The Reserve Bank of Australia unexpectedly raised its key interest rate this morning, possibly reflecting some unseen processes to investors, or simply due to the decision of the Federal Reserve to increase its own interest rates. The 0.25% hike pushes the rate from 3.85% to 4.1%, much higher than the forecast.

The decision of the RBA contradicts the general trend among Western central banks closely linked to the Federal Reserve and its monetary policy. Usually, they follow the policy of the American regulator, fully aligning with it and maintaining a certain level of interest rate relationship. But this time, the RBA chose to raise rates despite expectations in the market that the Federal Reserve would take a pause in rate hikes. It seems that the bank decided to take advantage of the situation and ensure that inflation continues its vigorous decline before the Australian economy falls into a recession.

Another reason could be the RBA believing that the Fed will still raise interest rates at the June meeting as US inflation remains high at 4.9%. Its decline also slowed recently, which could be a precursor to a halt. The labor market also remains strong, indicating that the demand for goods and services in the country remains sufficiently high to support inflation since people earn salaries and spend them.

Considering all this, AUD/USD will rise if the Federal Reserve takes a pause in rate hikes. If not, the rate hike in Australia will be offset, and in the conditions of growing dollar demand and capital inflows into the US, dollar will receive explicit support. Much, if not all, will depend on the actions of the Federal Reserve.

Forecasts for today:

AUD/USD

The pair trades above 0.6645 on the wave of the RBA's decision to raise interest rates. However, it failed to overcome the resistance level at 0.6675. If the price moves above it, a local increase towards 0.6800 can be expected. If this does not happen, the pair may correct towards 0.6645 or even lower towards 0.6615.

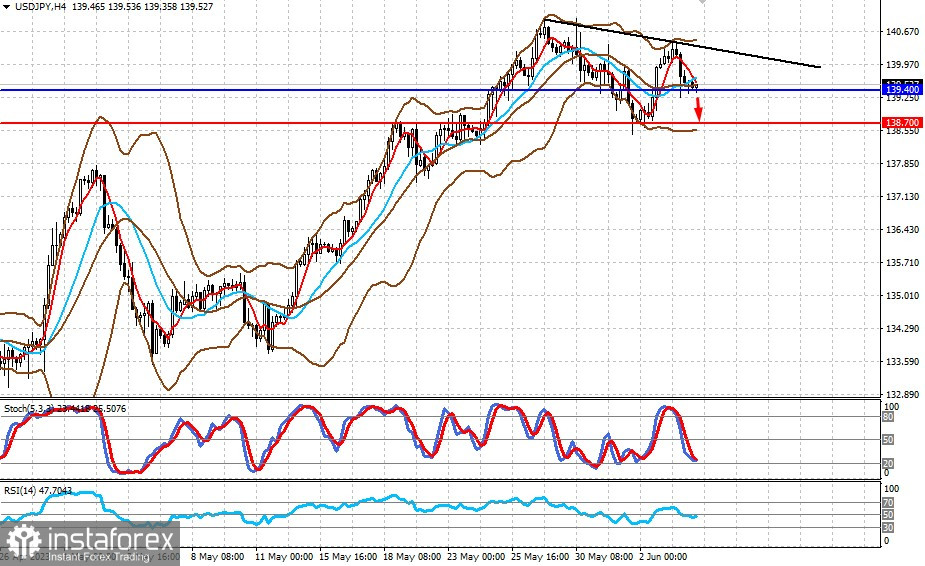

USD/JPY

The pair is hovering above 139.40. But if the price falls below it, the pair may decline towards 138.70.