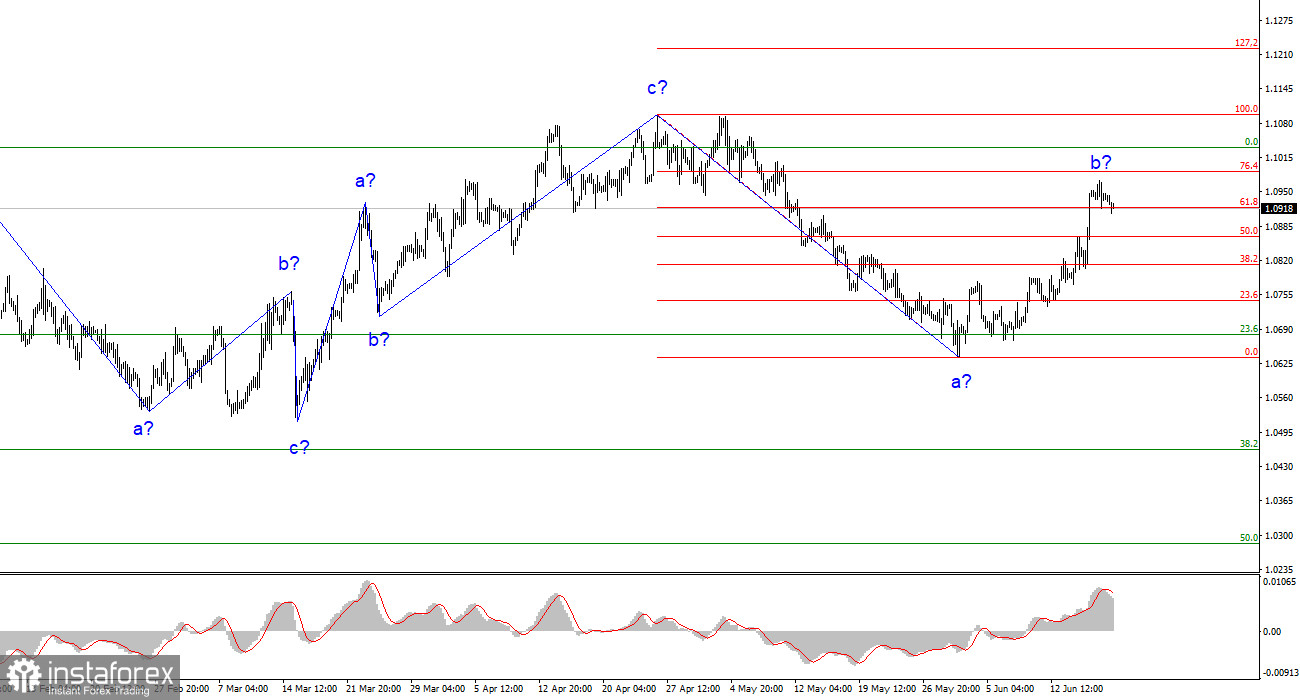

The wave analysis on the 4-hour chart for the EUR/USD pair continues to be non-standard but understandable. The price continues to move away from the previous lows, presumably within wave b. The upward trend that began on March 15th may still theoretically take on a more complex structure, but at the moment, I expect the formation of a downward segment of the trend, which is likely to be a three-wave structure as well. Recently, I have consistently mentioned that I expect the pair to reach around the 1.28 figure, from where the upward three-wave structure started. I am not abandoning this prediction for now.

The recent high point of the trend was only a few dozen points higher than the peak of the previous upward segment. Since December of last year, the pair's movement can be considered horizontal, and this type of movement will persist. The presumed wave b, which could have started forming on May 31st, currently has a convincing appearance and may conclude at any moment since it clearly shows three waves within it. Moreover, it has already taken on an elongated form.

Isabel Schnabel warns of risks.

The EUR/USD exchange rate declined by 25 basis points on Monday. This is a relatively small decrease to conclude the formation of the presumed wave b. However, now is a very reasonable time for this wave to be completed. The pair has retraced nearly 76.4% of wave a, which is a substantial correction. If the current wave count is correct, further price increases are unacceptable as they would break it. If that is the case, a downward wave should begin from the current levels with minimum targets located below wave a's low, meaning below the 1.06 figure.

The news background on Monday was relatively weak, which explains the low amplitude of movements. Nevertheless, Isabel Schnabel, a member of the ECB's Governing Council, made a speech today. She stated that inflation risks remain sufficiently high and have an upward tendency. According to her, the ECB should not do too little but not "overachieve." She also noted that the regulator underestimated the resilience of inflation last year, and the same situation may occur this year. "We must continue tightening until we see a clear trajectory of declining core inflation," Schnabel concluded. This speech is neutral for the euro, and the wave count is currently in the foreground. The news background is expected to remain relatively weak tomorrow, and the price decline may continue.

General conclusions.

Based on the analysis, a new downward trend segment continues. The pair once again has significant room for a decline. I still consider targets around the 1.05-1.06 range realistic, and I advise selling the pair with these targets in mind. I believe that the completion of wave b is highly probable at this point, and the MACD indicator has formed a "down" signal. Selling with a stop loss above the current peak of the presumed wave b is possible.

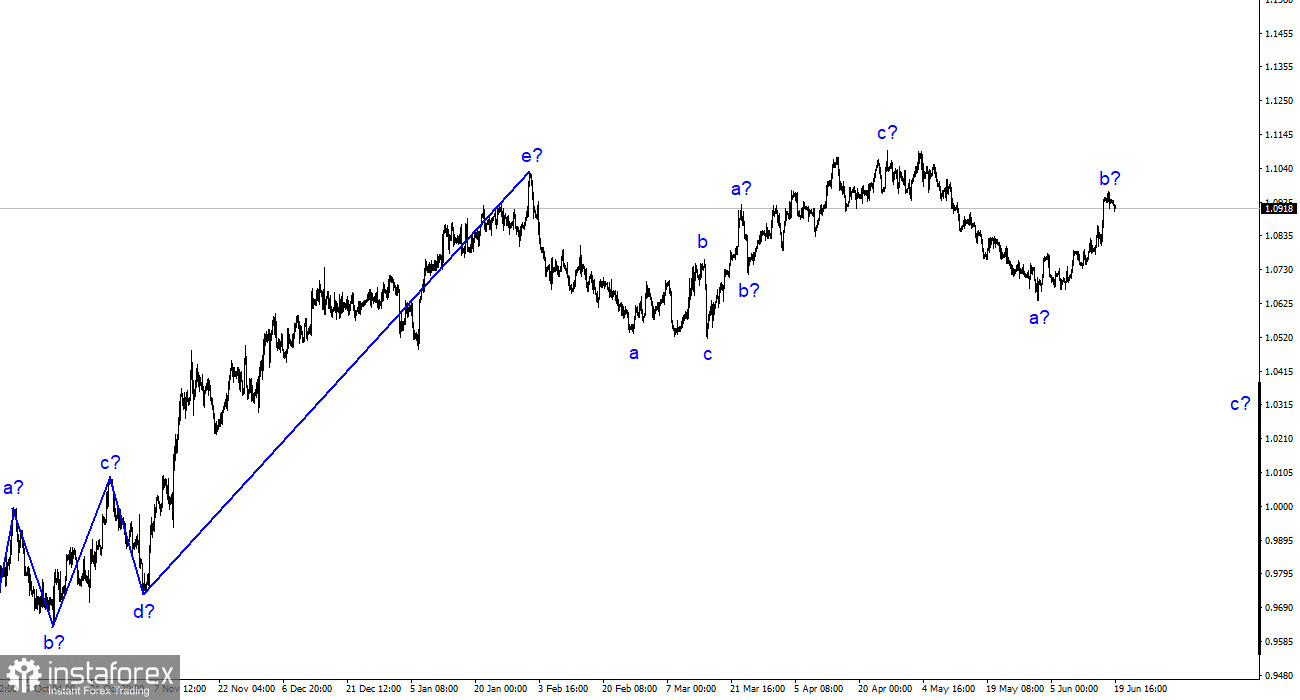

On a larger wave scale, the wave count of the upward segment of the trend has taken on an elongated form but is likely completed. We have seen five upward waves, most likely the structure of a-b-c-d-e. The pair then formed two three-wave structures, downward and upward. It is likely in the process of forming another descending three-wave structure.