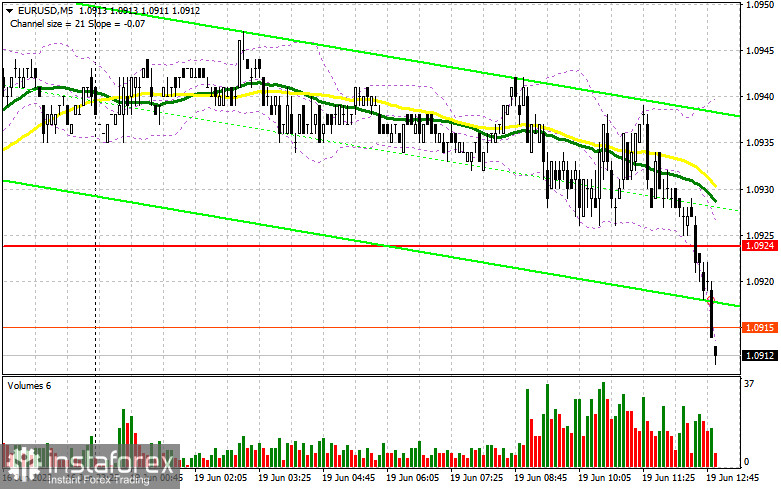

In my morning article, I turned your attention to 1.0924 and recommended making decisions with this level in focus. Now, let's look at the 5-minute chart and figure out what actually happened. A fall to 1.0924 occurred without a false breakout. Bulls did not show any activity at this level. For the afternoon, the technical outlook was slightly revised.

When to open long positions on EUR/USD:

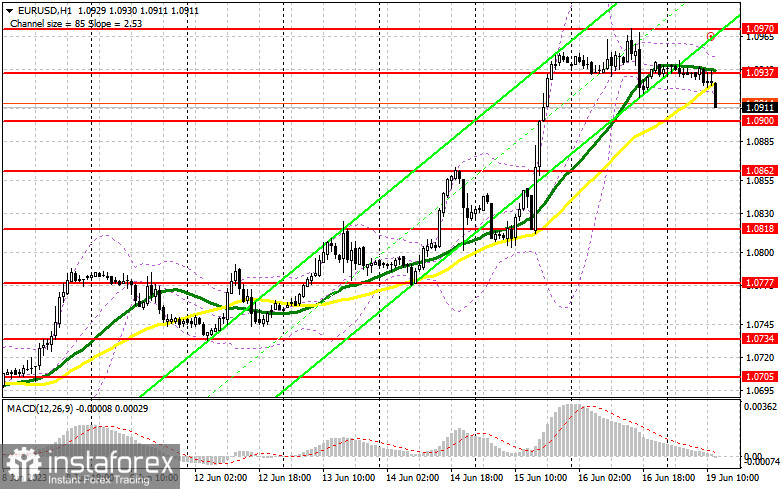

The lack of macro stats from the US may help sellers enter the market. However, they will hardly be able to initiate a long downward movement of the pair. Traders are likely to ignore the NAHB Housing Market Index. I would advise you to rely more on technical levels. I will go long near the support level of 1.0900, formed last Thursday after a rate hike by the ECB. Only a false breakout there, similar to the one I mentioned in my morning forecast, will give a buy signal. The pair could rise to the resistance level of 1.0937. A breakout and a downward retest of this level will bolster demand for the euro. The pair may reach 1.0970. A more distant target will be the 1.1002 level where I recommend locking in profits.

If EUR/ USD declines and bulls fail to protect 1.0900, in the afternoon, bears may return to the market expecting to build a downward correction. Therefore, only a false breakout of the support level of 1.0862 will provide new entry points for long positions. You could sell after a bounce from the low of 1.0818, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on EUR/USD:

Sellers managed to push the pair down in the morning. However, it will hardly lead to a trend reversal. Bulls are waiting for more favorable prices. This is why a sharp drop in the euro looks unlikely. For this reason, I would prefer to go short only after a rise and a false breakout of the resistance level of 1.0937, formed in the morning. The moving averages are also passing at this level. An unsuccessful consolidation there may create a sell signal that could push EUR/USD to 1.0900. A decline of this level as well as an upward retest could trigger a fall to 1.0862. A more distant target will be a low of 1.0818 where I recommend locking in profits.

If EUR/USD rises during the US session and bears fail to protect 1.0937, the market equilibrium will occur. The pair will slide in a sideways range. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.0970. You could sell EUR/USD at a bounce from 1.1002, keeping in mind a downward intraday correction of 30-35 pips.

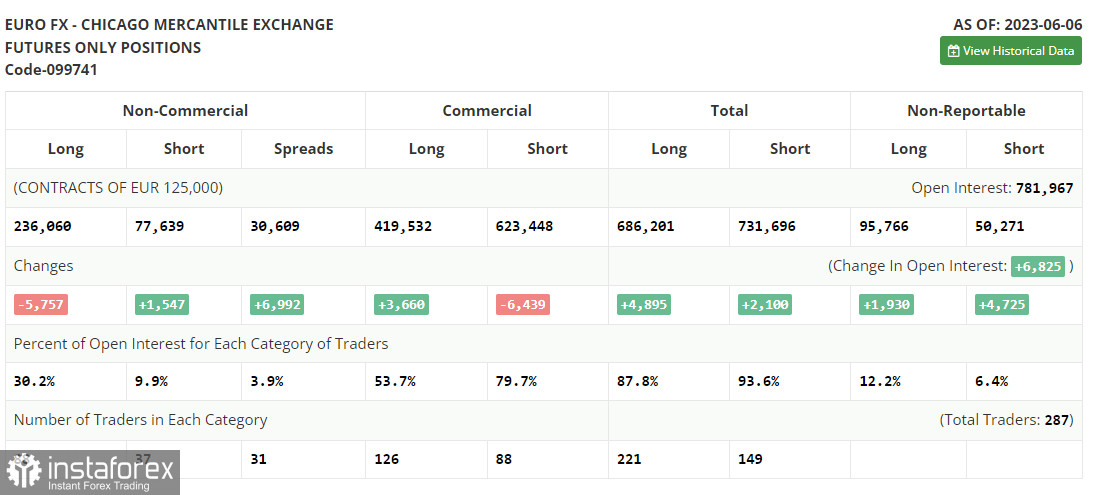

COT report

According to the COT report (Commitment of Traders) for June 6, there was a drop in long positions and a slight increase in short ones. Despite all this, the Fed's rate decision this week may significantly affect market sentiment. Hence, the above-mentioned changes are not important. If the Fed decides to skip a rate increase, the euro will climb markedly. Risk appetite will improve amid the ECB's commitment to a hawkish stance even despite the first signs of a slowdown in inflationary pressure. The COT report showed that long non-commercial positions decreased by 5,757, to 236,060, while short non-commercial positions rose by 1,457, to 77,060. At the end of the week, the total non-commercial net position declined and amounted to 158,224 against 163,054. The weekly closing price dropped to 1.0702 against 1.0732.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD rises, the indicator's upper border at 1.0960 will serve as resistance.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.