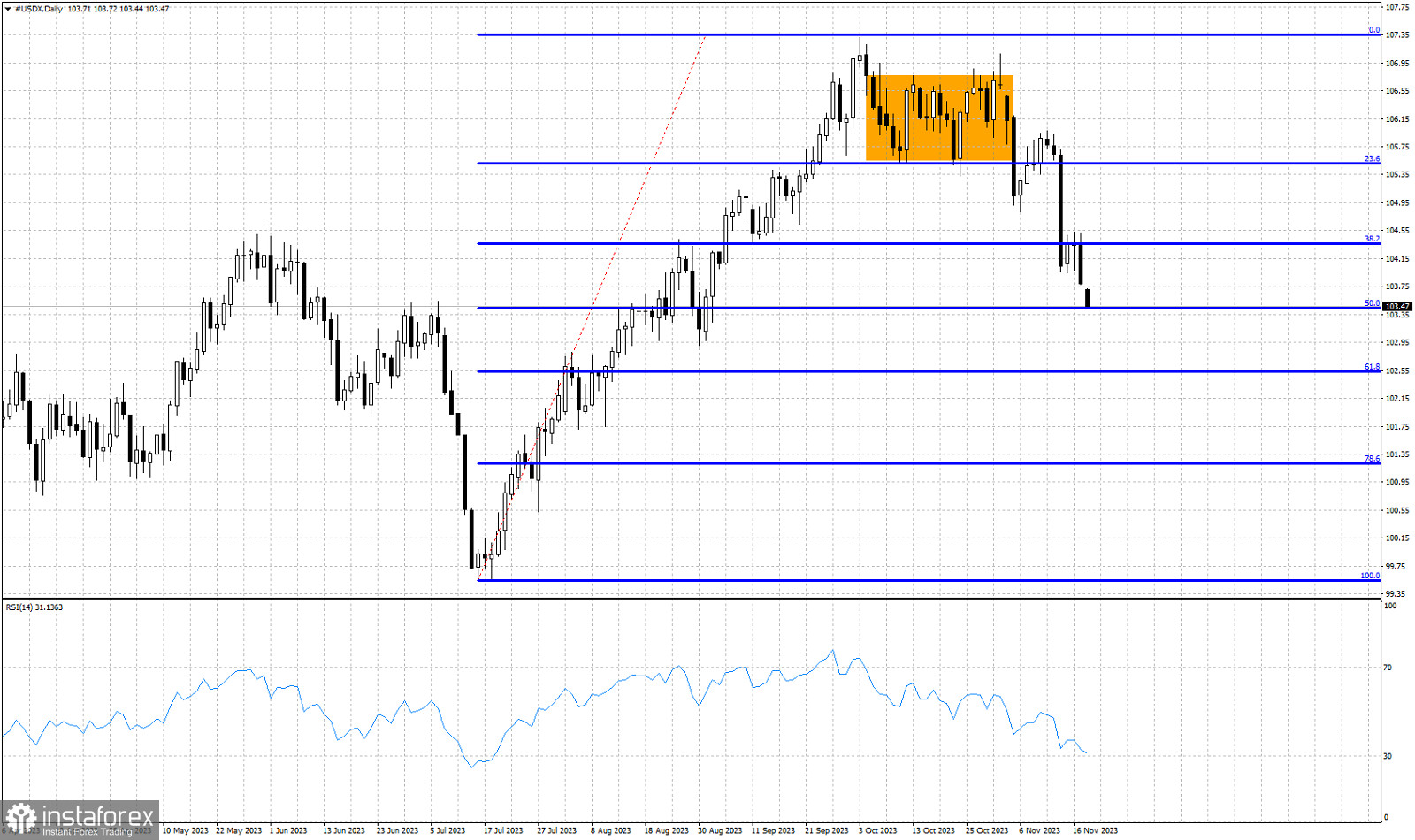

Blue lines- Fibonacci retracement levels

Orange rectangle- consolidation broken downwards

The Dollar index is under pressure. After breaking out and below the consolidation area (orange rectangle) we got a new bearish signal. Price broke below the consolidation range to new lows, bounced back up for a back test forming a lower high and continued to new lows. Current short-term trend remains controlled by bears. Price has retraced 50% of the initial rise from 99.55. Next major support is the 61.8% Fibonacci retracement at 102.55. Price is currently at 103.46 where we find the 50% Fibonacci retracement level. The RSI has not reached oversold levels yet. There more downside potential for the Dollar index.