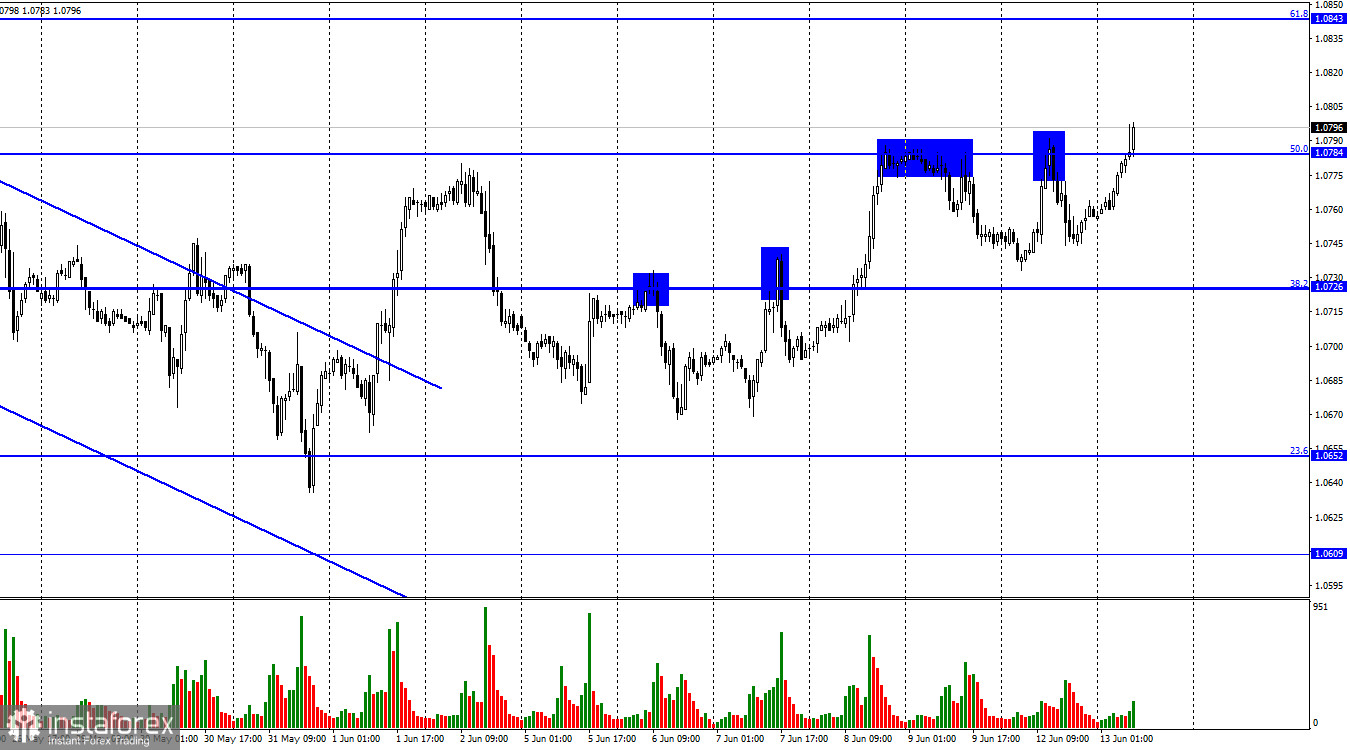

On Monday, the EUR/USD pair saw a new rise toward the corrective level of 50.0% (1.0784), a rebound from it, and a slight decline toward the Fibonacci level of 38.2% (1.0726). On Tuesday, the pair's quotes made a new return to the corrective level of 50.0% and consolidated above it. Thus, the upward movement may continue towards the next Fibonacci level at 61.8% (1.0843).

On Monday, there was no significant news background. There was no interesting news throughout the day, but this week is expected to be very eventful in terms of news, so the most interesting is yet to come. This morning, the first important news has already been released. Inflation in Germany decreased to 6.1% y/y in May, and the Harmonized Index of Consumer Prices fell to 6.3% y/y. A series of reports were also published in the UK, which we will discuss in the corresponding review.

Meanwhile, Gabriel Makhlouf, one of the representatives of the ECB, stated that the market should not expect a quick rate hike after they reach its peak level. "I cannot answer the question of how long the interest rate will remain at its peak level, as it depends on the inflation's response to our actions," Makhlouf said. "I am very curious to know who is spreading this information and on what basis we are planning to start easing the monetary policy by the end of the year," Makhlouf questioned. His words suggest that the ECB plans to continue tightening and does not see significant reasons to abandon its hawkish policy in 2023. Although inflation is decreasing, it is still far from the target level.

At the same time, the European regulator is unlikely to raise rates more than twice. This is what the market is currently counting on in terms of tightening. And one of the remaining two rate hikes could occur as early as this week.

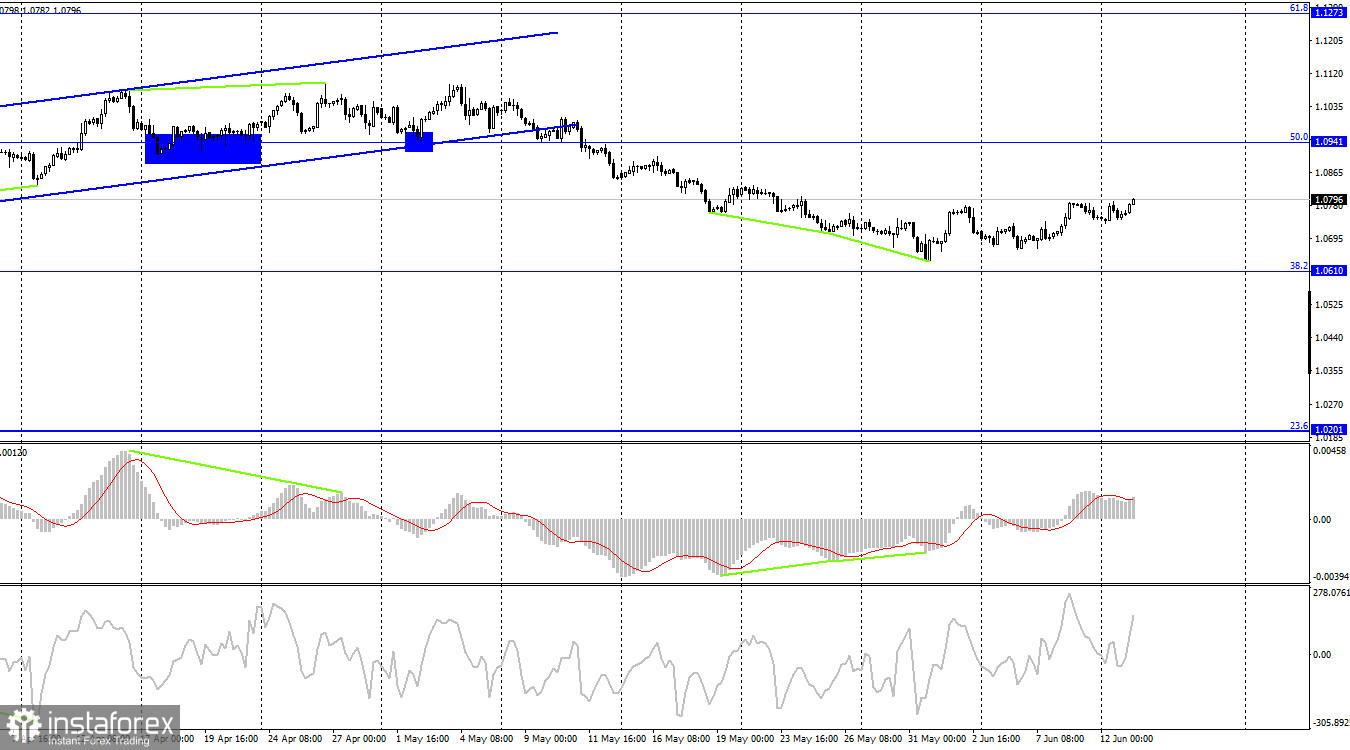

On the 4-hour chart, the pair has reversed in favor of the euro and may continue toward the Fibonacci level of 50.0% (1.0941). No imminent divergences are observed in any of the indicators. The level of 1.0941 is quite far away, so potential sell signals should be monitored on the hourly chart.

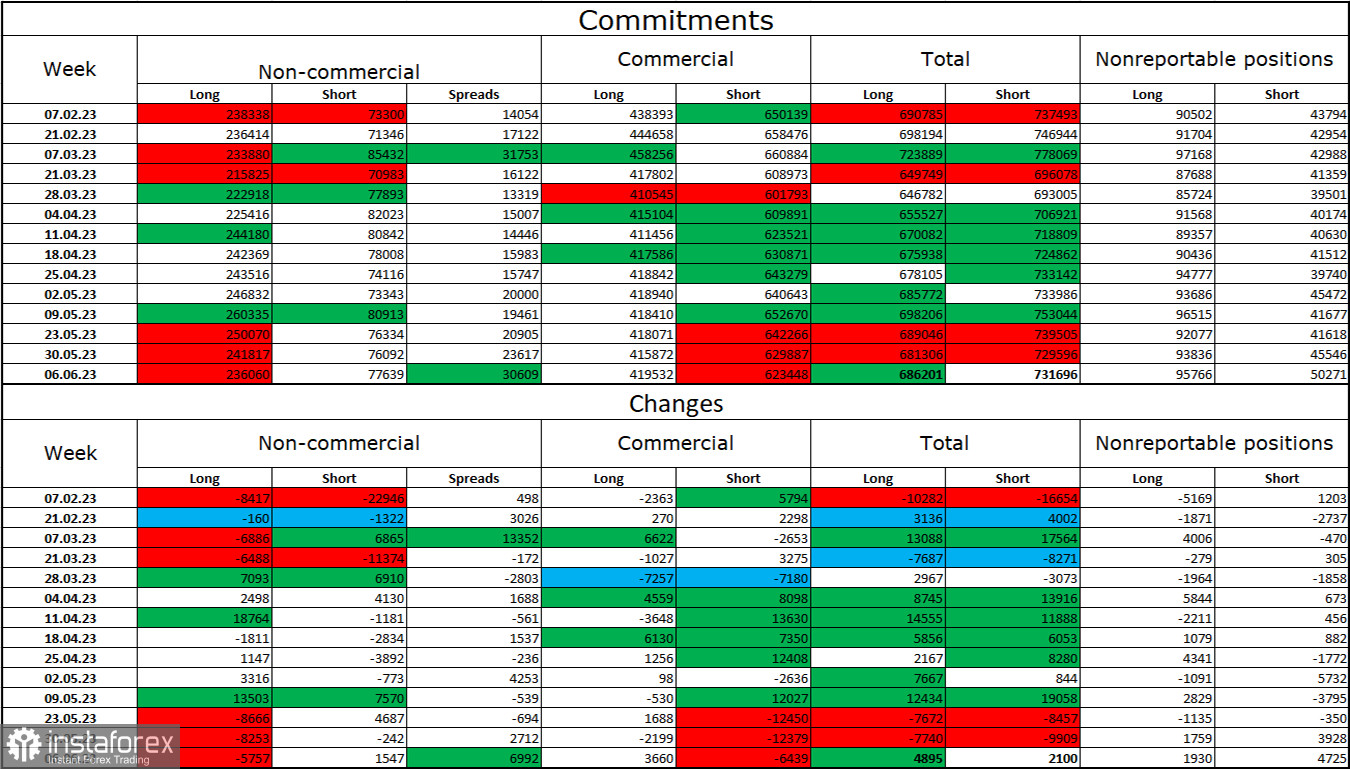

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 5,757 long contracts and opened 1,547 short contracts. The sentiment among large traders remains "bullish" and is again strengthening. The total number of long contracts held by speculators now stands at 236,000, while short contracts total only 77,000. Strong bullish sentiment is still prevailing for now, but the situation will continue to change soon. The euro has been declining over the past month. The high value of open long contracts suggests that buyers may close them soon (or have already started, as indicated by the latest COT reports). There is currently an excessive bias toward bulls. The current figures allow for a continuation of the euro's decline in the near term. However, much will depend on the Fed this week.

News Calendar for the US and the European Union:

European Union - Germany Consumer Price Index (CPI) (06:00 UTC).

European Union - ZEW Economic Sentiment Index in Germany (09:00 UTC).

USA - Consumer Price Index (CPI) (12:30 UTC).

On June 13, the economic events calendar includes several entries focusing on inflation in the USA. The impact of the news background on trader sentiment today can be quite strong.

Forecast for EUR/USD and trader advice:

Sell positions for the pair can be opened if it consolidates below the level of 1.0784 on the hourly chart, with a target of 1.0726. I advised buying the pair if it closes above the level of 1.0784 on the hourly chart, with a target of 1.0843. Currently, these trades can be held open.