The beginning of the new week marked a new stage of confrontation between cryptocurrencies and the Securities and Exchange Commission (SEC). The SEC filed lawsuits against two major cryptocurrency exchanges and declared several major crypto projects as securities. The SEC's policy significantly revived crypto investors who had been largely passive until then.

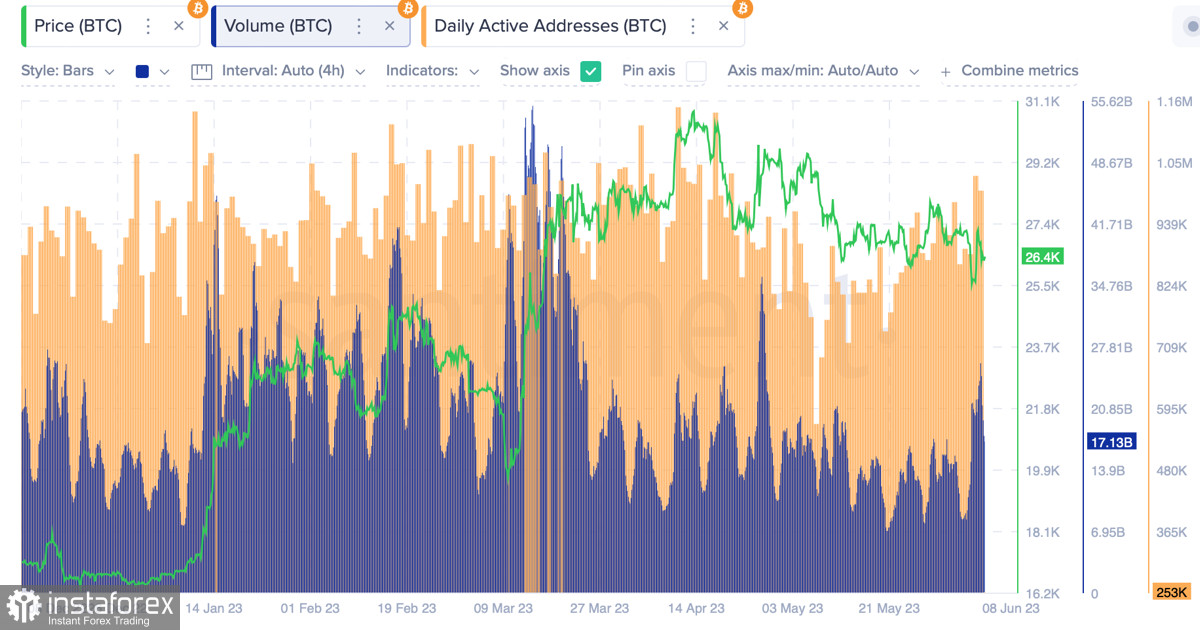

Trading volumes, the number of unique addresses, and constant movement of coins between wallets and platforms have led to more active price movements in cryptocurrencies. Taking this into account, it can be expected that Bitcoin will break out of the current range in the near future.

Bitcoin's Prospects

After a month-long pause and consolidation period during which over 50,000 BTC was accumulated, the trading activity of the cryptocurrency is gradually increasing. The main catalyst for this process has been the legal actions taken against crypto exchanges by the SEC, but in addition to that, almost all categories of holders have been accumulating BTC.

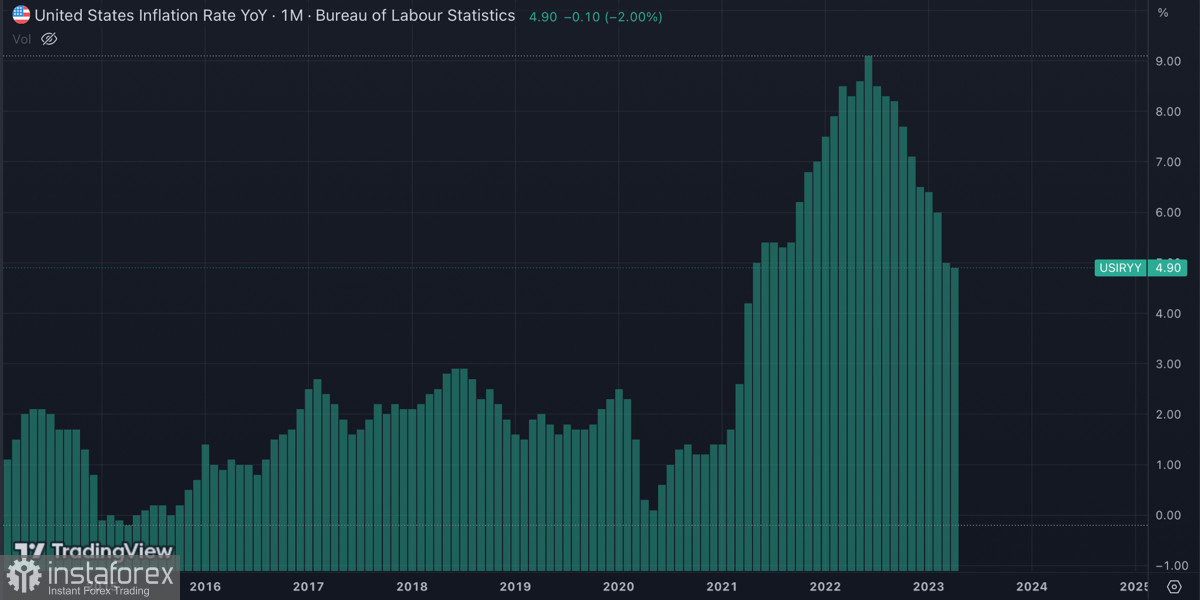

Over the past six months, Bitcoin's trading activity has significantly decreased, and investment flows into crypto assets have fallen by 97%. In this situation, important macroeconomic events become the main catalysts for price movements in BTC. In the near future, we can expect several key events capable of fueling the flame engulfing the crypto market.

Next week, two important events for the global economy and the crypto industry are expected. Inflation data, and the Federal Reserve's decision on pausing/further rate hikes, will play a significant role in Bitcoin's prospects. However, as usual, investors will start reacting to the news before its release.

BTC/USD Analysis

Considering investors' caution, the first strong price movements can be expected before June 14. If we highlight the bullish targets within the potential upward movement, the immediate resistance area of $26.8k–$27k stands out. A successful breakthrough of this range would pave the way for BTC towards the second key level of $27.5k.

Breaking the $27.5k level would allow the cryptocurrency to enter operational space and approach the final resistance point of $28k–$28.5k. A definitive breakthrough and consolidation above this level would enable the asset to regain momentum towards $30k.

The main target for the bears remains unchanged: a downward break and consolidation below the $24.6k–$25k level. This would ultimately break the structure of the upward trend and open the path to $23k. An intermediate target on the way to realizing this idea is the $26k level, which plays the role of local support.

Subsequently, the bears will have to face a strong buy order block in the $25.5k–$26k range. Trading through this zone may take some time as the level of bullish sentiment does not drop below certain thresholds. At the same time, the bears still have the news background on their side, forcing investors to sell BTC.

Technical Analysis of BTC/USD

After the successful formation of the "bullish engulfing" pattern, buyers failed to sustain their success. The price started to decline again, and although volumes significantly dropped, bearish pressure has led to BTC trading near $26.4k. Trading volumes have also decreased to $17 billion, indicating a gradual fading of momentum.

Technical metrics on the daily chart vividly demonstrate a high level of market volatility. In the past three days, the stochastic oscillator has formed three bearish and two bullish crossovers. Additionally, the MACD also shows uncertainty, indicating a relative balance between bulls and bears.

Conclusion

The regulatory policy of the SEC has significantly revived the crypto market and shown potential price movement prospects in the short term. It is likely that volatility will continue to increase, and we will see the initial reactions of investors at the beginning of the next trading week. At this stage, the price has roughly equal chances of continuing the downward movement or reversing to the upside.