5M chart of GBP/USD

GBP/USD has gone back to trading upward and gained over 100 pips. The pound started rising overnight, which also suggests that the market is anticipating the US inflation report. However, important data were also published during the early European trading session in the UK, which helped traders buy the pair more actively. The unemployment rate in the UK decreased instead of increasing as projected, and the number of unemployment benefit claims decreased instead of increasing as forecasted. These reports were significant, and therefore, the pound received market support from the morning. When the US inflation data was released, the market initially traded in both directions, but then the upward momentum resumed as the report turned out to be unfavorable for the dollar.

The first buy signal was generated overnight, but the long position could only be opened with the start of the European session as the price had not strayed far from the entry point. Prior to the inflation report, the profit from the trade was 50 pips, so traders had to either close it manually or set a breakeven stop loss. In either case, traders obtained a profit of at least 50 pips as the pair continued to rise after taking a short break.

COT report:

According to the latest report, non-commercial traders closed 5,200 long positions and 4,500 short ones. The net position dropped by 700 but remained bullish. Over the past 9-10 months, the net position has been on the rise despite bearish sentiment. In fact, sentiment is now bullish, but it is a pure formality. The pound is bullish against the greenback in the medium term, but there have been hardly any reasons for that. We assume that a prolonged bear run may soon begin even though COT reports suggest a bullish continuation. However, we can hardly explain why the uptrend should go on.

The pound has gained about 2,300 pips. Therefore, a bearish correction is now needed. Otherwise, a bullish continuation would make no sense even despite the lack of support from fundamental factors. Overall, non-commercial traders hold 52,500 sell positions and 65,000 long ones. We do not see the pair extending growth in the long term.

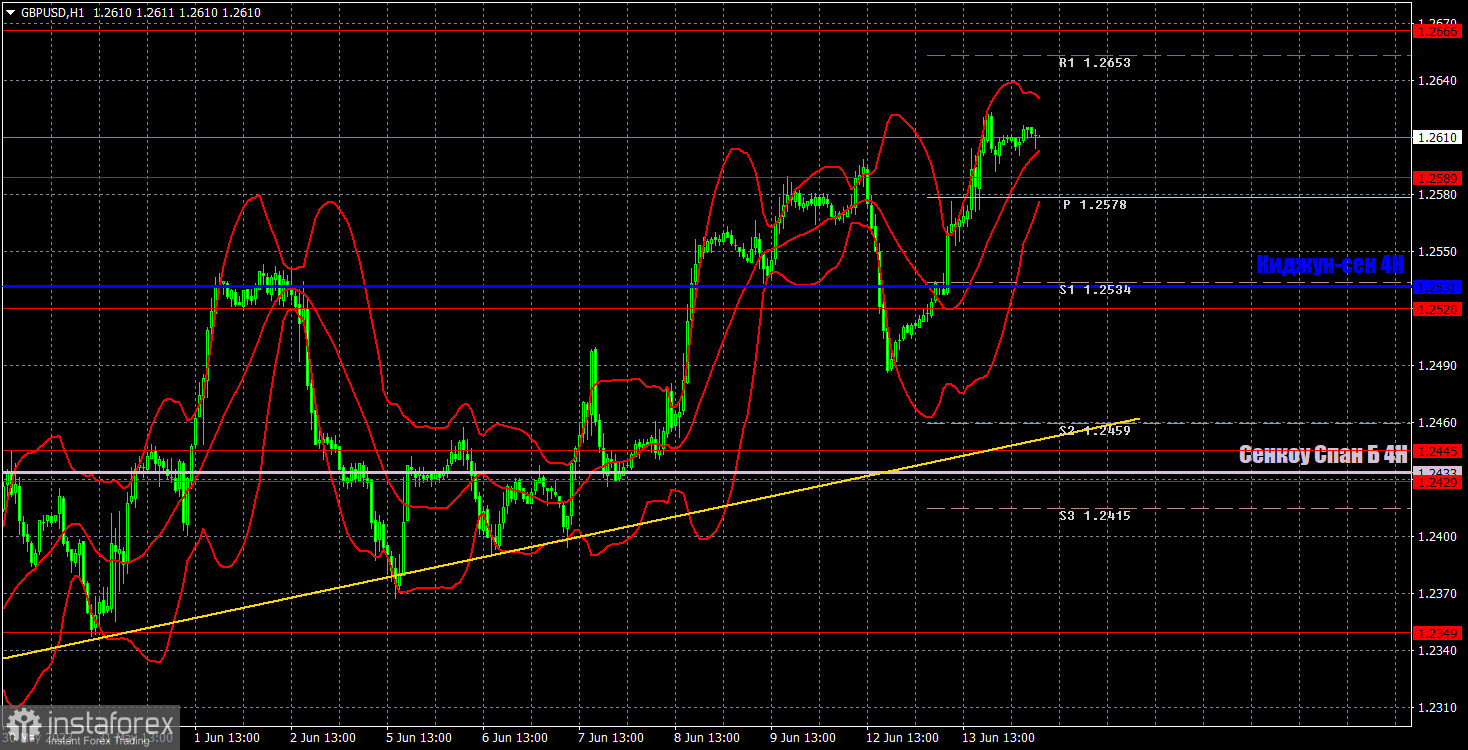

1H chart of GBP/USD

In the 1-hour chart, GBP/USD is moving up but abruptly and with pauses. The ascending trend line supports the bulls, and yesterday they were also supported by the macroeconomic background. However, it is illogical for the pound to rise further since the US has not been presenting us with impressive economic data. So, from a technical perspective, we have an uptrend, but this week can prove to be quite unpredictable, as the fundamental background is strong.

On June 14, trading levels are seen at 1.2269, 1.2349, 1.2429-1.2445, 1.2520, 1.2589, 1.2666, 1.2762, 1.2863. The Senkou Span B line (1.2433) and the Kijun-sen line (1.2531) may also generate signals when the price either breaks or bounces off them. A Stop Loss should be placed at the breakeven point when the price goes 20 pips in the right direction. Ichimoku indicator lines can move intraday, which should be taken into account when determining trading signals. There are also support and resistance which can be used for locking in profits.

On Wednesday, several interesting reports are scheduled in the UK, including monthly GDP data and industrial production. We do not consider them crucial, but since there are quite a few, there may be a certain market reaction. The US producer price index isn't also that important, but in the evening, the results of the Federal Reserve meeting will be announced.

Indicators on charts:

Resistance/support - thick red lines, near which the trend may stop. They do not make trading signals.

The Kijun-sen and Senkou Span B lines are the Ichimoku indicator lines moved to the hourly timeframe from the 4-hour timeframe. They are also strong lines.

Extreme levels are thin red lines, from which the price used to bounce earlier. They can produce trading signals.

Yellow lines are trend lines, trend channels, and other technical patterns.

Indicator 1 on the COT chart is the size of the net position of each trader category.

Indicator 2 on the COT chart is the size of the net position for the Non-commercial group of traders.