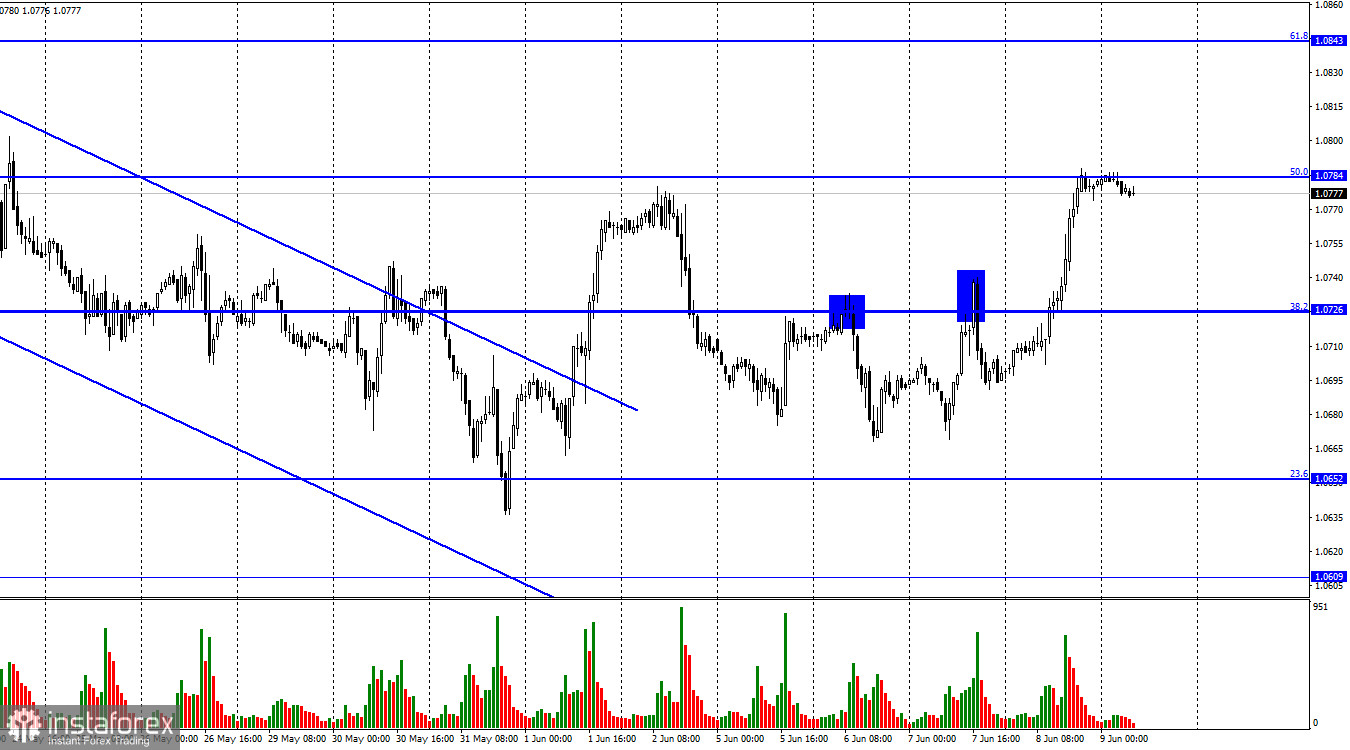

On Thursday, the EUR/USD pair reversed in favor of the European currency and rose to the Fibonacci correction level of 50.0% (1.0784). A rebound of the pair's exchange rate from this level will favor the American currency and potentially lead to a decline toward the Fibonacci level of 38.2% (1.0726). If the quotes close above the level of 1.0784, it will increase the probability of further growth towards the next Fibonacci level of 61.8% (1.0843).

Yesterday was a complete surprise for many traders. The European currency started its ascent at night and maintained its momentum and direction throughout the day, increasing by nearly 100 points. Interestingly, there was almost no news background on Thursday, and the released reports did not support the euro. The final estimate of EU GDP for the first quarter showed a decrease of 0.1% quarter-on-quarter and an increase of 1.0% year-on-year. Traders were expecting 0% and 1.2%, respectively. Since GDP is an indicator directly reflecting the state of the economy, bears could have entered the market. However, that did not happen. The market ignored the mentioned report.

The report on initial jobless claims was released in the United States, which exceeded traders' expectations by 30,000. This is a negative factor for the US dollar, but the claims report came out after noon, while the dollar had fallen since night. Perhaps in the second half of Thursday, this report supported the euro. But how to explain its morning and daytime growth? Traders are currently trading regardless of the news background. There were very few economic reports throughout the current week. Some days, the pair's movements aligned with expectations, but not yesterday. The next week will feature the FOMC meeting and the US inflation report. These two events clearly help the market determine its further direction and priorities.

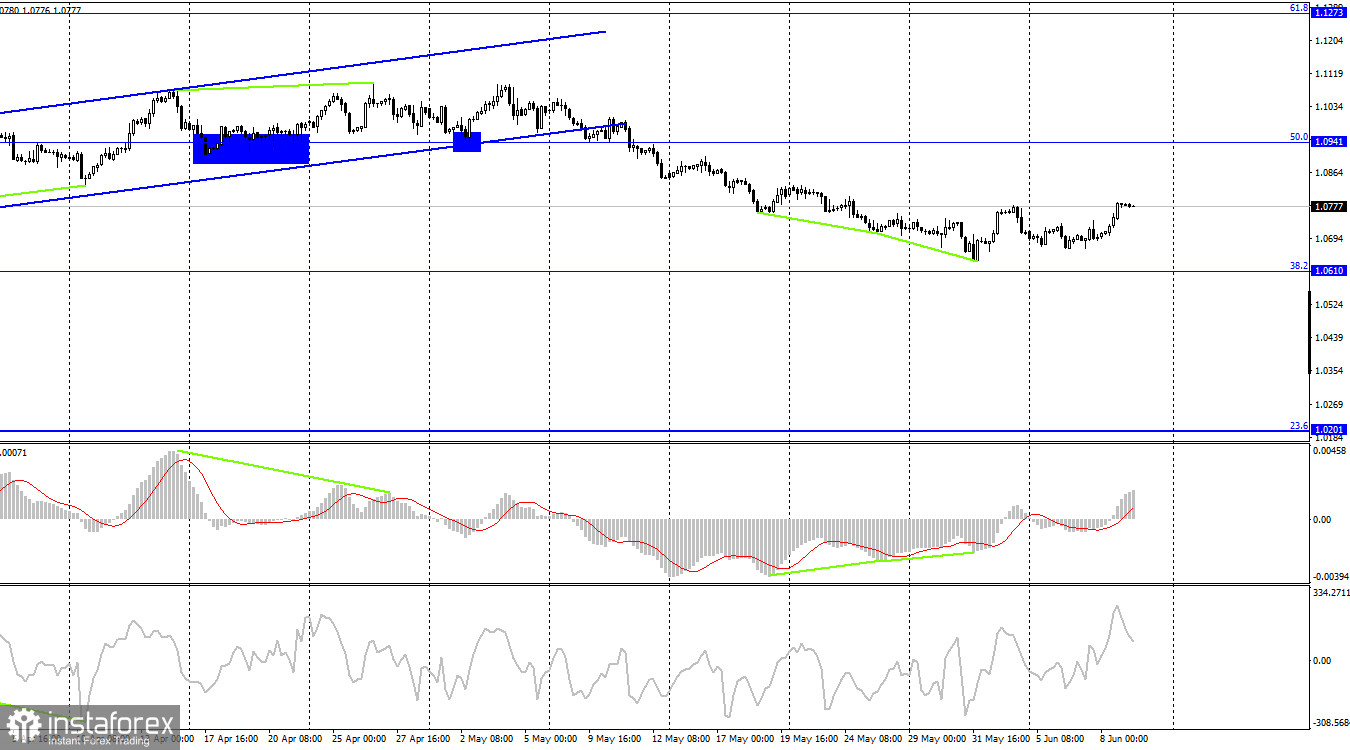

On the 4-hour chart, the pair has reversed in favor of the euro and may continue its upward movement toward the Fibonacci level of 50.0% (1.0941). There are no visible divergences today with any indicators. The level of 1.0941 is quite far away, so potential sell signals should be monitored on the hourly chart.

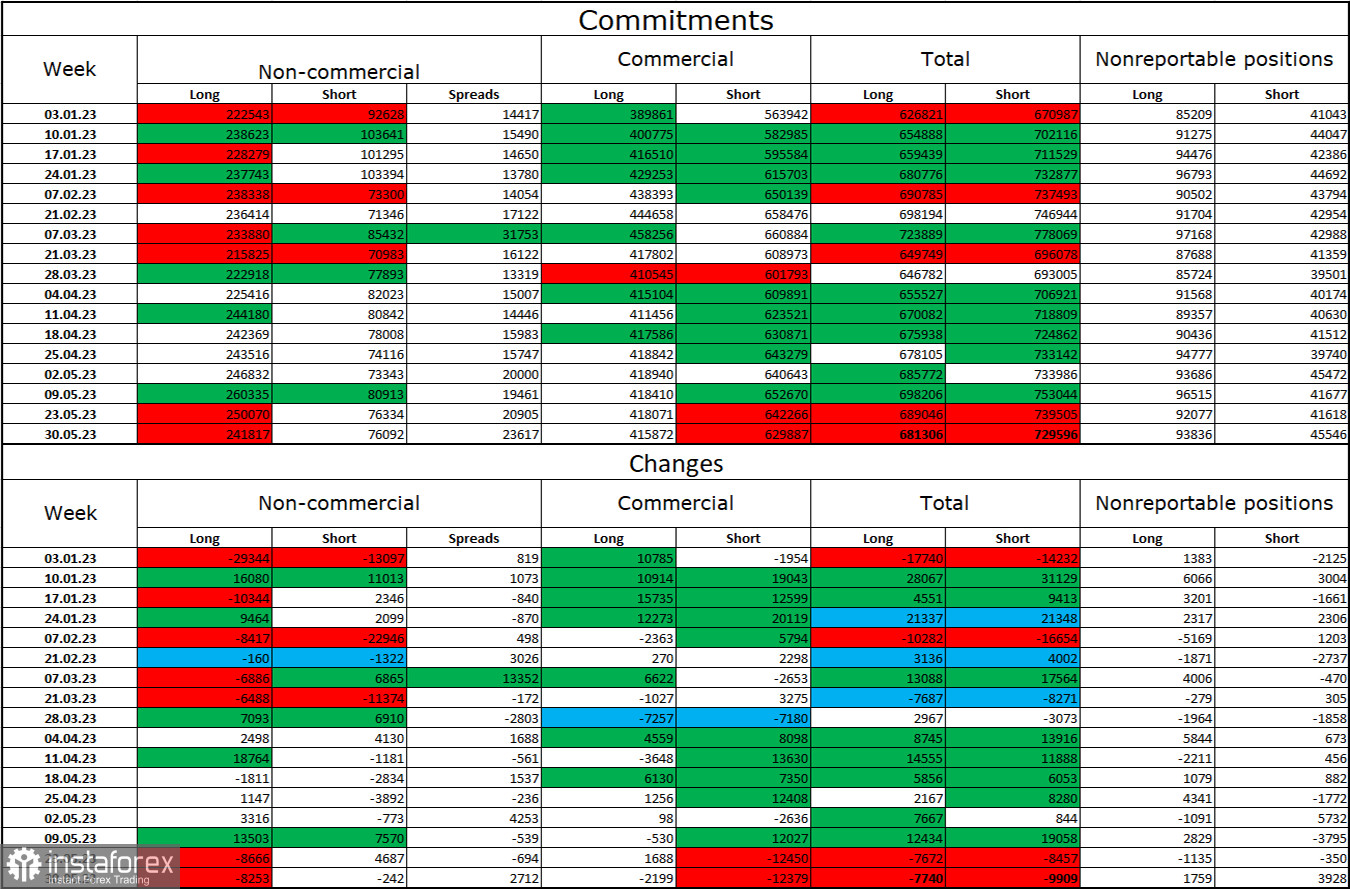

Commitments of Traders (COT) report:

In the last reporting week, speculators closed 8,253 long and 242 short contracts. The sentiment of large traders remains bullish but has slightly weakened in recent weeks. The total number of long contracts held by speculators now stands at 242,000, while short contracts amount to only 76,000. For now, strong bullish sentiment persists, but the situation will continue to change soon. The European currency has been falling for two consecutive weeks. The high value of open long contracts suggests that buyers may start closing them soon (or may have already started, as indicated by the latest two COT reports). There is currently an excessive bias toward bulls. The current figures allow for a further decline in the euro soon.

News Calendar for the United States and the European Union:

On June 9, the economic events calendar did not contain any entries. The impact of the news background on traders' sentiment will be absent today.

Forecast for EUR/USD and trading advice:

Short positions on the pair can be opened on a breakout below the level of 1.0784 on the hourly chart, with a target at 1.0726. I advise buying the pair on a close above 1.0784 on the hourly chart, with a target of 1.0843.