Market activity dipped as the Federal Reserve's monetary policy meeting approaches. It seems that more and more investors let go of their expectations that the Fed will take a pause in raising rates after the central banks of Canada and Australia unexpectedly announced 0.25% rate hikes this week.

Perhaps, members of the two banks know something about the Fed's likely actions at the upcoming meeting, or they could be speculating. In any case, this could serve as a leading indicator, especially considering that the central banks typically act to the position of the Fed.

Another signal for a 0.25% increase by the Fed could be the combination of strong labor market data and slowing decline in inflation. This led to stock indices not showing a clear direction, while the ICE dollar index hovered around 104.00 this week.

In another note, China's export and import volume data, as well as its trade balance, could be an indication of a cooling economy. Despite successfully maintaining strong growth during the 2008-09 crisis and subsequent years, China's economy appears to be weakening, thus affecting the global economy.

Current market conditions may persist until the end of this week.

Forecasts for today:

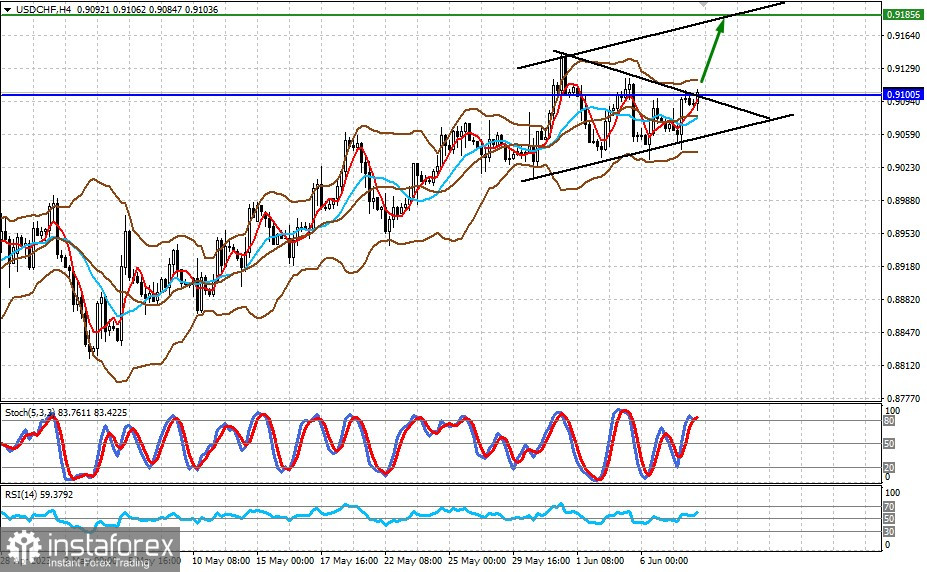

USD/CHF

Latest price movements appear to be a continuation of a pattern. A breakdown of 0.9100 will likely lead to a rise to 0.9185.

GBP/USD

The pair remains in a sideways range ahead of the Fed's monetary policy meeting. If it fails to rise above the level of 1.2470, there will be a reversal downwards and a decline towards 1.2300.