As Bitcoin and Ethereum brace for another potential blow with the US Consumer Price Index data release, a recent survey conducted by the Cato Institute and Yougov revealed that most Americans are not ready to embrace a central bank digital currency (CBDC), despite its active development. The findings suggest relatively low support for CBDCs among respondents.

In late May 2023, Cato Institute, a public policy research organization, and Yougov, a company specializing in public opinion and data, rolled out a survey that reflected American attitudes towards a potential CBDC launch. The survey ran from February 27 to March 8, 2023, with over 2,126 individuals participating.

The survey consisted of three questions. The first asked if participants would support or oppose a state-issued CBDC that allowed the government to monitor all purchases. Only 13% expressed full support for such a CBDC, with 68% firmly opposing it. Around 20% remained undecided, expressing no clear preference.

The second question asked whether respondents would support a CBDC that allowed the government to control their spending. In this scenario, only 10% fully backed the idea, while 74% were firmly against it. Approximately 16% stated they were uncertain and could not firmly commit to either side.

The final question addressed their support for a CBDC designed to combat money laundering and fraud. 42% fully approved, and only about 28% completely rejected the possibility of reducing fraud with a CBDC. Approximately 31% could not decide.

Overall, concerning a CBDC without set criteria, 34% of Americans opposed the US Central Bank's CBDC, and 16% supported the idea. Interestingly, almost half of those surveyed, 49%, had no clear opinion on the matter, possibly due to a lack of knowledge.

Moreover, about 72% of respondents admitted they were unfamiliar with CBDCs.

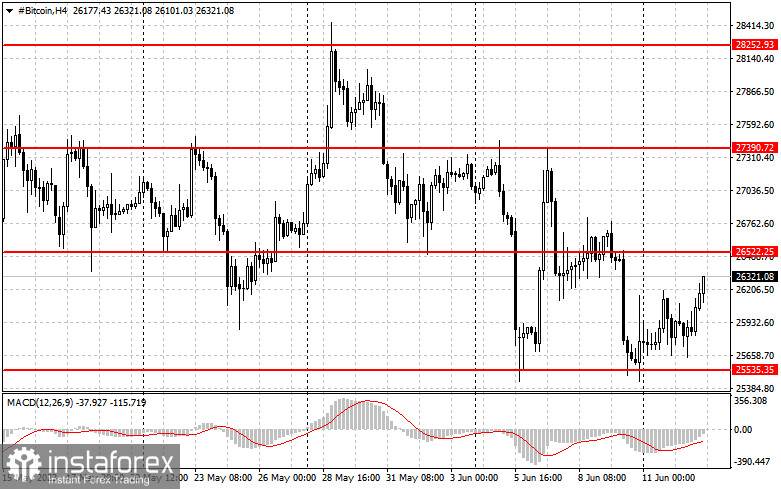

As for Bitcoin, an increase under present conditions is only feasible following a return to $26,500. This would provide a chance for a bullish market, reaching $27,400. The next target would be in the area of $28,200, where a significant profit-taking and Bitcoin pullback may occur. Since the trading instrument is under pressure, the focus is on defending $25,535. Its breach would be a blow to the asset, opening a path to $23,900. A break of this level would plunge the world's first cryptocurrency toward $23,400.

Ethereum buyers try to drag the ETH price to $1,790, which until recently shielded Ethereum from a fall. Only after rising above $1,790, the price may reach $1,925 and $2,030, which would reinstate the bullish trend and lead to a new Ethereum surge towards $2,130. If pressure on ETH returns, a break of $1,690 would lead to a test of $1,640 and $1,570. Its breach would push the trading instrument down to a low of $1,520.