EUR/USD

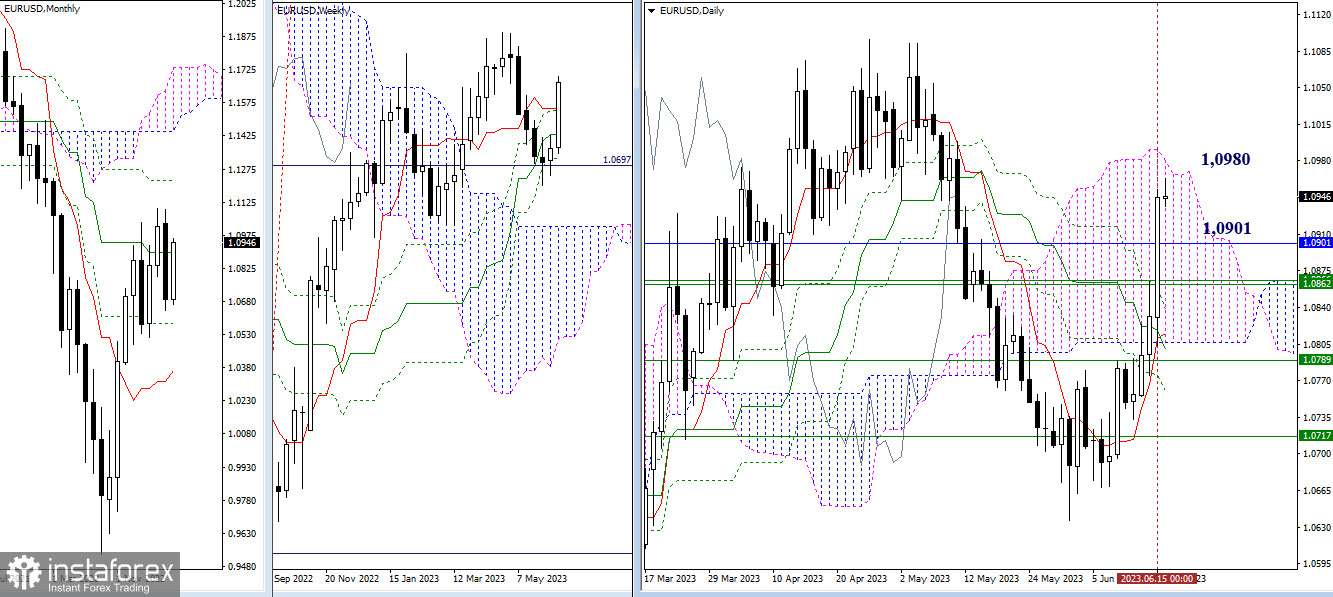

Higher timeframes

Bulls showed massive performance yesterday by organizing a daily movement that surpasses the achievements of the past few weeks. The most important tasks in this direction now are to break out of the daily cloud into the bullish zone (1.0980) and restore the weekly upward trend (maximum peak at 1.1096). If bears try to recover their positions in the near future, the levels reached yesterday (1.0866 - 1.0901) are likely to defend the interests of the bulls.

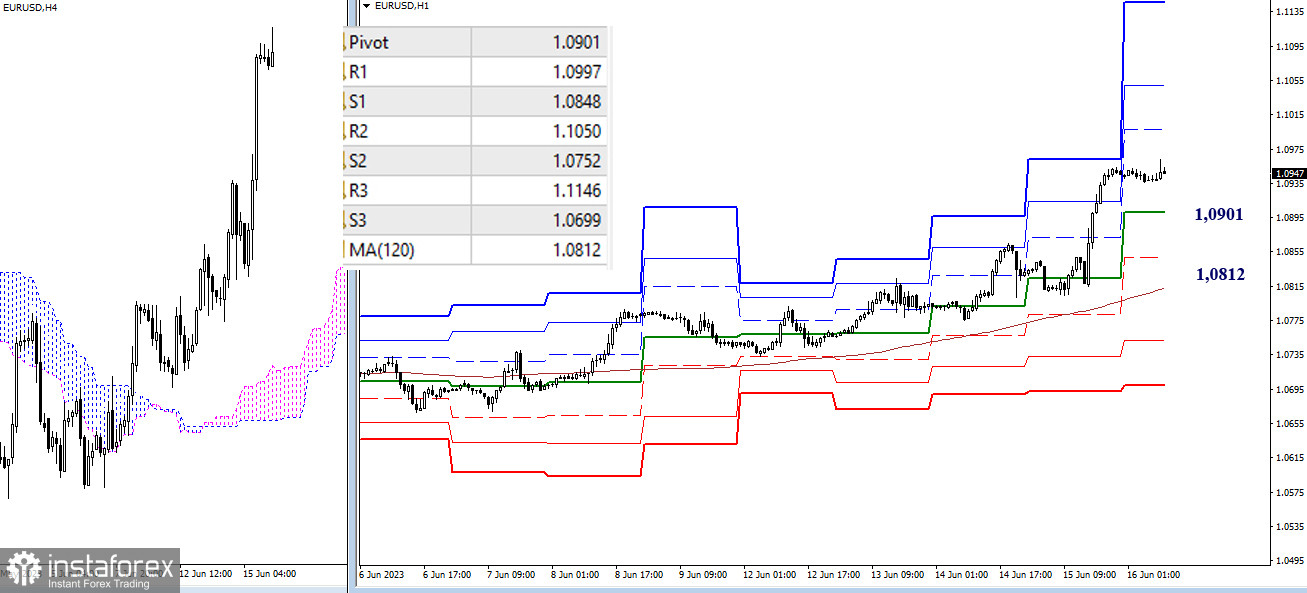

H4 - H1

On lower timeframes, an upward trend is developing. The intraday targets for the upward movement today provide space for bulls, located at 1.0997 - 1.1050 - 1.1146 (resistances of classic pivot points). At the same time, the key levels allow for enough room in case of a corrective decline. The key levels serve as supports today, located at 1.0901 (central pivot point of the day) and 1.0812 (weekly long-term trend), with additional support possibly provided by 1.0848 (S1). A break and consolidation below the key levels will change the prevailing sentiments, in which case it is better to reassess the working situation.

***

GBP/USD

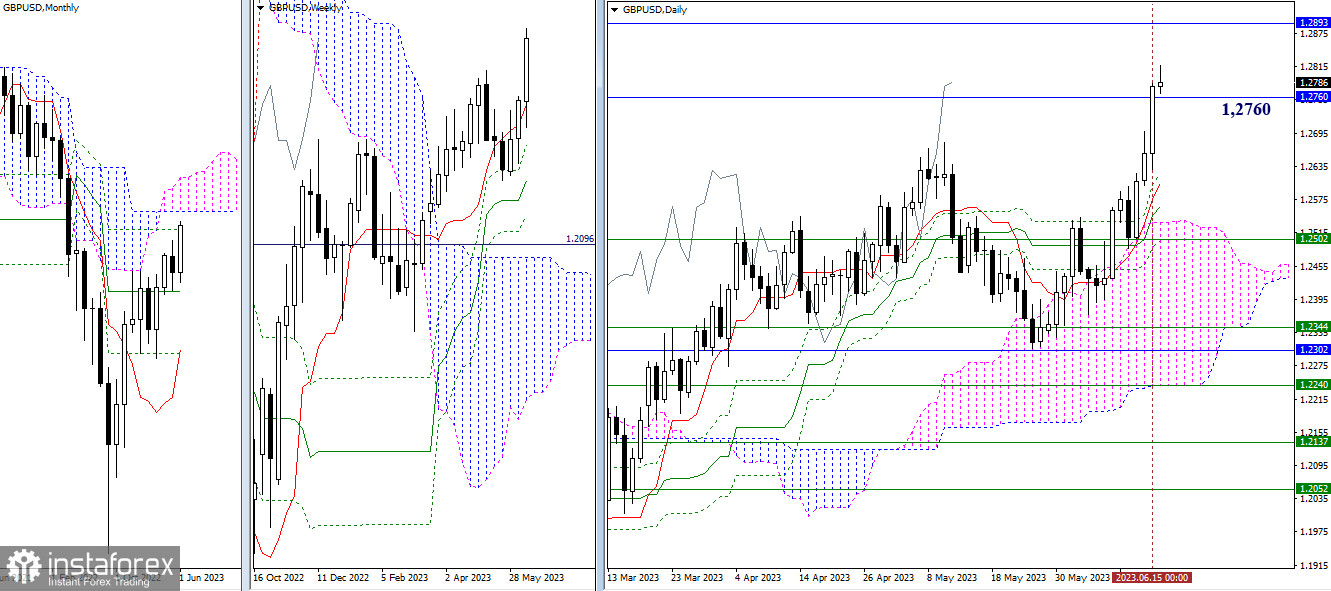

Higher timeframes

Last day, the bulls managed to close above the final level of the monthly Ichimoku cross (1.2760). This is a strong level that, with its attractiveness and influence, can currently impede the development of the situation. If bulls continue the rise, the next important level in this range is the monthly cloud, the boundaries of which are currently at 1.2893 and 1.3141. However, if bears fall below 1.2760 and continue the decline, they will encounter the daily Ichimoku cross. Its levels will form corrective supports, with the main levels of the cross currently located at 1.2604 and 1.2562. In the following days, the cross will continue to rise according to the price chart.

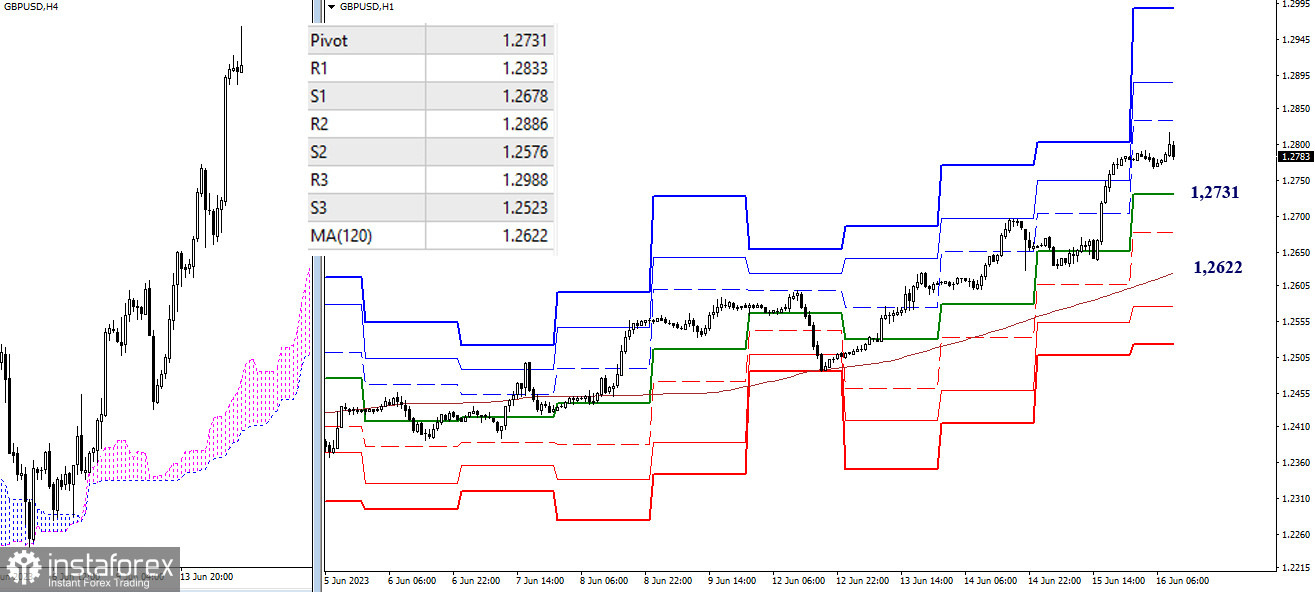

H4 - H1

On lower timeframes, the main advantage belongs to the bulls as they develop an upward trend. Intraday targets for the upward movement today are 1.2833 - 1.2886 - 1.2988 (classic pivot points). The key levels currently serve as supports, situated at 1.2731 (central pivot point) and 1.2622 (weekly long-term trend). Additional support in case of bearish activity may be provided by classic pivot points (1.2678 - 1.2576 - 1.2523).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)