To win in battle, strength alone is not enough. Determination is necessary. European Central Bank President Christine Lagarde's speech at the press conference following the ECB's June meeting seemed more unequivocal to the markets than Fed Chairman Jerome Powell's vague statements. Lagarde stated that if there is no significant change in core inflation, the central bank will continue to raise rates. Amid this, German bond yields jumped, and EUR/USD rose above 1.09 for the first time since mid-May.

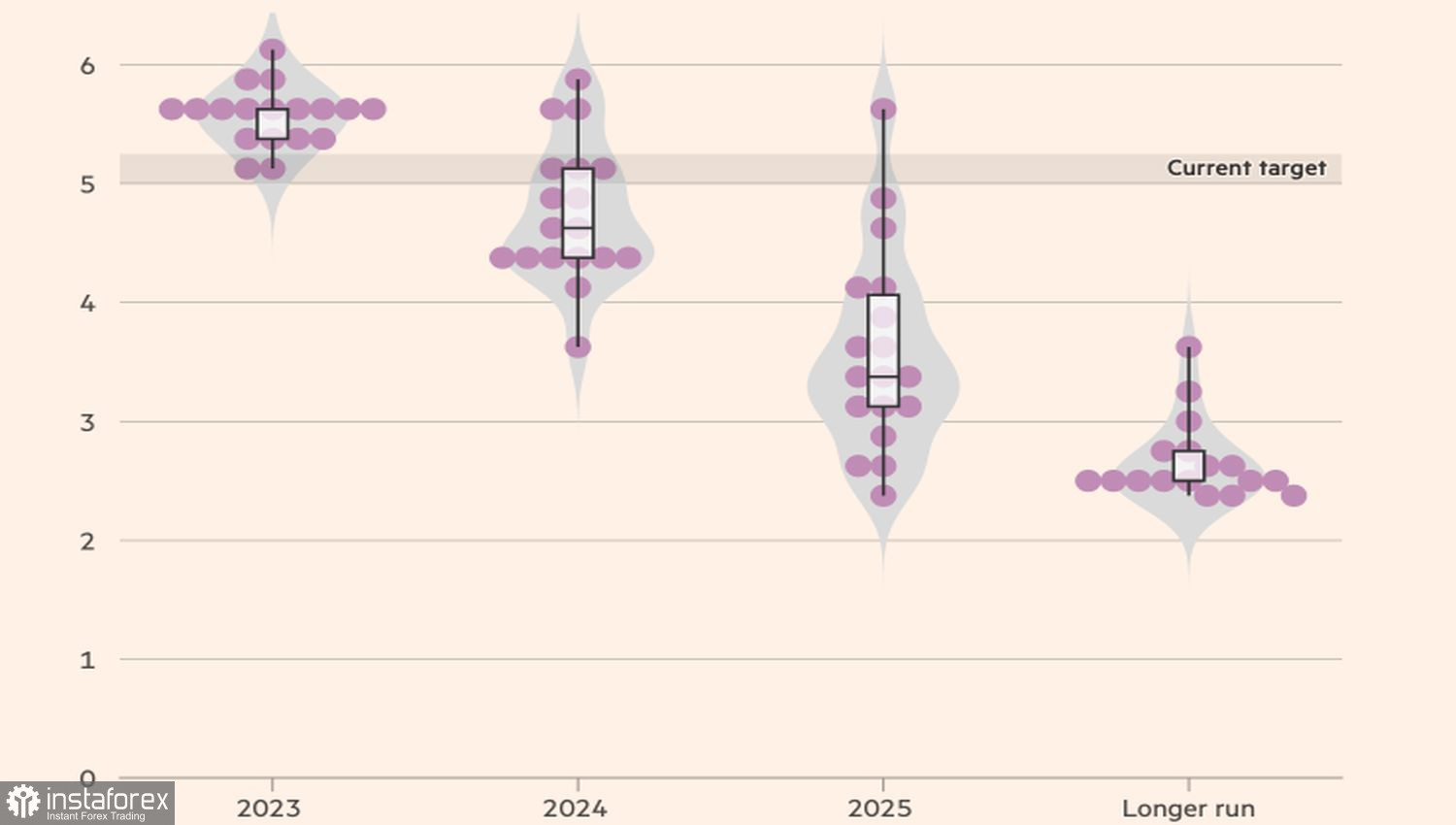

Meanwhile, Powell tried to downplay the signal of a 50 basis point increase in the federal funds rate to 5.75% in the updated FOMC forecasts. He referred to July as an active month for decision-making but did not mention that borrowing costs would inevitably rise as a result. Moreover, the statement that the pause is not really a pause but another step towards monetary tightening confused investors. According to Powell, the Fed is approaching the end of the cycle, and during this period, it is necessary to reduce the pace. However, keeping the rate at 5.25% is a halt!

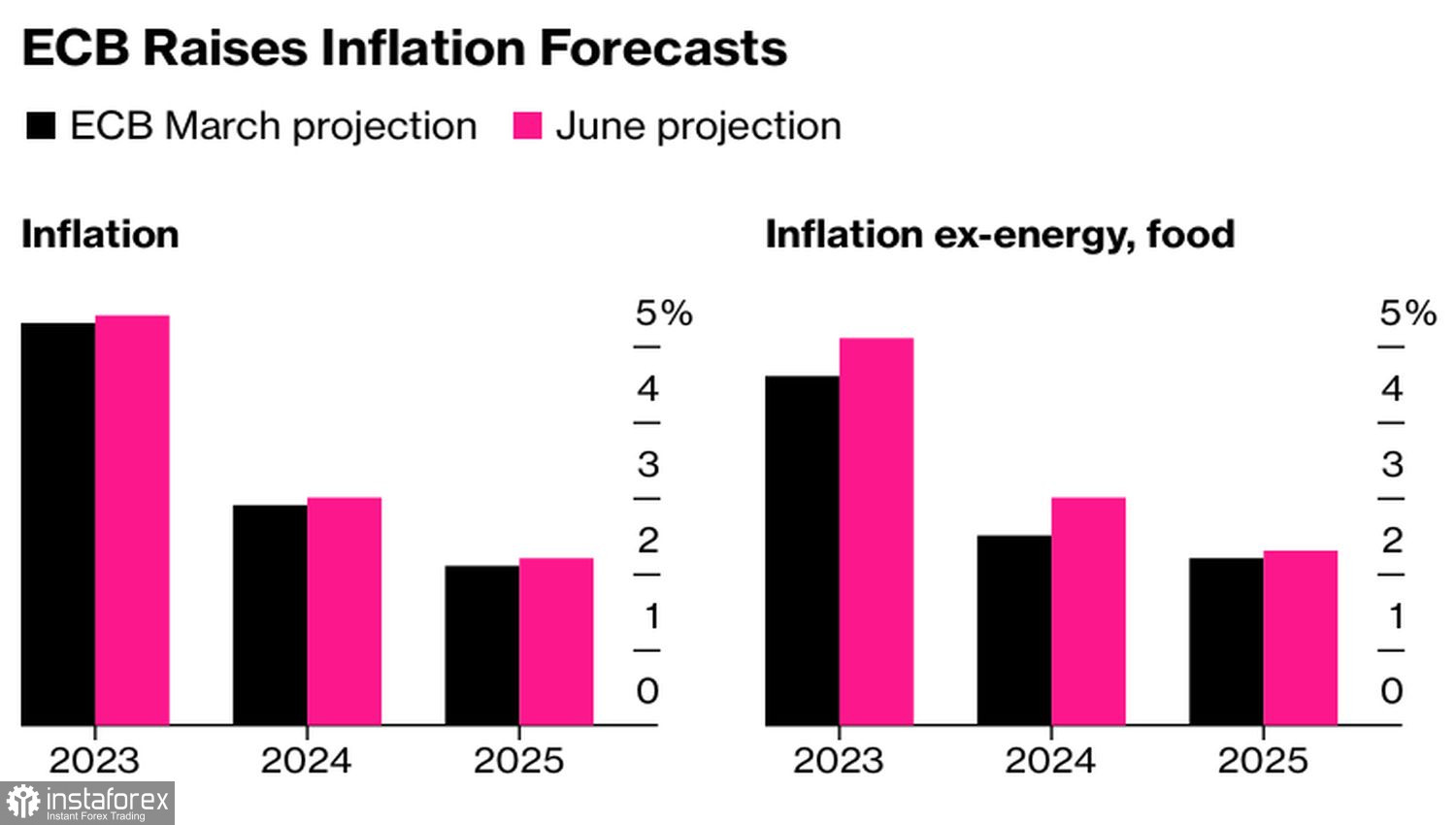

Against this murky backdrop, Lagarde appeared as a paragon of clarity. According to her, inflation in the eurozone has been unacceptably high and at a high level for a very long time. So the ECB has not finished its work yet. In conjunction with the fact that the central bank raised its forecast for core inflation in 2023 from 4.6% to 5.1% and in 2024 from 2.5% to 3%, this hints at a continuation of the monetary policy tightening cycle beyond the summer. The money market immediately increased the chances of a deposit rate hike to 4% in September from 50% to 80%. This became no less of a catalyst for the rise of EUR/USD than the increase in German bond yields.

ECB Inflation Forecasts

In my opinion, the market has made a mistake. It believed the words and closed its eyes. The strengthening of the euro against the U.S. dollar following the meetings of the two leading central banks in the world is the result of Lagarde's clearer rhetoric compared to Powell's. In reality, the main point has been missed. The Federal Reserve intends to raise the federal funds rate to 5.75%. These are the new FOMC forecasts. And so far, the Committee has been right on the money.

It has long been signaling an increase in borrowing costs to the current level of 5.25%. It has long been asserting the absence of a "dovish" pivot. Investors often did not believe the central bank, and were punished for it. The same thing will happen now. We need not just to listen but also to see.

FOMC Forecasts for the Federal Funds Rate

The markets may soon come back down to earth. The ECB and the Federal Reserve intend to take two more steps, and the U.S. economy appears stronger than Europe.

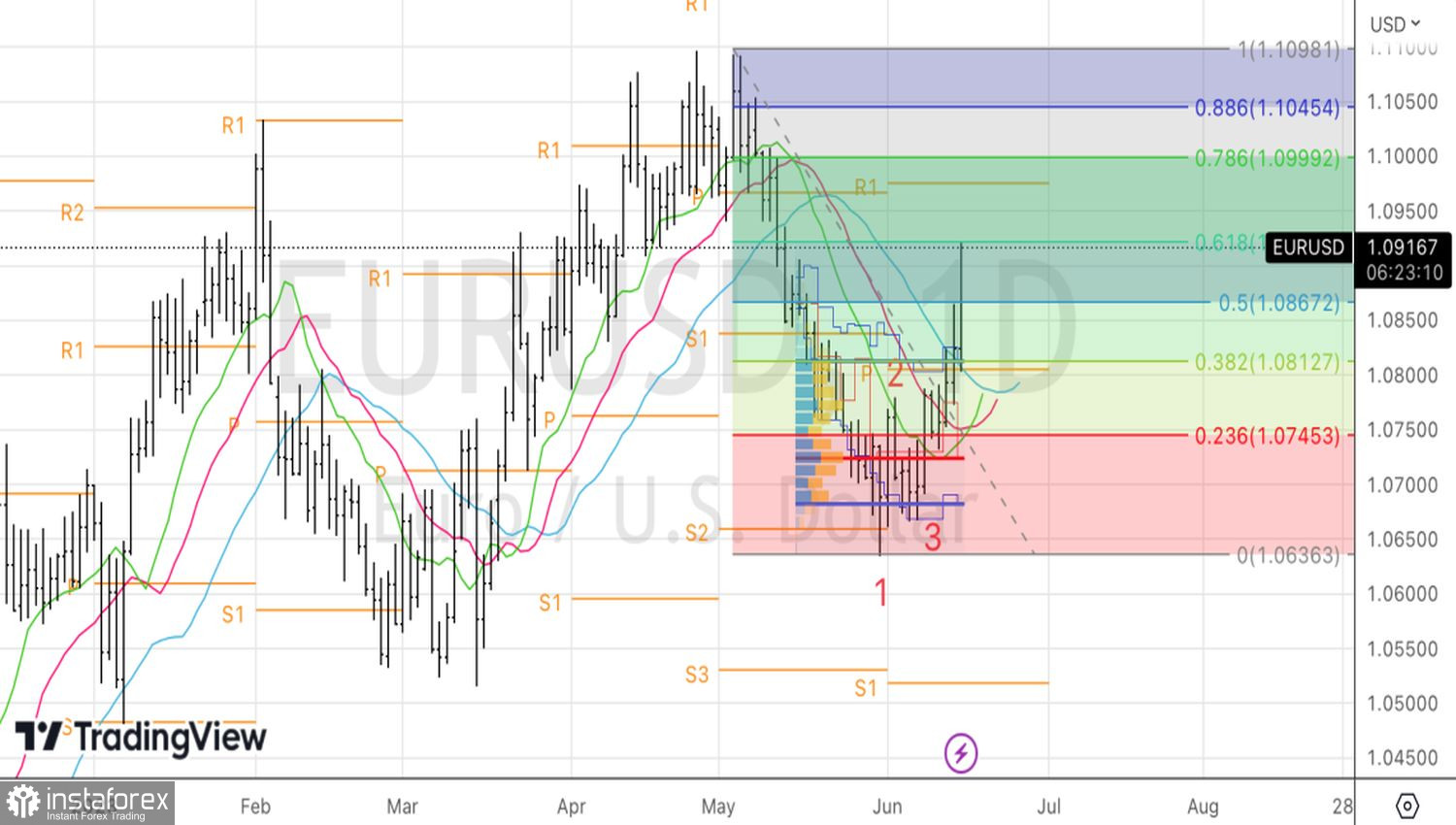

Technically, on the daily chart, the implementation of the 1-2-3 reversal pattern in EUR/USD continues. We successfully entered long positions on the rebound from 1.0775. The previously mentioned targets at 1.0925 and 1.0975 are getting closer. However, a rebound of the main currency pair from these resistance levels will not only be a reason to take profits but also an opportunity for a reversal—opening short positions.