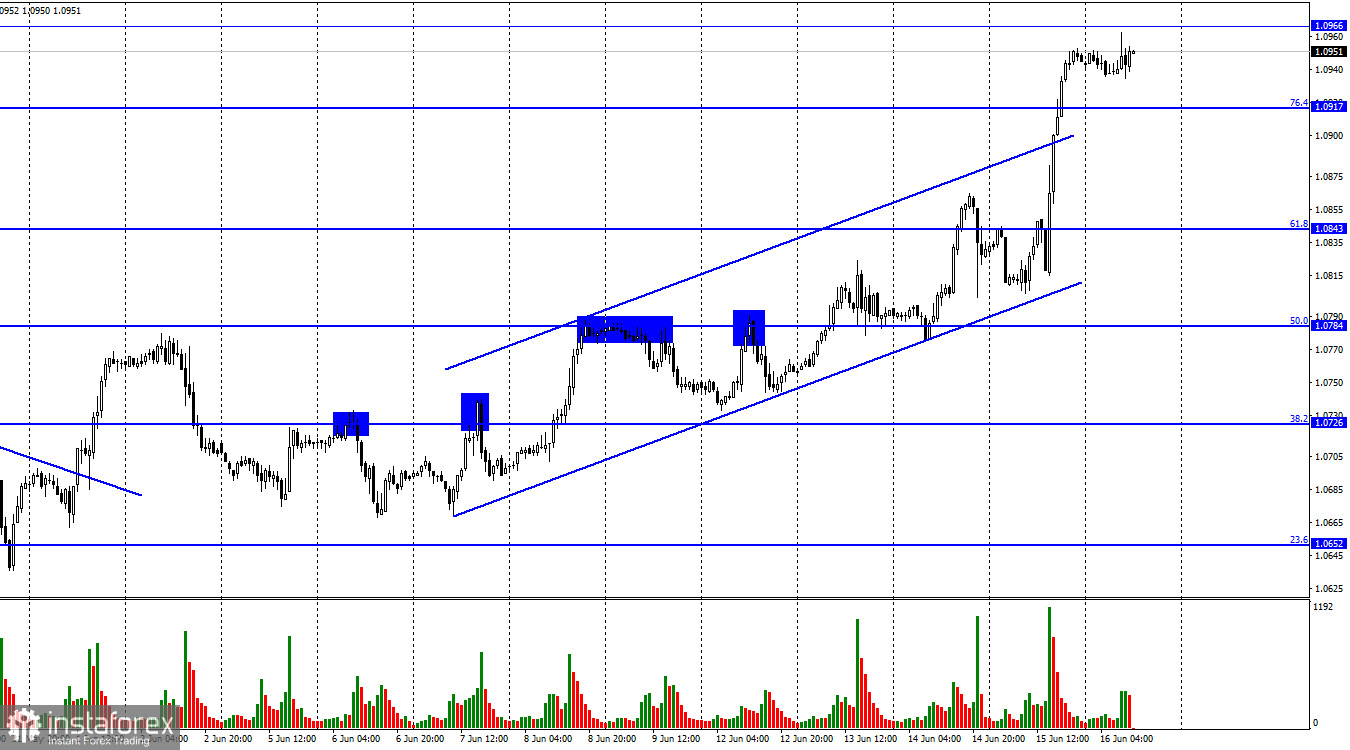

The EUR/USD pair executed another reversal in favor of the European currency on Thursday, consolidating above the levels of 1.0843 and 1.0917. Thus, the euro's growth may be continued towards the next level at 1.0966. A rebound from this level could favor the US currency, leading to a slight decline toward the levels of 1.0917 and 1.0843. The ascending trend corridor continues to characterize traders' sentiment as "bullish," a close above it indicates the pair's overbought condition.

Yesterday was both interesting and important. On the one hand, there were no surprises regarding the ECB interest rate. The regulator raised the rate by 0.25%, as expected. On the other hand, traders reacted to this decision as if they had no prior knowledge of it. It gives the impression that ECB members spent a month convincing the market of a pause in June and then unexpectedly tightened monetary policy. The euro rose by 140 pips. I did not expect such growth from a pair already under bulls' control. However, as often happens, the market interpreted this puzzle in its own way, and we can only accept its decision.

Since the rate has already increased to 4%, the European regulator is approaching the end point of tightening. Christine Lagarde practically stated at the press conference that the rate would also be raised in July since inflation remains uncontrollable and still too high. There needed to be a clear answer to the question of what rate level could be considered the maximum. As Lagarde left the door open for further increases even after July, the market perceived it as a reason to continue buying the euro. Although I still expect that the maximum rate will be reached in July.

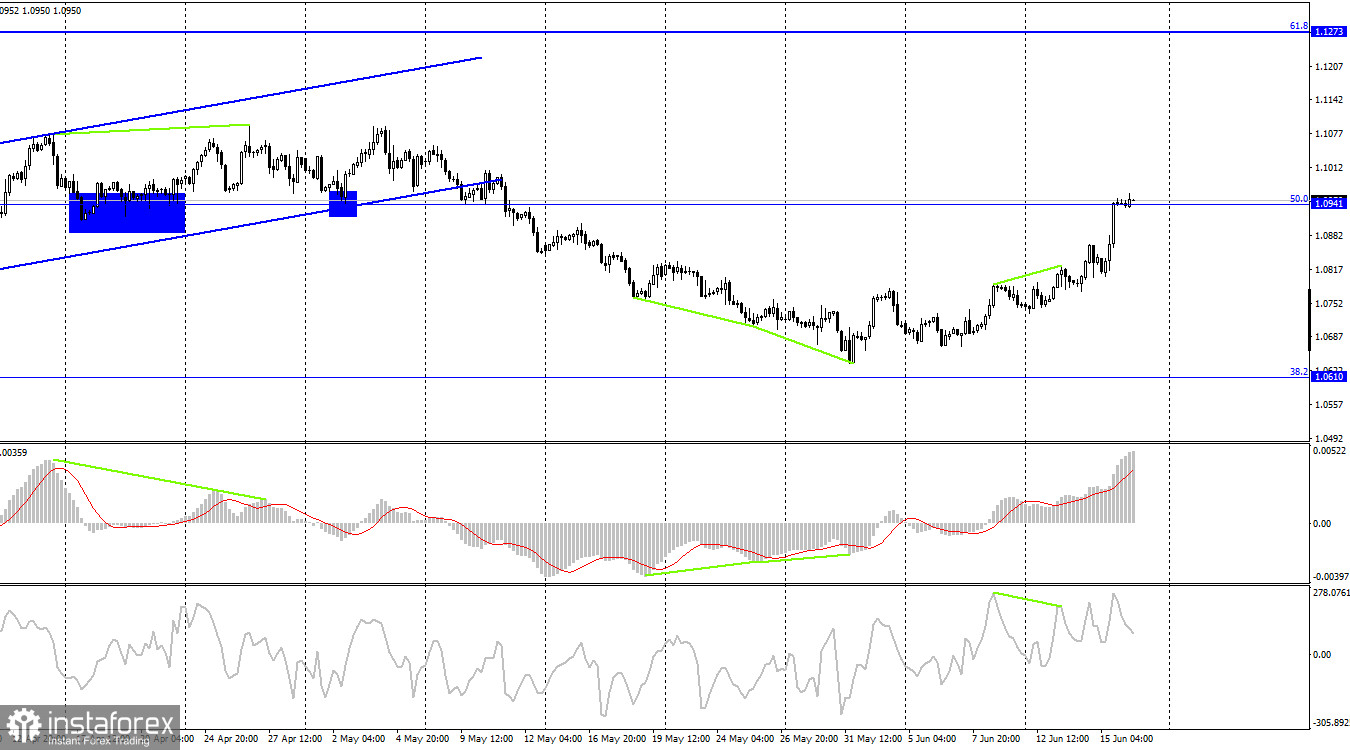

On the 4-hour chart, the pair reached the Fibonacci level of 50.0% (1.0941). The bearish divergence in yesterday's CCI indicator has already been invalidated. A rebound from the 1.0941 level would favor the US currency, leading to a slight decline towards 1.0610. Consolidation above the 1.0941 level increases the chances of further growth towards the next corrective level of 61.8% (1.1273).

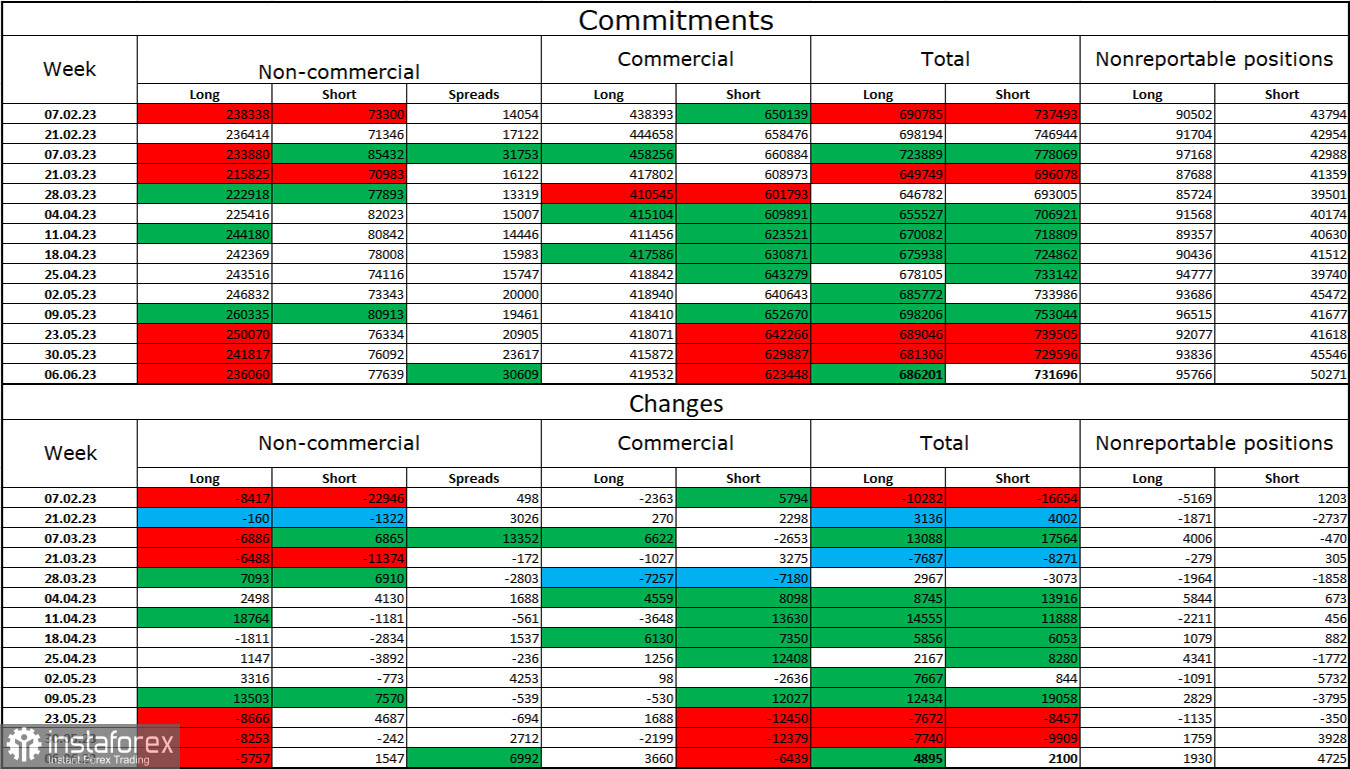

Commitments of Traders (COT) report:

During the last reporting week, speculators closed 5,757 long contracts and opened 1,547 short contracts. The sentiment of large traders remains "bullish" and strengthens once again. The total number of long contracts held by speculators now stands at 236,000, while short contracts amount to only 77,000. Strong bullish sentiment is still present, but the situation will continue to change soon. The European currency has been declining over the past month. The high value of open long contracts suggests that buyers may start closing them soon (or have already started, as indicated by the latest COT reports). There is currently an imbalance heavily favoring bulls. The current figures allow for a continuation of the euro's decline in the near term. However, this week, much will depend on the Federal Reserve (FRS).

News Calendar for the United States and the European Union:

Eurozone - Consumer Price Index (09:00 UTC).

USA - University of Michigan Consumer Sentiment Index (14:00 UTC).

On June 16, the economic calendar contains only two entries, with the Eurozone Consumer Price Index already released, reaching 6.1% for May. The impact of the news on traders' sentiment for the remainder of the day will be weak.

Forecast for EUR/USD and trading recommendations:

Short positions can be opened on the pair in case of a bounce from the 1.0966 level on the hourly chart, with targets at 1.0917 and 1.0843. Upon closing above the 1.0784 level on the hourly chart, I recommended buying the pair, with targets at 1.0843 and 1.0917. All targets have been reached. Upon closing above the 1.0941 level on the 4-hour chart, new purchases can be made, with a target of 1.1035.