The sharp slowdown in inflation has convinced everyone that the Federal Reserve will not only stop raising interest rates but will also begin preparing for a gradual easing of monetary policy. Well, almost everyone. The exception is the US central bank itself. Not only did Fed Chairman Jerome Powell mention the possibility of a rate cut but even hinted that the Bank still has one or two more rate hikes in its plan. Why did it turn out this way? The thing is, if you look at the news reports, interest rates are always mentioned in connection with inflation. So it creates the impression that determining the parameters of monetary policy is solely based on the dynamics of consumer prices. But this is a false perception. After all, if you just paid attention to the Fed's press releases, in addition to inflation, the labor market is always present. Employment in the United States is currently near record highs. In other words, the labor market is overheated. And this can have serious consequences for the entire economy. This can be addressed with high interest rates. And not only can it be done, it must be done. That is precisely why Powell said what he said. But take note that even the most relatively sensible observers were truly misled by the sharp decline in inflation. So expectations clearly did not align with reality because almost everyone momentarily forgot about the labor market. Everyone except the Fed. Therefore, from a macroeconomic perspective, the decision to keep interest rates unchanged and to signal the possibility of a rate hike is absolutely justified and logical.

It is also worth noting Powell's statement that the Fed has decided to keep interest rates unchanged in order to assess their impact on the economy and markets. The thing is, such an impact is not instant. It is a rather protracted process that takes several months. In other words, the economy is still digesting the previous rate hikes. Therefore, this means that Powell's statement indicates that there won't be any rate cuts until next year.

Everything will now shift to the European Central Bank. There is no doubt that today it will raise the refinancing rate from 3.75% to 4.00%, and the market has largely already taken this decision into account. What is more important is what ECB President Christine Lagarde will say later. The situation in Europe differs somewhat from what is observed in the United States. While inflation is slowing down on both sides of the Atlantic, the situation with the labor market is somewhat different. If there are signs of overheating in the United States, unemployment in Europe remains relatively high. This situation can be addressed through a relatively accommodative monetary policy. In other words, everything in Europe points to the need to lower interest rates. Of course, the likelihood of Lagarde making such an announcement today is quite low. Most likely, we will hear something along the lines of the need to wait and see how things develop. In other words, today's rate hike will most likely be the last. And here are two important points to consider. Firstly, interest rates in the United States are somewhat higher than in Europe, which is the main driver of the dollar's strength. Secondly, the situation is such that the ECB will be the first to start lowering interest rates. In other words, the interest rate disparity will grow in favor of the dollar.

So the expected correction, which everyone has been waiting for so long, is not likely to materialize. However, the problem is that the dollar is already significantly overbought. And further growth of these imbalances can have serious consequences, primarily for the American economy. But it will only be possible to observe this as time passes by.

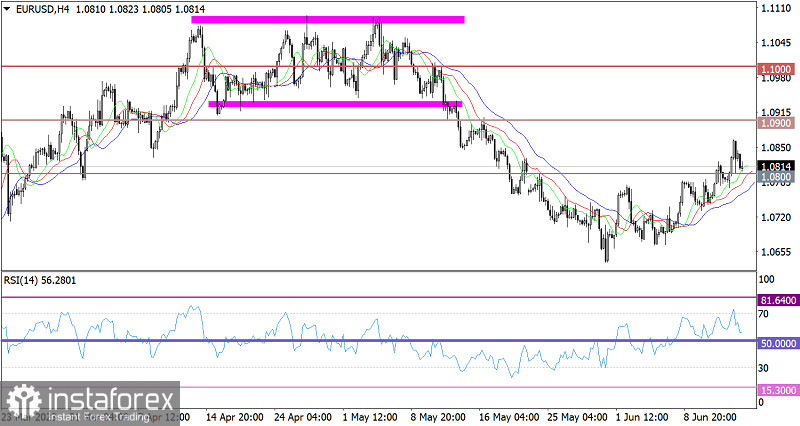

The EUR/USD pair has locally strengthened in value to 1.0865, but then experienced a pullback to the previous level of 1.0800. The gradual rise indicates a process of recovery for the euro after the decline in May.

On the four-hour chart, the RSI temporarily entered the overbought zone, which served as a technical signal for a possible pullback. It is worth noting that the indicator is hovering in the upper area of 50/70, indicating a prevailing bullish sentiment among market participants.

On the same time frame, the Alligator's MAs are headed upwards, which corresponds to the recovery stage.

Outlook

Keeping the price above the 1.0800 level allows for a subsequent increase in long positions on the euro. This, in turn, may lead to a new phase of recovery. However, if the quote falls below the 1.0750 level, this would disrupt the recovery phase.

The complex indicator analysis unveiled that in the short-term, indicators suggest a pullback, while indicators in the intraday and medium-term periods are pointing to an ascending cycle.