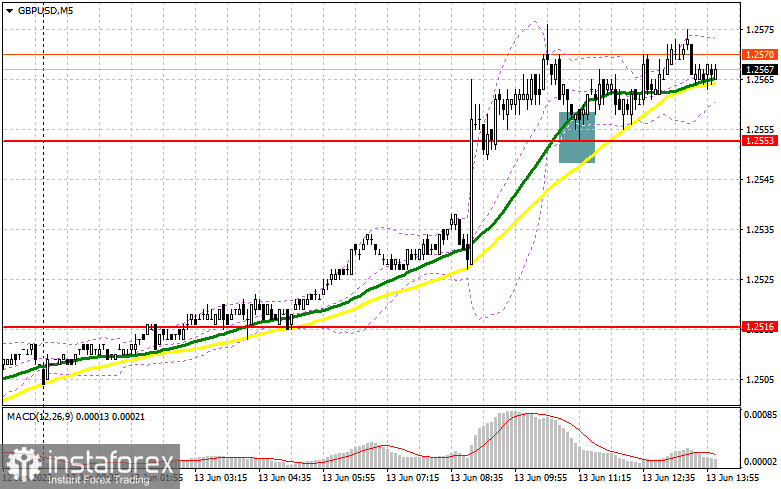

In my morning forecast, I highlighted the level of 1.2553 and recommended making trading decisions based on it. Let's look at the 5-minute chart and analyze what happened there. The breakout and subsequent retest from above to below 1.2553 provided a buy signal, resulting in an upward movement of 18 pips. The technical picture has stayed the same for the second half of the day.

To open long positions on GBP/USD, the following conditions are required:

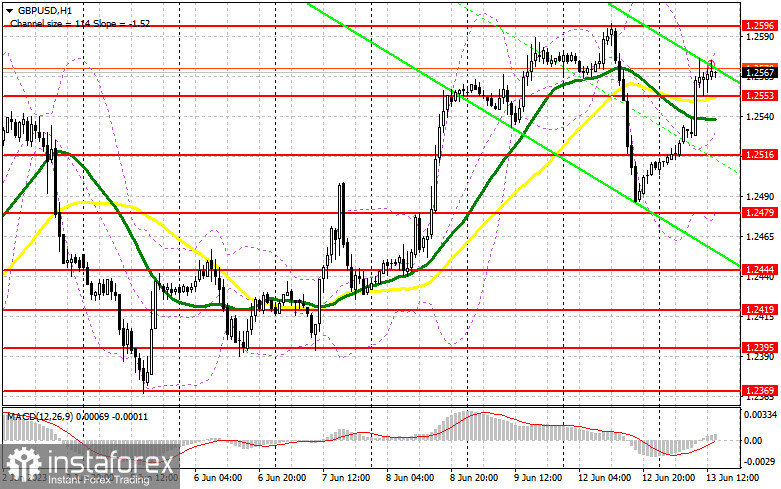

As long as trading continues above 1.2553, further growth in GBP/USD can be expected. Buyers will particularly show themselves after news of a decrease in inflation in the US, leading to a surge in the pound to monthly highs of around 1.2596. Having another entry point around 1.2553 would be desirable, so protecting this level remains a priority task for the bulls. A breakout and retest from above to below 1.2596, similar to what I discussed earlier, will provide an additional signal to open long positions, strengthening the presence of bulls with a movement towards 1.2636, reinforcing the upward trend. The ultimate target will be the area of 1.2674, where I will take profit.

In the scenario of a pound decline towards 1.2553 and a lack of activity from buyers, pressure on the pair will return. The persistence of high inflation in the US will also limit the upside potential of the pair. In that case, I will postpone market entry until the support at 1.2516 is reached. I will only open long positions there on a false breakout. I plan to buy GBP/USD on a rebound from 1.2479, targeting a 30-35 pip correction within the day.

To open short positions on GBP/USD, the following conditions are required:

Sellers were unable to show anything after the news that the unemployment rate in the UK dropped to a record 3.8%, which puts pressure on the Bank of England to continue raising rates. All hope now lies with strong inflation in the US, which will help defend 1.2596. I will only open short positions after GBP/USD rises to monthly highs, forming a false breakout. This will allow a downward move towards support at 1.2553, which acted as resistance earlier in the morning. A breakout and retest from below to above this range will restore the chances of a downward correction and provide a signal to open short positions with a decline toward 1.2516. The ultimate target remains the minimum of 1.2479, where I will take profit. In the case of further growth in GBP/USD and a lack of activity at 1.2596, which seems likely, buyers will continue to dominate. In that case, I will postpone selling until the resistance at 1.2636 is tested. A false breakout there will be an entry point for short positions. I plan to sell GBP/USD on a rebound from the May high of around 1.2674, but only with the expectation of a downward correction of 25-30 pips within the day.

Indicator signals:

Moving averages

Trading is conducted above the 30-day and 50-day moving averages, indicating further growth in the pair.

Note: The author considers the period and prices of the moving averages on the hourly chart (H1), which differ from the general definition of classical daily moving averages on the daily chart (D1).

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.2479, will act as support.

Description of Indicators:

• Moving Average: Determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

• Moving Average: Determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence): Fast EMA period 12, Slow EMA period 26, SMA period 9.

• Bollinger Bands: Period 20.

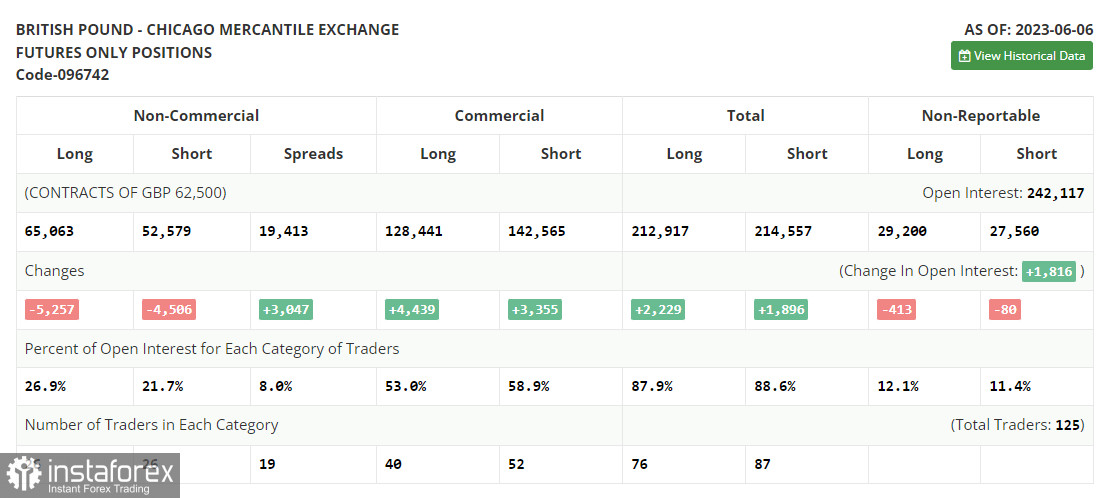

• Non-commercial traders: Speculators such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting specific requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.