The news background on Monday was not abundant or strong. In the morning, the demand for the euro and pound continued to decline after Friday's release of the strong Nonfarm Payrolls report in the United States. However, the ISM Non-Manufacturing Purchasing Managers' Index (PMI) was released in America, which disappointed dollar buyers. It wasn't exactly weak, as it reached 50.3 points, and any value above 50 is considered positive. However, the index has been falling for several consecutive months, and the next decline could be critical, as the index may fall below 50. The services sector traditionally copes better with aggressive monetary policy by the central bank. At the same time, the manufacturing sector has long been below the 50 mark. If both sectors fall below this mark, it could have a detrimental impact on the economic growth of the US economy, which has already been declining for two quarters.

In previous reviews, I mentioned that the US reports often please the markets, but some reports still raise doubts among investors. One positive aspect is that the Federal Reserve (Fed) is close to completing its tightening program, and the interest rate will increase at most one more time. This means that the slowdown in business activity will decelerate, and inflation is declining at a relatively high pace. By the end of the year (as believed by many analysts, including myself), the FOMC will announce a gradual rate cut. The actual policy easing is expected to begin in early 2024.

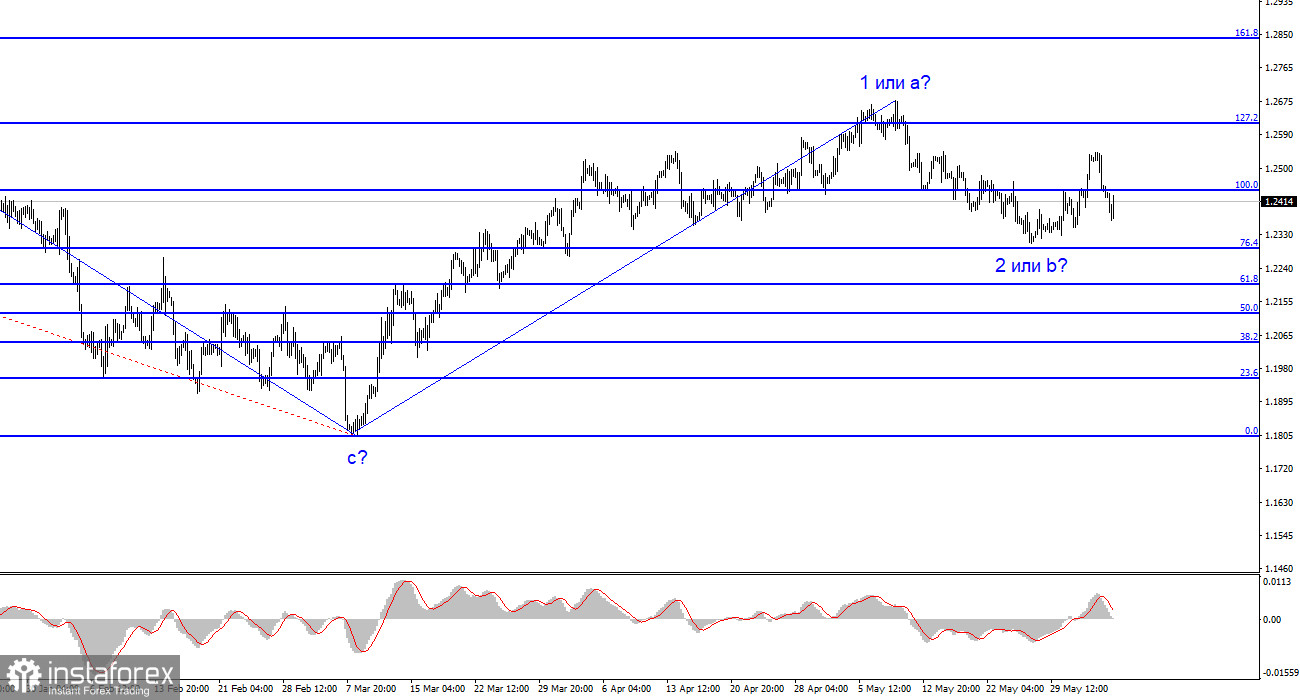

Based on all the aforementioned factors and considering the economic situation of the European Union and the United Kingdom, I still believe that both instruments have room to decline by several hundred points. However, I must note that the wave structure may start to become more complex. In the case of the British pound, it has been less than ideal in recent months, with a lack of impulse waves and many waves being almost equal in size. Currently, the question arises as to which wave is being formed at the moment.

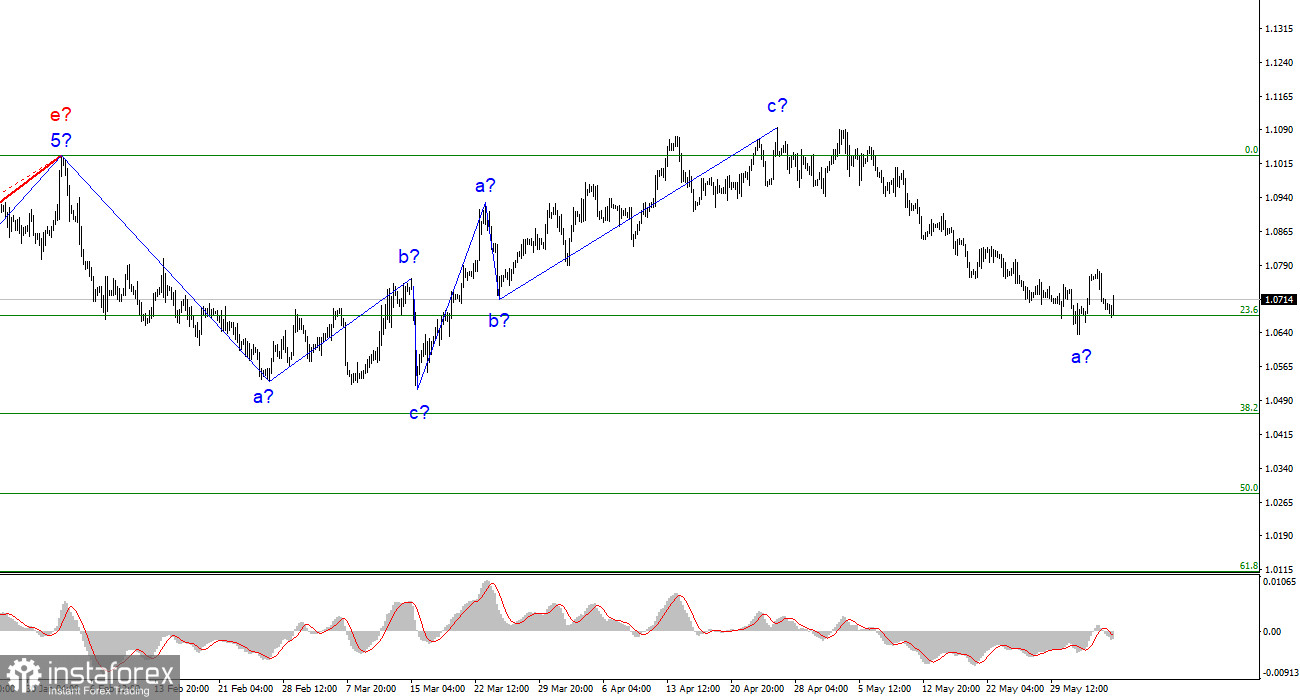

The euro's situation is slightly more appealing, as I can at least identify one completed wave and conclude with an 80% probability that a downtrend is being formed at the moment. We can't be so confident with the British pound. Moreover, this week's news background is unlikely to provide all the necessary clarity. There is a scarcity of news and reports, and almost no speeches.

Based on the analysis conducted, I conclude that the uptrend phase has ended. Therefore, I would recommend selling at this point, since the instrument has significant potential to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave may start from the 1.0678 level, so you can consider short positions if the pair surpasses this level or after an evident completion of wave b.

The wave pattern of the GBP/USD pair has long indicated the formation of a new downtrend wave. Wave b could be very deep, as all waves have recently been equal. A successful attempt to break through 1.2445, which corresponds to 100.0% Fibonacci, indicates that the market is ready to buy, which could disrupt the current scenario. I recommend selling the pound with targets around 23 and 22 figures, but now we need to wait for signals to resume the formation of the downward wave.