The US Securities and Exchange Commission has filed an emergency action application to freeze assets owned by BAM Management US Holdings and BAM Trading Services, and Binance.US. The SEC took decisive action on Tuesday, determined to fight the crypto industry in the US.

Bitcoin and Ether hardly reacted to this news, fully recovering from a slight dip triggered by the announcement that many top altcoins, including SOL, ADA, MATIC, and others, were declared securities in the US. Without proper licensing and SEC regulation, trading those digital assets will now get difficult.

As for Binance, the SEC requested a temporary restraining order from the court, aimed at freezing all assets of the company located within the US and under the control of BAM Management US Holdings and BAM Trading Services. These are the primary operational entities responsible for managing Binance US, the subsidiary of the Binance cryptocurrency exchange.

The order directly prohibits Binance from engaging in any activities that may lead to the destruction, alteration, or concealment of records related to the company's assets. In another court ruling, it is emphasized that BAM Management or Changpeng Zhao, the head of Binance, must provide substantial evidence that the company has not been engaged in any unlawful activities within the US in order to halt the account freezes. The Securities and Exchange Commission asserts that the restraining order is necessary to protect client funds.

Same with San Francisco-based Coinbase, the SEC has accused it of offering unregistered securities. As a result, the company's stocks plummeted by more than 15% yesterday. The regulator said in a statement that it believes a restraining order is necessary because of the defendants' years-long violation of the law, disregard for US laws, evasion of regulatory oversight, and various financial transfer issues, as well as the custody and control of customer assets.

However, these decisions have had no impact on the price of Bitcoin and Ether. They quickly recovered. Such decisions were expected. After all, the regulator made it clear last year that Binance had no place in the market. Against this backdrop, the company significantly reduced its investments in the US and focused on the rest of the world.

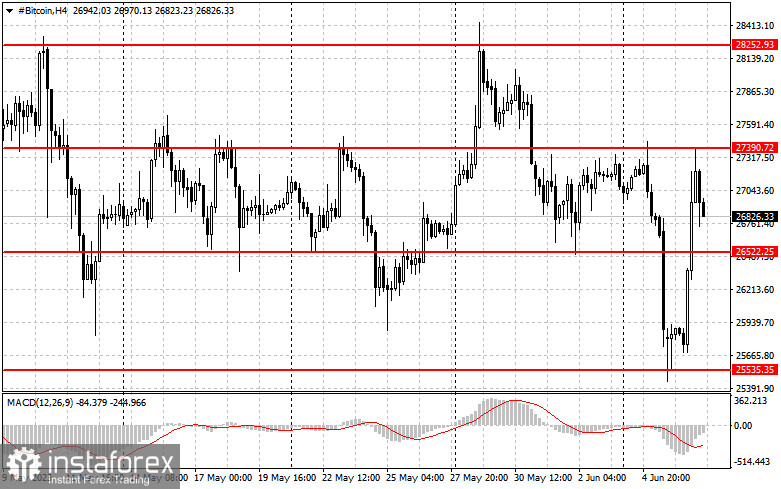

If the $26,700 level is defended, Bitcoin will be able to extend growth to the target of $27,500. The most distant target is seen around $28,200, where traders may lock in profit, causing a pullback. Meanwhile, if attempts to defend the $26,700 mark fail, the price may head toward $25,800. A breakout through this level may trigger a fall in the BTC value to $23,900.

ETH buyers are focused on defending the nearest support level of $1,790 and reclaiming $1,920 resistance. Only after that can we expect a move toward $2,030, which will allow the bullish trend to continue and lead to a new surge in price toward $2,130. If selling pressure increases again, a breakout through $1,790 and a test of $1,690 may occur. A breakout through 1,640 may push the price to a low of $1,570.