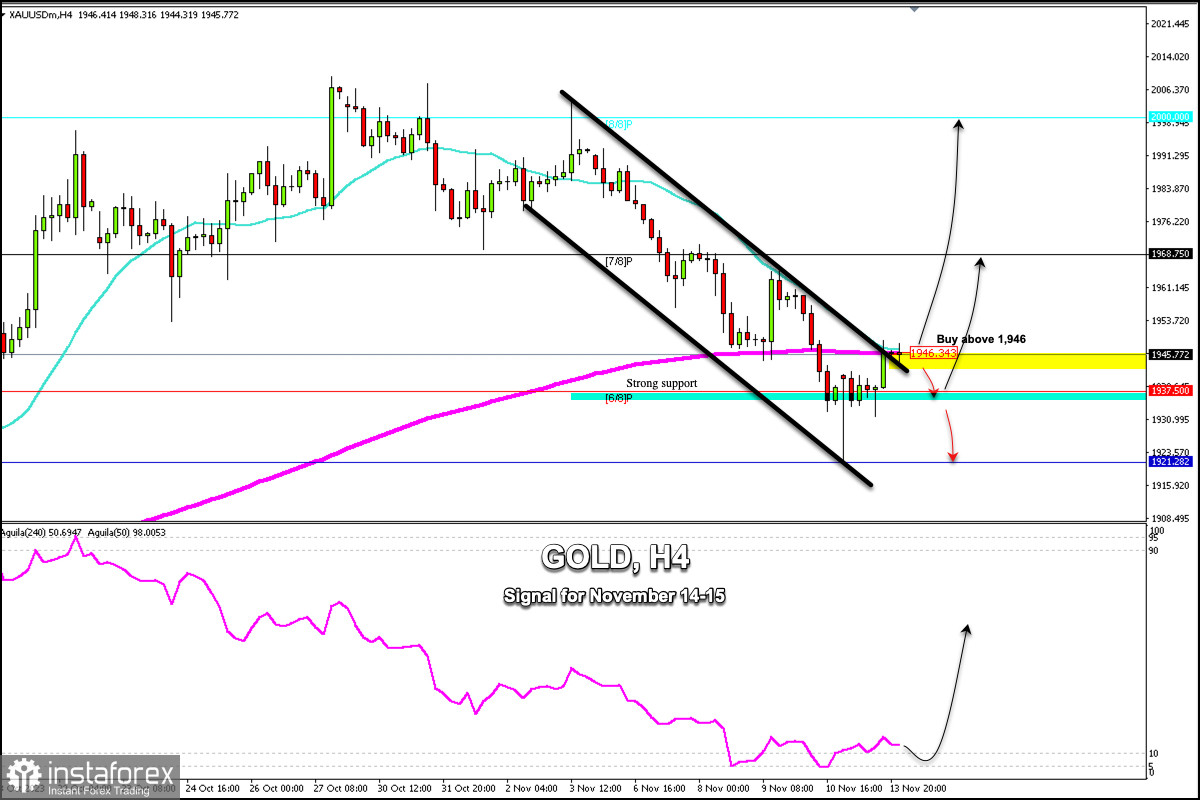

Early in the European session, Gold is trading around 1,945.77, around the 21 SMA, and the 200 EMA. On the H4 chart, we can see that gold broke the downtrend channel but is showing signs of exhaustion of its bullish strength. To recover, XAU/USD needs to consolidate above 1,946.

During the US session, the US inflation data will be released, which could generate a strong movement in gold. In case the data is negative for the US dollar, the metal could fall towards the 1,921 area and even towards the psychological level of 1,900. If the data is positive for the US dollar, gold could resume its upward cycle and could reach 1,968 or even 1,975.

If gold consolidates above the 21 SMA in the next few hours, we could expect it to continue rising and reach 7/8 Murray at 1,968 and even the psychological level of $2,000.

On the other hand, in case gold falls below the 200 EMA, we could expect it to find good support around the 6/8 Murray at 1,937 which could give it an opportunity to resume buying.

On the other hand, gold could turn bearish if it falls below 1,937 (6/8 Murray) and could accelerate its decline to 1,921 and 1,906 (5/8 Murray).

Since November 8th, the eagle indicator has been moving in an oversold zone. If gold makes a pullback in the coming hours and as long as it remains above 1,937, it will be seen as a signal to buy.