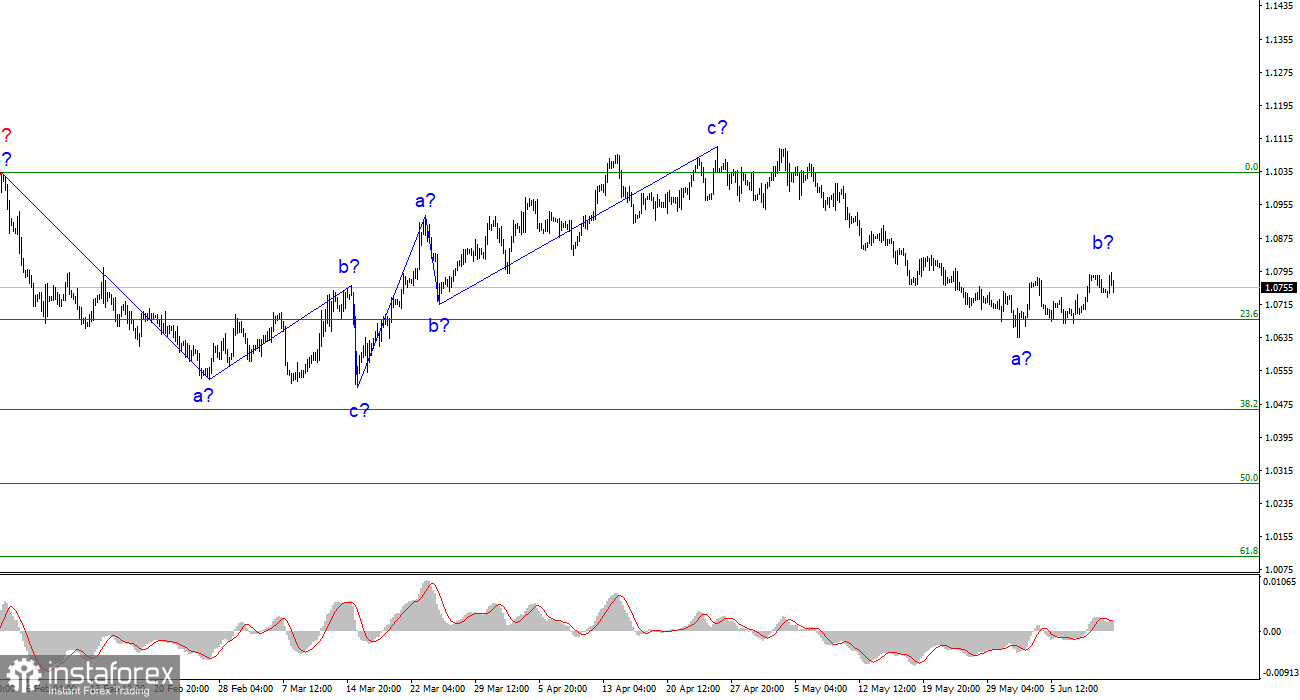

The wave analysis on the 4-hour chart for the euro/dollar pair continues to be non-standard but understandable. The quotes continue to move away from the previous highs, so the three-wave upward structure can be considered complete. The entire ascending trend, which began on March 15, could take on a more complex structure, but at this time, I expect the formation of a downward trend, which is likely also to be three-wave. Recently, I have regularly mentioned that I expect the pair to reach around the 5th figure, from which the upward three-wave structure began.

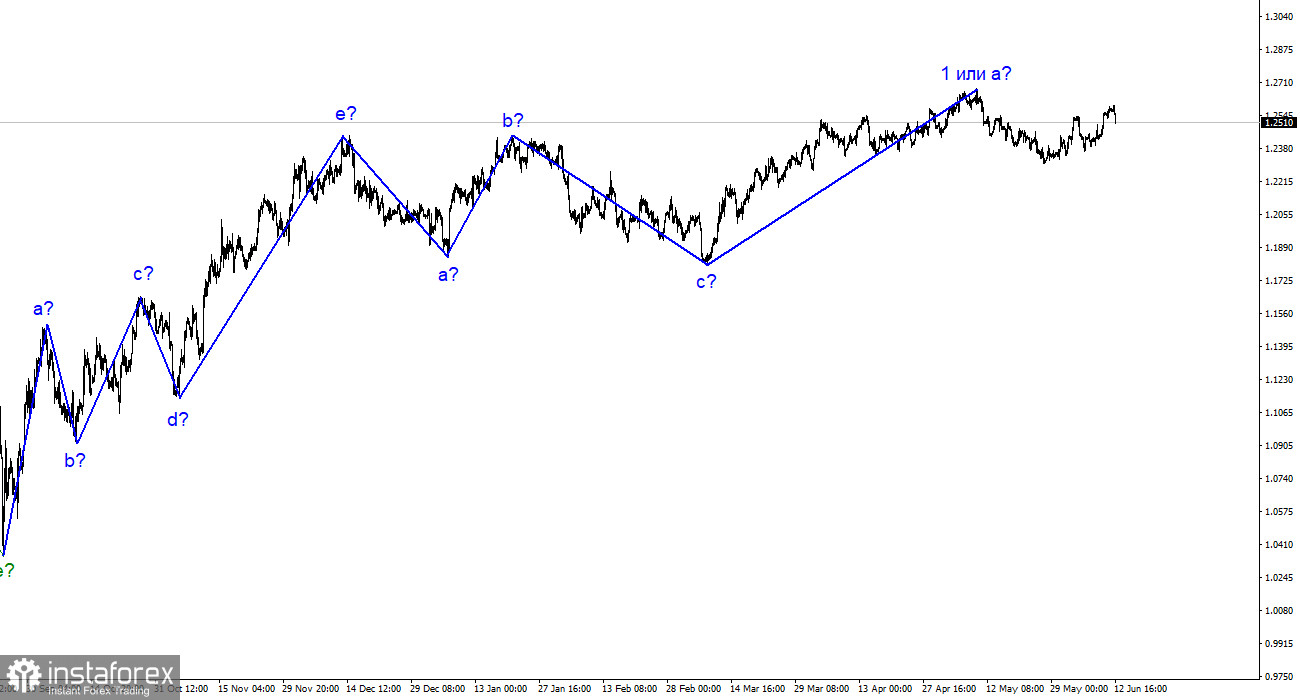

The high point of the last trend segment was only a few dozen points above the peak of the previous upward segment. Since December last year, the pair's movement can be considered horizontal, which will continue. The presumed wave b, which could have started its formation on May 31, currently looks very inconclusive, but at the same time, it can end at any moment, as it already shows three waves within it.

The euro may receive support this week.

The euro/dollar pair rate increased by five basis points on Monday (when writing the article). It showed an increase of 40 points throughout the day and then the same decrease. However, the range of movements could have been more impressive. There was no news background on Monday, so market activity was weak. This week, we have a lot of important and interesting events ahead, and the concert will begin tomorrow when important unemployment data is released in the UK and an inflation report in the US.

The inflation report can significantly affect market sentiment. The market expects the Consumer Price Index to continue to decline at a relatively high pace, and it expects the Fed to pause at the June meeting. These two factors can reduce demand for the dollar this week, and in this case, wave b will have a more convincing appearance. If inflation decreases by less than 4.3%, it will automatically increase the probability of a new tightening of the FOMC's monetary policy on Wednesday and increase demand for the dollar.

Whatever the pair's movements are this week, it cannot end with just one downward wave, which clearly does not fit into the structure of the previous upward trend segment. Therefore, in any case, we can expect at least one more downward wave. Based on this, it doesn't matter where and when wave b will end. It will be followed by wave c, pushing the pair down to the fifth figure.

General conclusions:

Based on the analysis conducted, the formation of a new downward trend segment is continuing. Therefore, selling can be advised now, and the pair has much room for a decline. I still consider targets around 1.0500–1.0600 quite realistic, and I recommend selling the pair with these targets. The formation of a corrective wave started at the level of 1.0678, so I suggest new sales in case of a successful attempt to break this level or after the clear completion of wave b. Within the correction, the pair may reach the 9th figure, but wave b already has all the grounds for completion.

On a larger wave scale, the wave analysis of the upward trend segment has taken on an extended form but is likely completed. We have seen five upward waves, which most likely form the structure of a-b-c-d-e. Furthermore, the pair has built two three-wave structures, downward and upward. It is likely in the process of forming another downward three-wave structure.