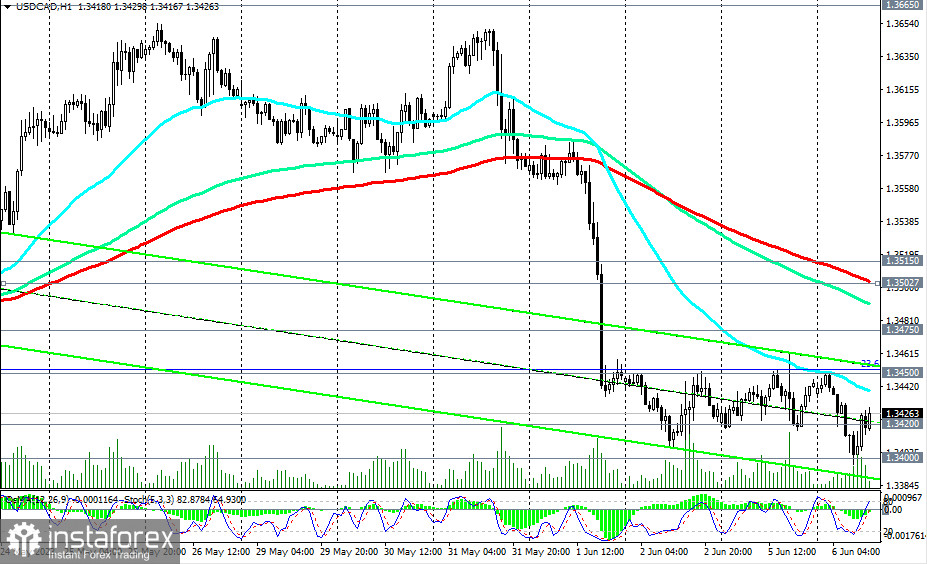

Significant volatility is expected in Canadian dollar quotes and the USD/CAD pair tomorrow at 14:00 (GMT) when the Bank of Canada will announce its interest rate decision.

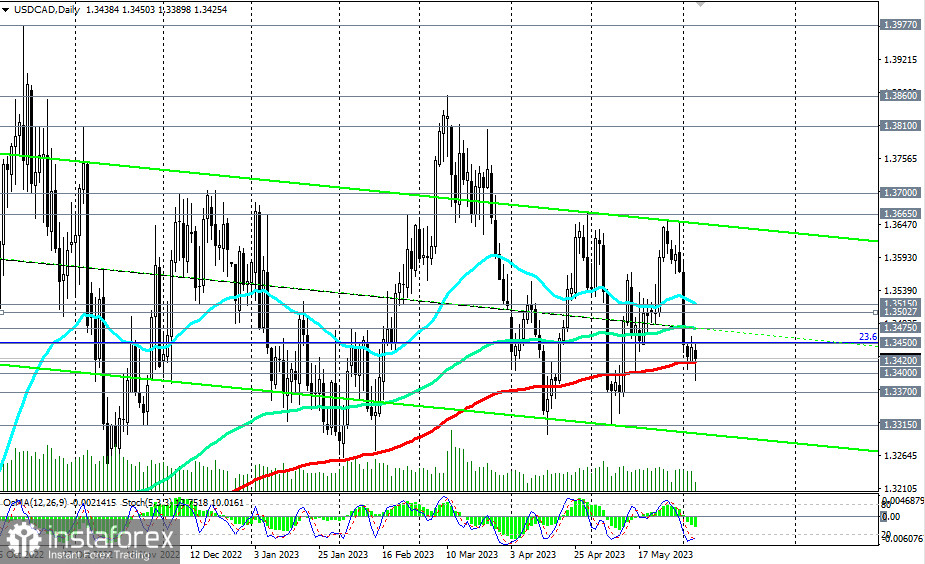

Over the past three days, the pair has been trading near the 1.3420 level, which is a key support level (200 EMA on the daily chart) separating the medium-term bullish market from the bearish market.

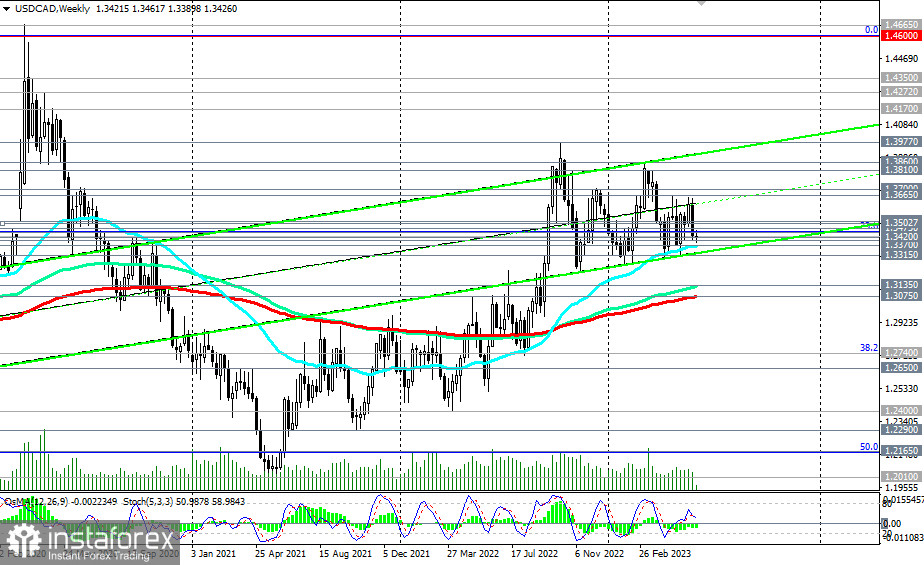

At the same time, the pair remains within the long-term bullish market zone, above the key support levels of 1.3135 (144 EMA on the weekly chart) and 1.3075 (200 EMA on the weekly chart).

From this perspective, the zone near the levels of 1.3370 (50 EMA on the weekly chart), 1.3400, and 1.3420 appears favorable for opening new long positions on the USD/CAD pair.

A breakthrough of the resistance levels at 1.3503 (200 EMA on the 1H chart), 1.3515 (50 EMA on the daily chart and 200 EMA on the 4H chart) would confirm a signal for further increase in long positions on the pair.

In this case, USD/CAD will head towards the upper boundary of the upward channel on the weekly chart and towards the levels of 1.3810, 1.3860, and after their breakout, towards 1.3977 (October high and highest level since June 2020).

In an alternative scenario, if USD/CAD breaks below the support level of 1.3370, it will resume its decline towards the key support levels of 1.3135 and 1.3075 (with an intermediate target at the local support level of 1.3315), which separate the long-term bullish market from the bearish market.

Support levels: 1.3420, 1.3400, 1.3370, 1.3315, 1.3200, 1.3135, 1.3075

Resistance levels: 1.3450, 1.3475, 1.3503, 1.3515, 1.3600, 1.3665, 1.3700, 1.3810, 1.3860, 1.3900, 1.3970, 1.4000