Gold faced turbulence following the Federal Reserve's decision to keep interest rates steady, taking a hit but maintaining resilience. The European Central Bank's (ECB) meeting has also eroded the optimism of XAU bulls.

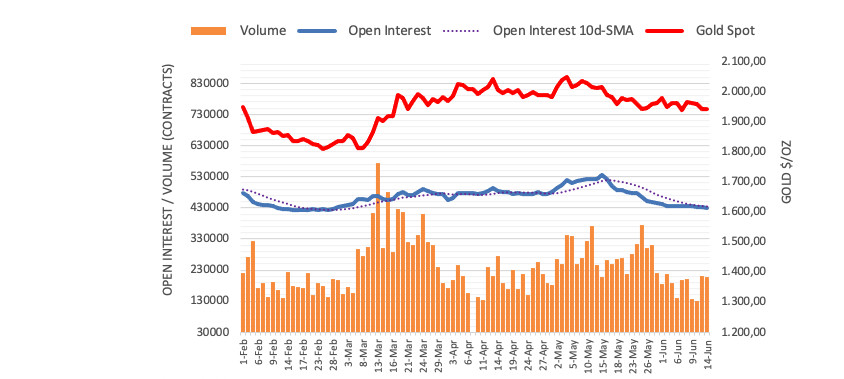

At the beginning of the week, the precious metal displayed a downward trend. Open interest in gold futures increased by only 419 contracts after a two-day drop, a sign that gold may decline even further, experts noted.

At the beginning of the week, gold was under pressure and traded at $1930, its lowest level in three months. The ECB's key interest rate decision led to a brief upswing of XAU/USD. On Thursday, June 15th, the European regulator announced a 25 basis point rate hike, meeting expectations. According to Christine Lagarde, President of the ECB, this step was necessary due to persistent inflation.

On Wednesday, June 14th, the Fed concluded its meeting, keeping interest rates steady between 5%–5.25%. Jerome Powell, Chairman of the Federal Reserve, indicated concerns about rising inflation, and stated the regulator was ready to tighten monetary policy further if necessary.

In response, gold began a bearish trend, which has persisted since the Fed meeting. Analysts believe that XAU still has support near $1,930, though the situation could change at any moment.

Looking ahead, the Fed has planned two additional rate hikes of 25 basis points each in 2023, followed by a 100 basis point cut in 2024. Market participants are confident that the regulator's actions will depend on current macroeconomic data. Should reports indicate a looming recession in the US economy, the Fed might be compelled to conclude its current monetary policy tightening cycle. Under such circumstances, gold still has short-term upside potential, analysts suggest.

Later on, the precious metal tried to break the downward trend, albeit unsuccessfully. To alleviate bearish pressure, XAU/USD needs to surpass $1,940, experts say. Such movement, combined with diminishing open interest in gold and reduced trading volumes, signals a limited downside potential for the yellow metal.

On Friday morning, June 16th, the price of gold dipped slightly, despite the metal showing a determined push towards new highs. Gold futures with delivery in August on the Comex exchange fell by 0.15% to $1,967.65 per ounce. Afterwards, the precious metal reversed course and tested $1,970, reaching $1,969.90 per ounce.

Commerzbank economists predict that gold would rebound in the coming months, but only if the Federal Reserve steps back from rate hikes in the medium term. However, this scenario seems unlikely. According to the bank's outlook, a rate hike in the second half of 2023 would bolster the dollar but pose a threat to gold's upward trajectory. Commerzbank expects the first rate cut to occur only in early 2024. "As this should become apparent at the end of the year, the gold price should then also begin to sustainably establish itself above $2,000 and even reach a new record high next year.," the analysts add.

This view is shared by currency strategists at TD Securities, who are bullish on gold in the short term. They predict that by the end of 2023, the precious metal will reach $2,100 per ounce. However, if macroeconomic data remains robust enough to validate the Fed's rate forecasts, gold might pull back to $1,900.

"Gold could well rally on any data showing inflation pressures are easing and the economy is reversing gears," analysts noted, adding that the precious metal could start climbing If the US central bank actively lowers rates to hit the 2% inflation target.