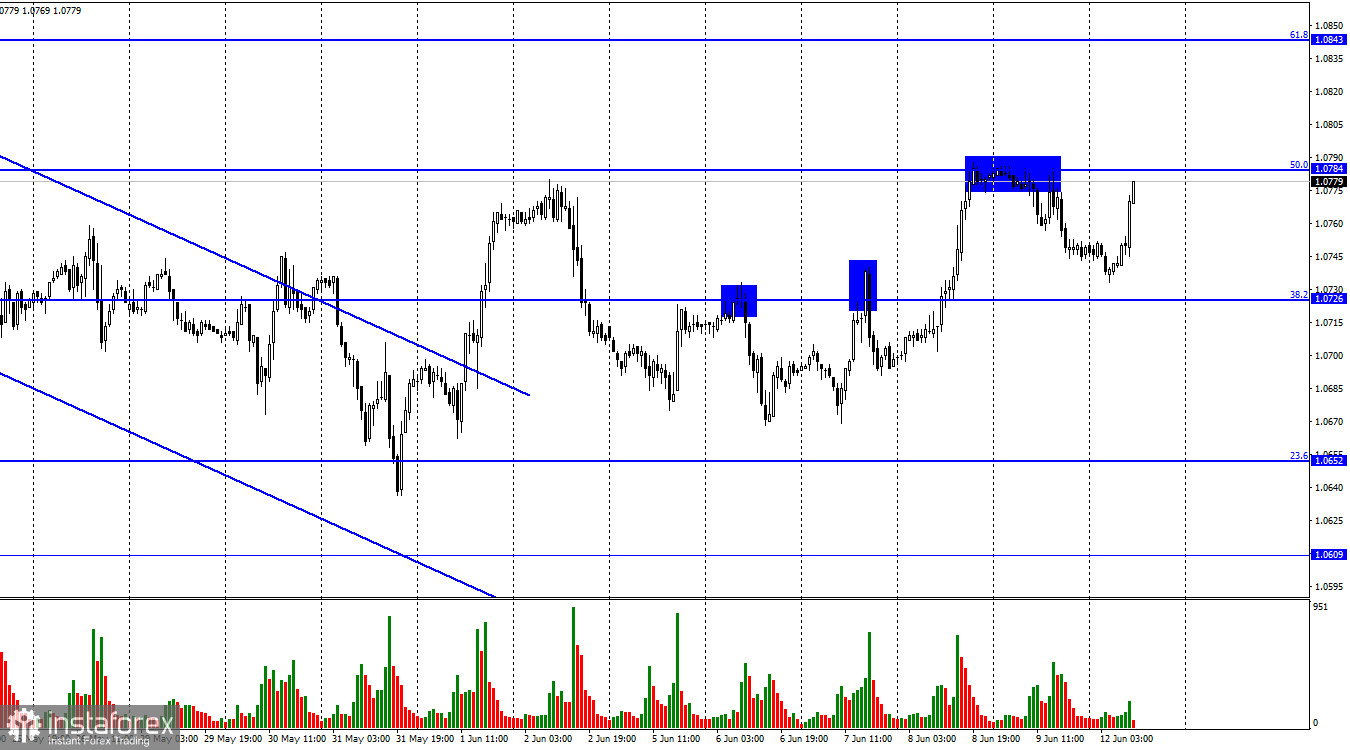

On Friday, the EUR/USD pair bounced back from the 50.0% correction level at 1.0784, with a pivot towards the US dollar, and dropped to 1.0726. However, a surprising pivot favoring the euro took place on Monday, resulting in a rebound to 1.0784. Another bounce from this level will likely work in favor of the US dollar, causing a further fall towards 1.0726 again. If the quotes manage to settle above 1.0784, the pair may reach the correction level of 61.8% – 1.0843.

The new week is starting quite dull, as Monday's economic calendar does not offer important events. Nonetheless, the first few hours have shown that traders are far from resting and are actively preparing for important upcoming events. There will be many of these. Before diving into them, let's try to understand why the dollar is already falling on Monday, even though there has not been any negative news for it yet.

It all comes down to the Federal Reserve meeting, which ends on Wednesday, and the results will be published in the evening. A couple of weeks ago, after several hawkish FOMC members spoke, the probability of further monetary policy tightening in June exceeded 50%. However, at this moment, it has dropped back to 10-20%, and the market believes the next rate hike may not come until July. Many FOMC members stated that the regulator should shift to a 0.25% step every two meetings, and Monday's US dollar drop could be the market's reaction to the Federal Reserve's softening.

Given that today's calendar is empty, there are no other assumptions. Tomorrow's report on US inflation will be of great importance, which could demonstrate a significant decline, thus further reducing the chances of tightening even in July.

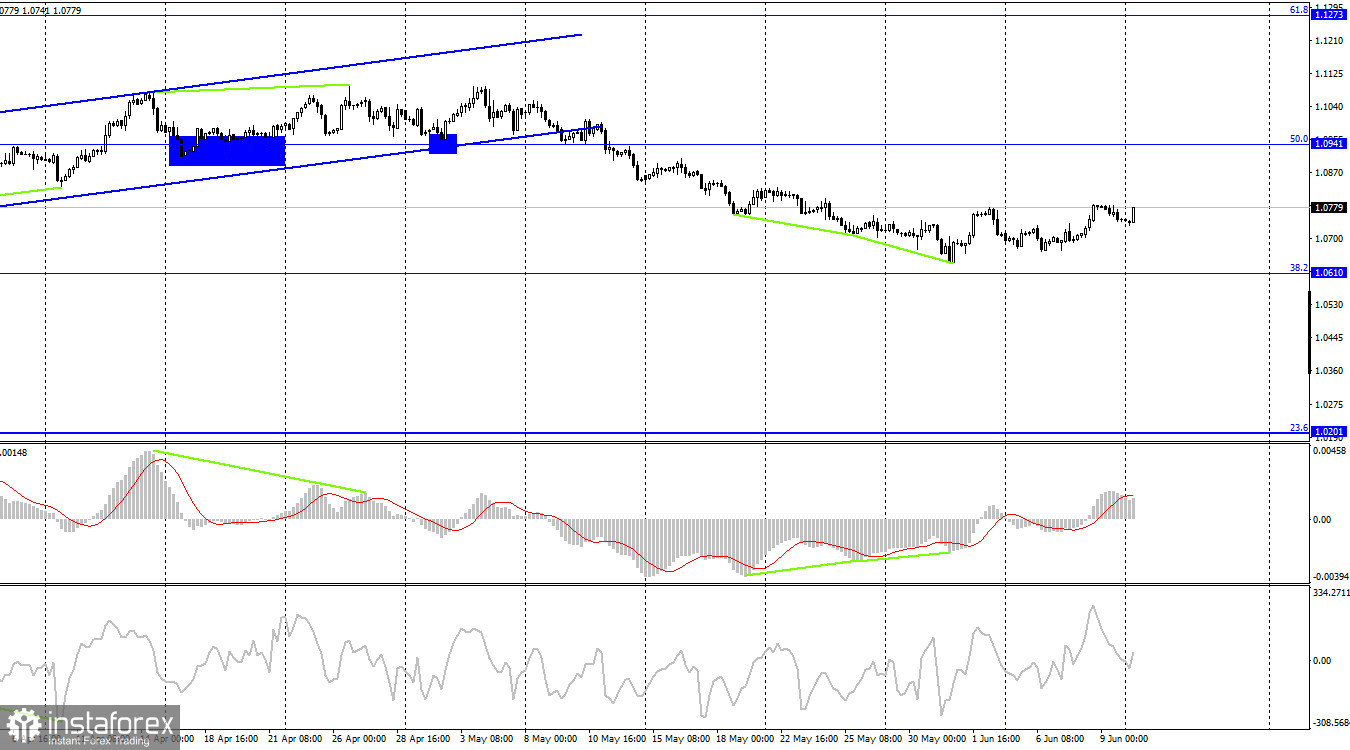

On the 4-hour chart, the pair has reversed in favor of the euro and may continue its growth towards the 50.0% Fibonacci level - 1.0941. There are no emerging divergences in any of the indicators today. Given the considerable distance to 1.0941, potential sell signals should be tracked on the hourly chart.

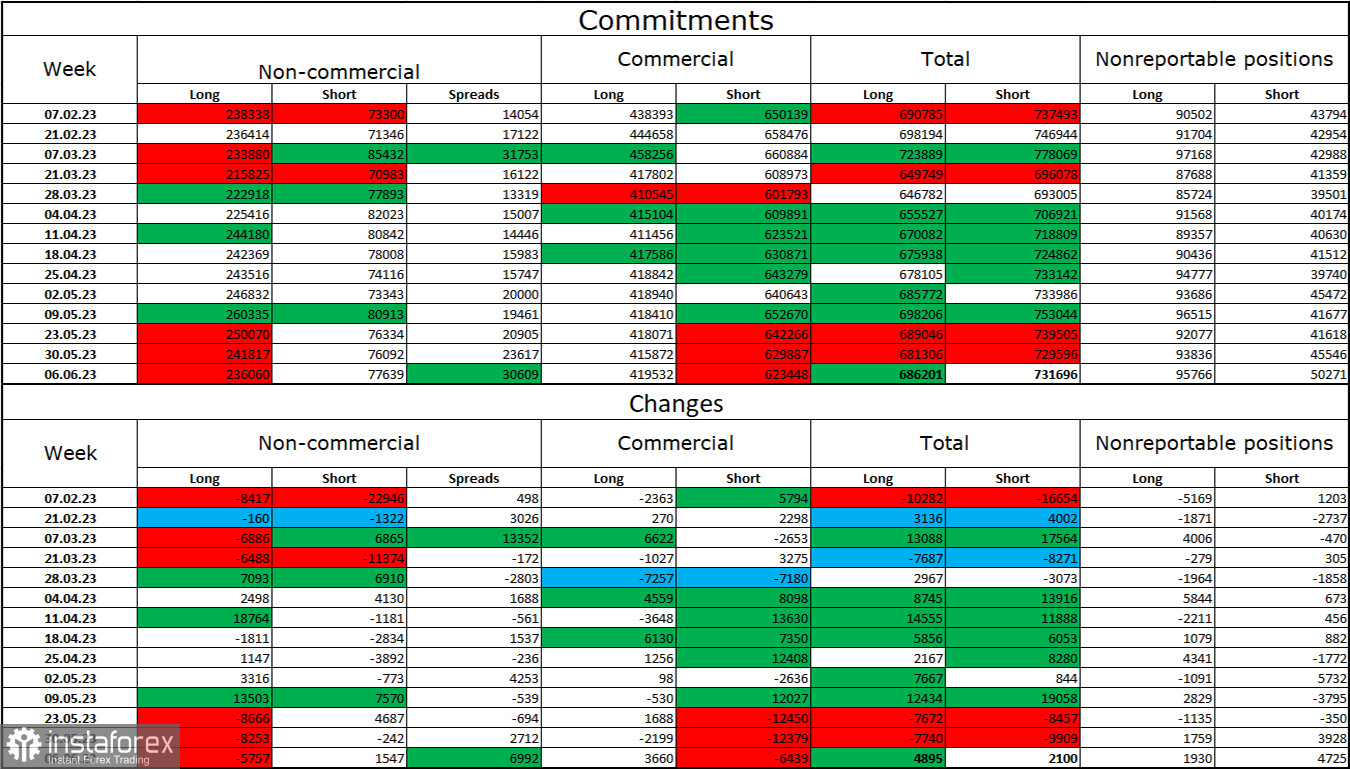

COT report:

In the last reporting week, speculators closed 5,757 long contracts and opened 1,547 short ones. The sentiment among large traders remains bullish and is gaining strength again. The total number of long contracts held by speculators now amounts to 236,000, while short contracts total just 77,000. The strong bullish sentiment persists for now, but I believe the situation will continue to change shortly. The euro has been falling over the last month. The high volume of open long contracts suggests that buyers may start to close them soon (or have already started to do so, as the latest COT reports indicate). The current tilt is too heavily toward bulls. The current figures allow for the euro to continue falling shortly. However, a lot will depend on the Fed this week.

US and EU economic calendars:

The economic calendar for June 12 has no entries, meaning today's market sentiment will be unaffected by the news.

EUR/USD forecast and recommendations for traders:

You may sell the pair on a rebound from 1.0784 on the hourly chart, targeting 1.0726. On the other hand, if the pair closes above 1.0784 on the hourly chart, you can consider buying the euro with a target of 1.0843.