EUR/USD:

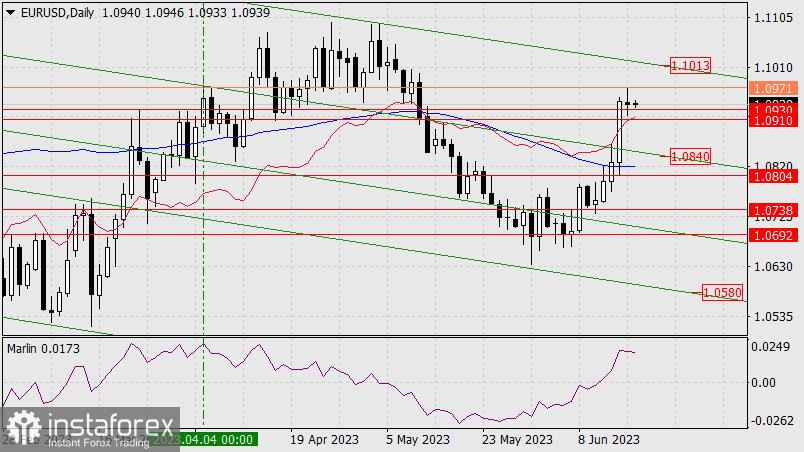

On Friday, the euro fell by 5 pips, reaching the upper shadow of the April 4th peak. This level is not very strong, but after testing the stronger target range of 1.0910/30, a reversal could occur from a weaker level. If the price surpasses Friday's high (1.0971), the price will try to test the upper limit of the price channel around 1.1013. The daily Marlin oscillator is turning downward, indicating that the euro will likely try to return below the range of 1.0910/30. Consolidation below this range would allow for a bearish push towards the lower embedded line of the price channel around 1.0840.

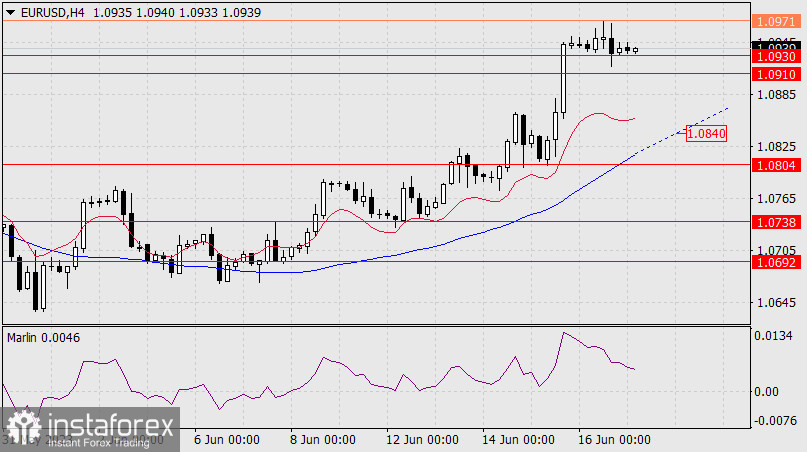

On the four-hour chart, there is a price consolidation above the target range of 1.0910/30, indicating a desire for further upward movement. The Marlin oscillator will also turn upward, easing the oversold condition. However, if the euro has no intention of rising, once the price falls below the mentioned range, it will consolidate below the zero line along with the oscillator, as its decline is quite rapid.

The support level at 1.0840 approximately corresponds to the MACD line on the four-hour chart. The same indicator line on the daily chart is also approaching this area. The support is becoming stronger, and its significance is increasing day by day. Therefore, breaking below this level would be a definitive signal for the development of medium-term downward movement (1.0580).