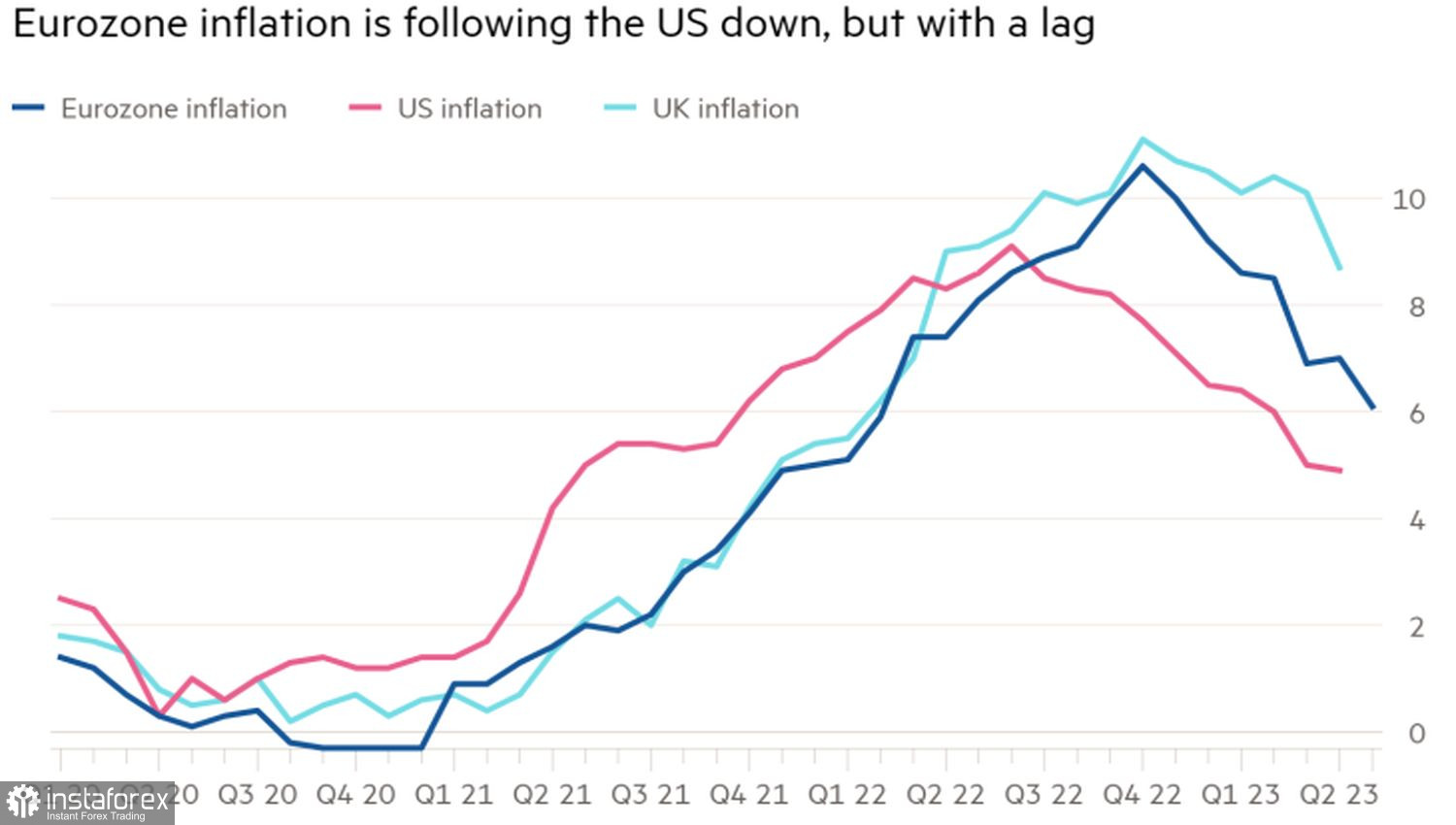

Impressive growth in American employment opened discussions about the contrasting developments in the U.S. and UK economies. The former maintains its strength despite the Fed's aggressive tightening of monetary policy. The latter is experiencing a stagflation state, a combination of a GDP on the verge of contraction and high inflation. Consumer prices in Britain are higher than in other G7 countries and show no signs of slowing down.

Inflation dynamics in the U.S., Britain and the Eurozone

In theory, high inflation should stimulate the central bank to raise interest rates. This should signal a rally in sovereign bond yields, leading to an expansion of the yield differential with foreign counterparts and a strengthening of the national currency. However, with the pound, it's different. Despite expectations of a 100 bps increase in the repo rate and the federal funds rate at a maximum of 25-50 bps, GBP/USD quotes fell. Investors believed that the Bank of England was inefficient in performing its duties.

In reality, the main reason for the weakness of the pound is the stagflationary environment in Britain. Markets fear that the more the Bank of England tightens monetary policy, the closer the recession will be. In such a situation, stock indices are reluctant to rise, and the rally in bond yields looks like panic. In the U.S., on the other hand, the stability of the economy allows the Fed to do even more than investors expect. The S&P 500 is growing, and capital is flowing into the States.

GBP/USD is under pressure from rumors that inflation in Britain will sharply slow down in the next couple of months. According to Panmure, the main reason for high prices is electricity bills, which are expected to decrease significantly in June and September, pushing CPI down, reducing the expected ceiling of the repo rate, and putting pressure on the sterling.

On the other hand, the markets have nearly ruled out the idea of a rate hike by the Federal Reserve in June. This will restrain the bearish momentum on the analyzed pair and may result in its medium-term consolidation. Especially considering that before the FOMC meeting on June 13-14, Fed hawks will no longer be able to support the U.S. dollar with their rhetoric. According to the rules, officials must remain silent before the session.

Technically, the inability of GBP/USD buyers to hold quotes above the 1.2475 pivot level indicates their weakness. A breakthrough of dynamic supports such as moving averages and fair value at 1.2425 will increase the risks of a correction towards the long-term upward trend and provide a basis for selling the pound against the U.S. dollar.