In recent reviews, I have drawn your attention to the divergent movements of the euro and the pound, which in itself looks quite strange and unusual. It would be easy to explain why this is happening if the news background in Great Britain was strong or it was weak in the European Union. However, this happened in the absence of influential economic releases, and there is no news at all from Britain. The euro is honestly trading around the 1.0679 level in the absence of news. On the other hand, the pound is rising again after retracing its gains, which raises a lot of questions. The current growth could well be an internal corrective wave as part of Wave 2 or Wave B, but each new day brings us closer to the possibility of seeing a full-fledged ascending Wave 3 or Wave C.

Analysts from Credit Suisse have expressed the assumption that demand for the euro may continue to decline in the near future. They attribute this to the fact that only 70 bps of rate cuts are priced for the ECB from Sep '23 to Sep '24. If this is indeed the case, monetary tightening should be completed this summer, implying a maximum of two additional 25-point rate hikes. Economists note that the market has likely already priced in these two remaining hikes, while the Fed's policy appears more aggressive at the moment, considering the recent statements by FOMC members. As a result, the ECB rate may settle at 4.25%, while the Fed rate is already at 5.25% and could rise to 5.75% in 2023.

The Fed is not expected to soften its policy until 2024, while the ECB may start lowering rates this year. Credit Suisse also points out that the euro has benefited from the ECB's rate hike factor over the past 8 months, which has significantly boosted its price. However, the upward momentum is now fading, and there is no longer any support for the euro currency.

The question remains as to why there is an increase in demand for the pound. Although there is no official information from the Bank of England, the market may anticipate further tightening based on high inflation. If this is indeed the case, the pound may continue to rise for some time, but the BoE cannot raise rates indefinitely and is unlikely to reach the level of the Fed's rate. Therefore, the pound has limited potential for growth regardless of any tightening in the UK. I believe that even this cannot justify the pound's growth, but there are no other explanations.

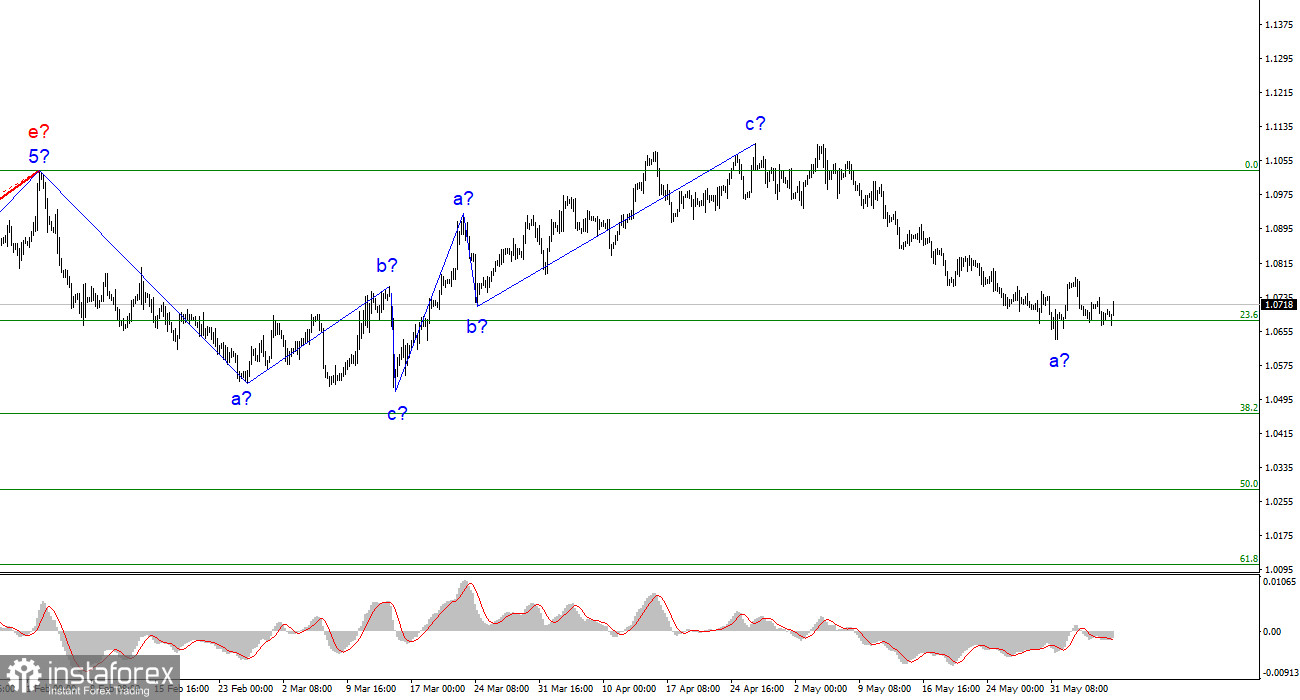

Based on the analysis conducted, I conclude that the uptrend phase has ended. Therefore, I would recommend selling at this point, since the instrument has enough room to fall. I believe that targets around 1.0500-1.0600 are quite realistic. I advise selling the instrument using these targets. A corrective wave may start from the 1.0678 level, so you can consider short positions if the pair surpasses this level or after wave b has obviously been completed.

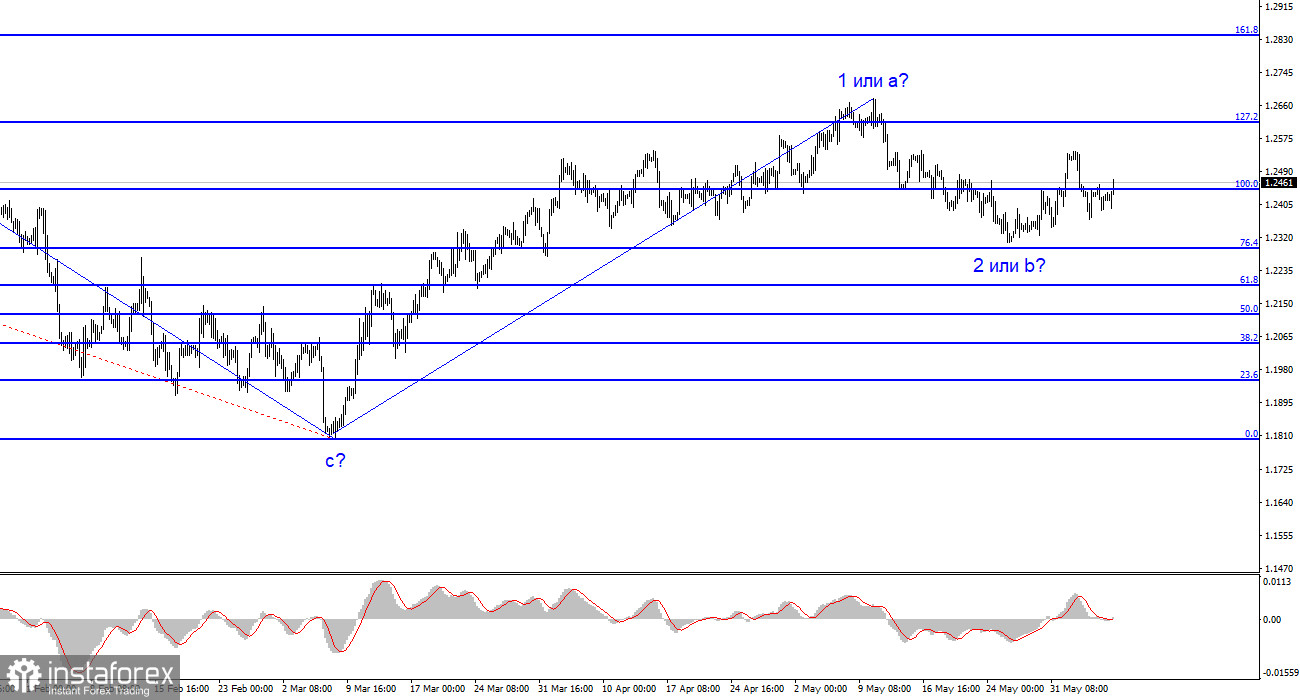

The wave pattern of the GBP/USD pair has long suggested the formation of a new downward wave. Wave b could be very deep, since all the waves have recently been equal. However, the recent growth indicates a possible completion of this wave on May 25th. In this case, the trend segment may transform into a full-fledged ascending wave. That would present a completely different wave pattern and different conclusions and recommendations. Therefore, I currently recommend selling the pound with targets around the 23 and 22 figures, but we need to wait for signals of the resumption of the downward wave, which are currently absent.