Analyzing Wednesday's trades:

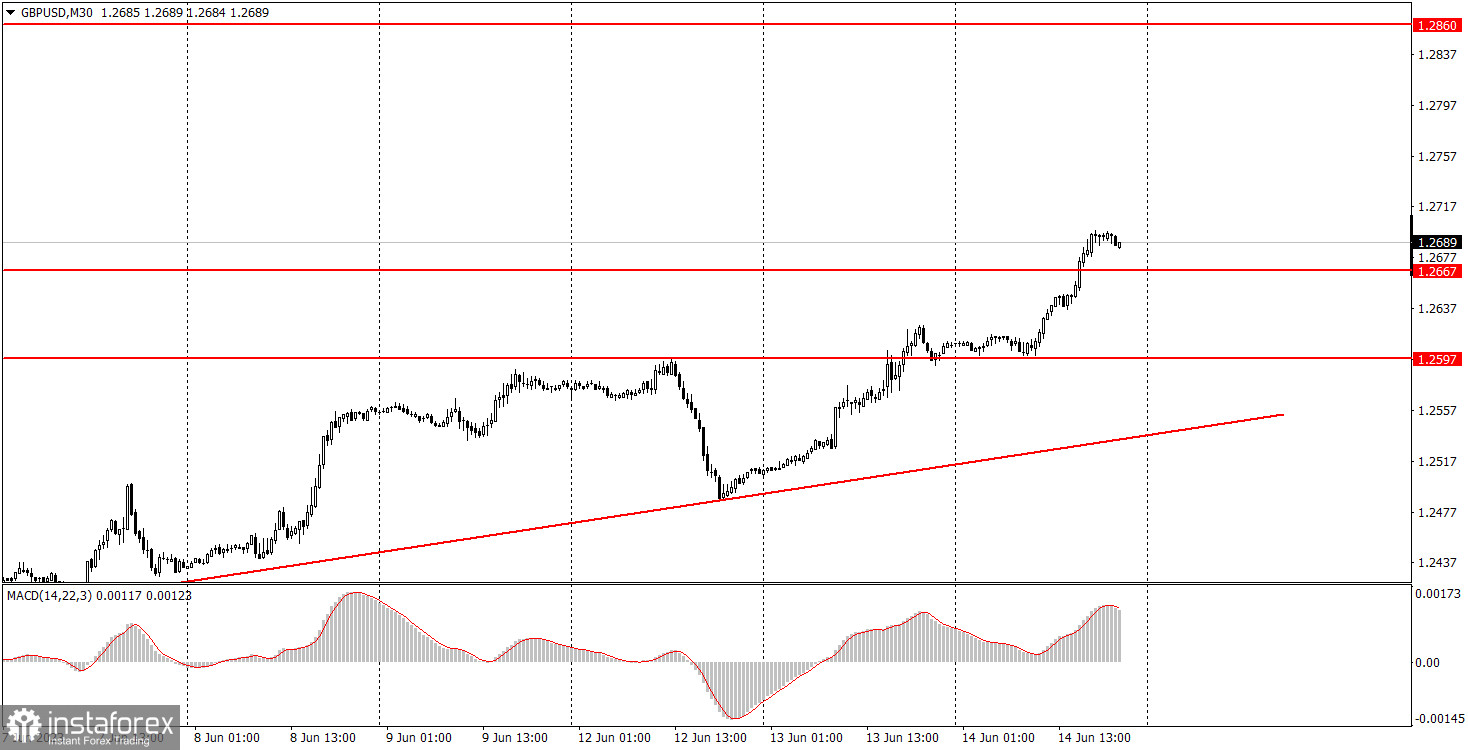

GBP/USD on 30M chart

On Wednesday, GBP/USD continued its illogical upward movement for most of the day. Naturally, when the results of the Federal Reserve meeting became known, a reverse downward movement began, which still needs to be thoroughly analyzed, as well as the meeting results themselves. For now, one thing can be said: for several days or weeks in a row, the market has been inaccurately assessing the monetary policy balance between the Bank of England and the Federal Reserve. There were simply no other reasons for the British pound to rise. Just like a few months ago, the pound rises for any reason or even without any reason. The dollar, on the other hand, seems to be cursed. This morning, two absolutely mediocre reports were released in the UK, but the pound rose all day. The US producer price index could have put some pressure on the US currency, but why does the market need it if it constantly sells the dollar? We believe that the pound's growth is illogical. The pound's decline at the end of the day was due to profit-taking on long positions.

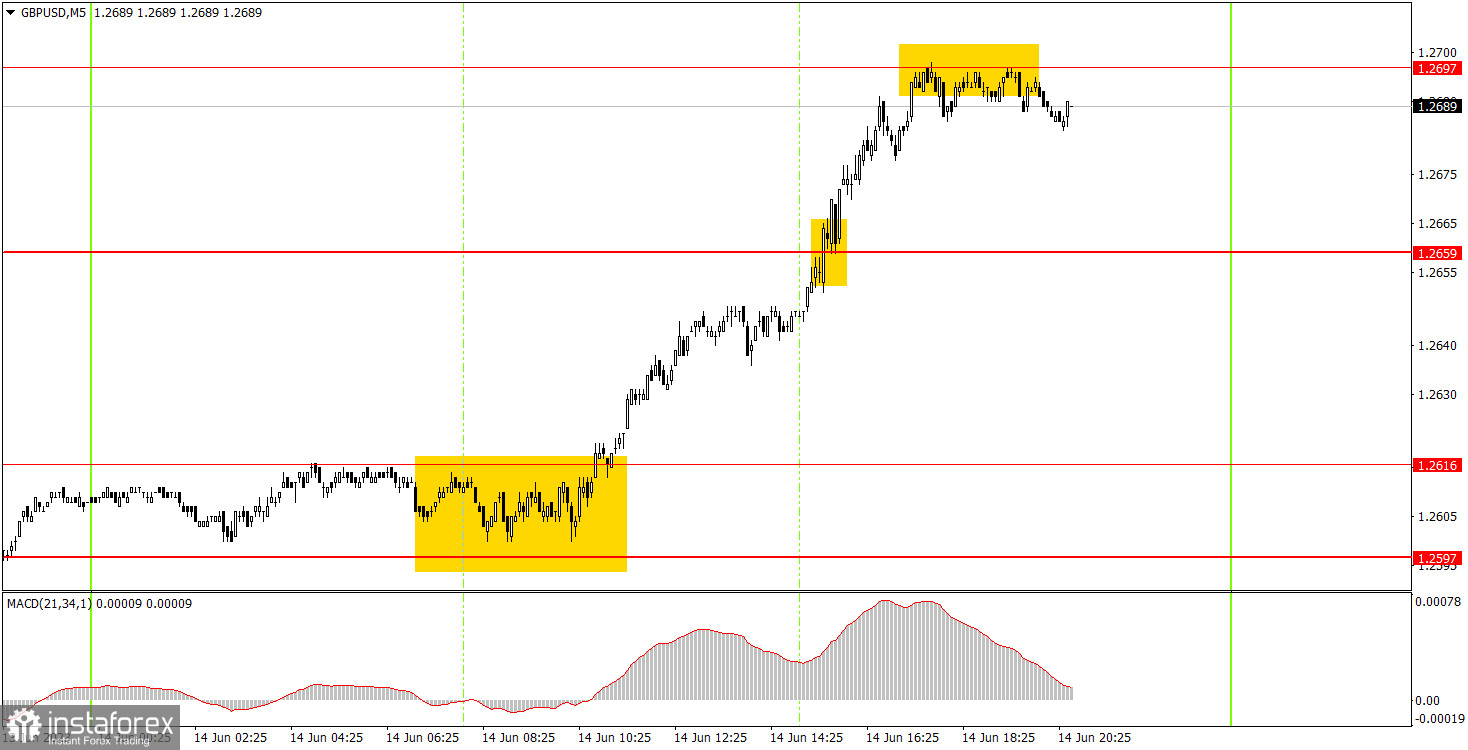

GBP/USD on 5M chart

Three trading signals materialized on the 5-minute chart, but in fact, there was only one. At the very beginning of the European trading session, the pair formed a buy signal around the 1.2597-1.2616 area, after which we saw a rise to the target level of 1.2697. From this level, there was a bounce, and the sell signal formed at the moment of the Federal Reserve meeting results announcement. Therefore, the long position should have been closed before this event in any case. The profit amounted to about 65 pips. It doesn't make sense to analyze and evaluate further movements at the moment. They are all impulsive and occurred too late in time. Beginners had the opportunity to earn on a good trend, and that's what matters most.

Trading tips on Thursday:

On the 30-minute timeframe, the GBP/USD pair continues its upward trend in the short term. For example, the market didn't have any special reasons to buy the pound, but the pair still rose as if on yeast. Therefore, there is no need to talk about any logic in the movements at the moment. The key levels on the 5M chart are 1.2372, 1.2457, 1.2499, 1.2538, 1.2597-1.2616, 1.2659, 1.2697, 1.2772, and 1.2860. When the price moves in the right direction by 20 pips after opening a trade, a stop loss can be set at breakeven. There are no important events lined up for the UK on Thursday, and in the US, several less significant reports will be published. We do not expect a strong reaction to them, and volatile movements may persist tonight and tomorrow morning as the market continues to digest the results of the Federal Reserve meeting.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.