Yesterday was a neutral day for the British pound. There were no reports or other events in the UK, while the US published several reports of minor importance. However, even the results of the ECB meeting helped bull traders find a reason to buy the pound which advanced by 140 pips, just like the euro. The fact that the euro and the pound are interrelated and often pull each other along is well known. But on Thursday, it would have been more fair if the pound had grown at least a little less than the euro. Yet, the pound advanced so rapidly as if the Bank of England had announced its decision yesterday. It is hard to imagine what will happen next week when the British regulator actually raises the rate by 0.25%.

Yesterday, traders took notice of several US reports. Thus, US retail trade volume grew by 0.3% in May, slightly above traders' expectations. Industrial production fell by 0.2%, slightly below the forecast. The number of jobless claims for the week ending on June 10 increased by 262,000, coming closer to what was expected by traders. So, the data from the US wasn't disappointing and, most likely, did not affect the market sentiment.

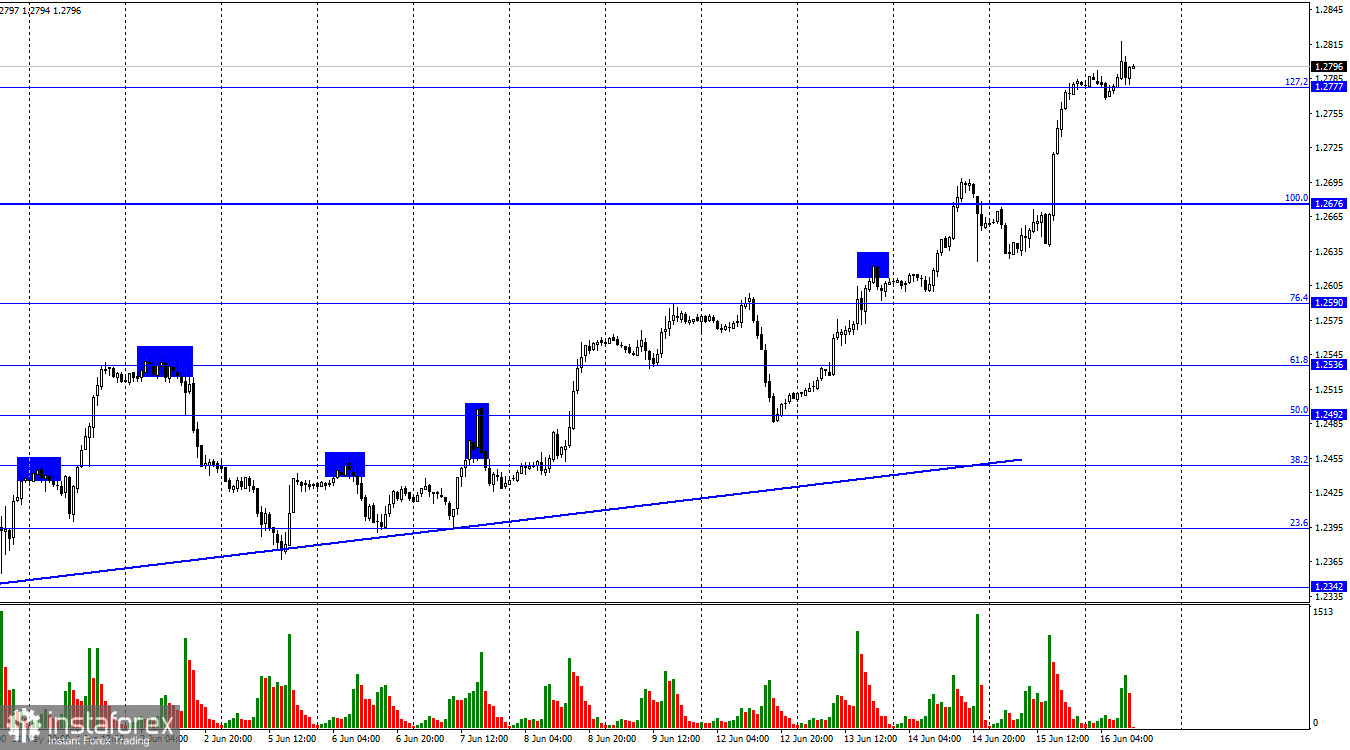

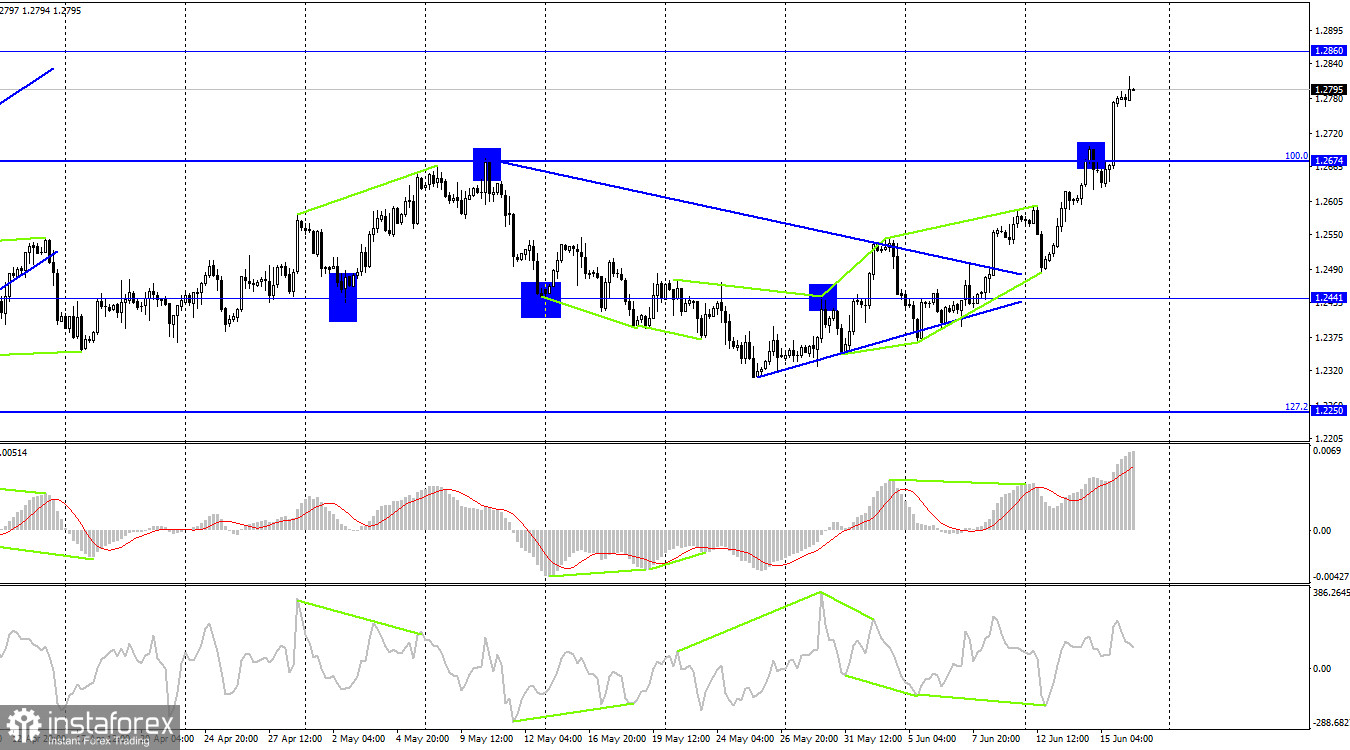

On the 4-hour chart, the pair settled above the Fibonacci retracement level of 100.0% at 1.2674. Thus, the pair's upward cycle can be extended towards the next level of 1.2860. No emerging divergences are observed in any of the indicators today. The pair's rebound from 1.2860 will favor the US currency and may push the pair lower to 1.2674.

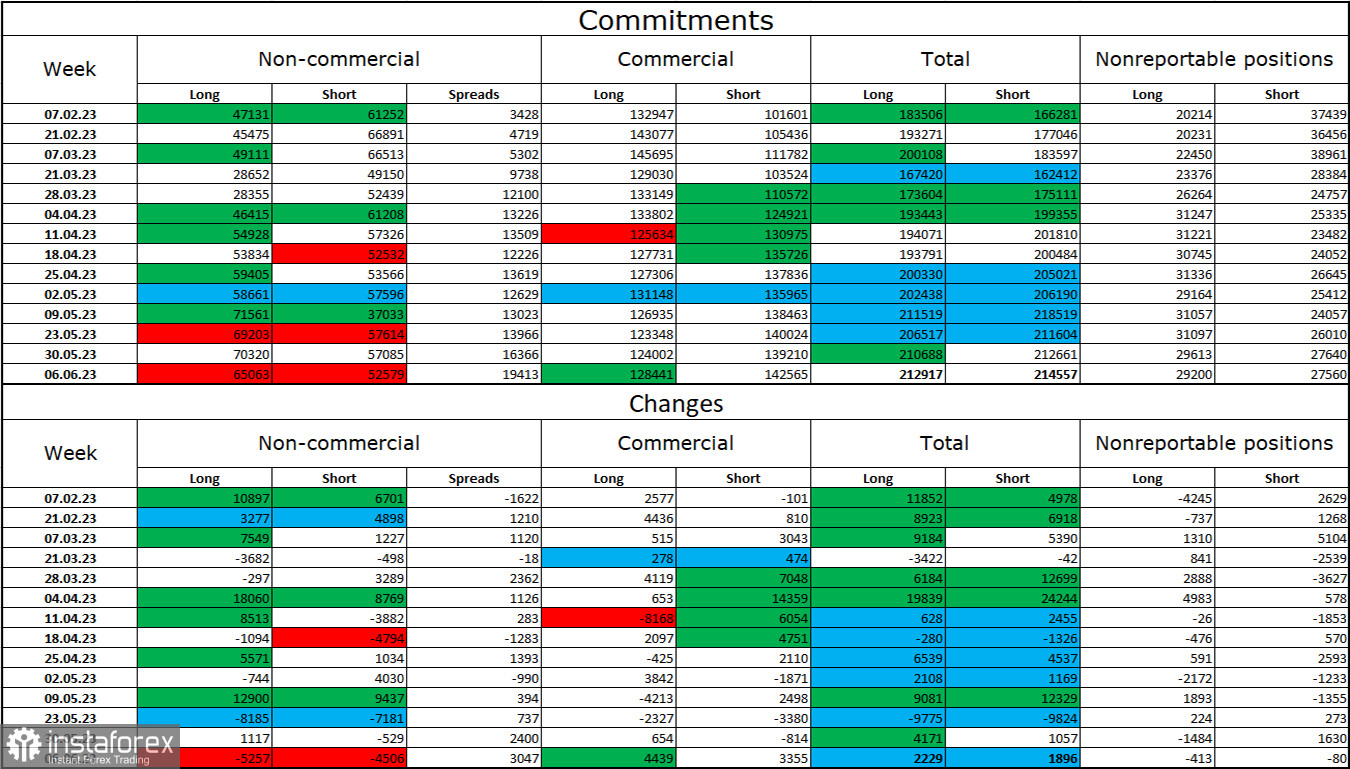

Commitments of Traders (COT) report

The non-commercial group of traders has become less bullish on the pair over the past reporting week. Long contracts decreased by 5,257 while short contracts fell by 4,506. The overall sentiment of large market players remains bullish although the number of long and short positions is almost the same, with 65,000 and 52,000 respectively. In my view, the pound has good upside potential and benefits from the information background more than the US dollar. However, I doubt that the pound will develop a strong uptrend in the coming months. The meeting of the Bank of England will clear up the pound's prospects.

Economic calendar for US and UK:

US – Michigan Consumer Sentiment (14-00 UTC)

On Friday, there is only one significant event in the economic calendar which is unlikely to influence the market.

GBP/USD forecast and trading tips:

Selling the pound will be possible when the price closes below 1.2777 on the H1 chart with the target at 1.2676. Long positions on the pound were relevant after the pair closed above 1.2546 with the targets at 1.2623, 1.2676, and 1.2810. The first two targets have been tested. You can go long on the pound in case of a close above 1.2777 on H1, setting the targets at 1.2860 and 1.2905.