EUR/USD

Higher timeframes

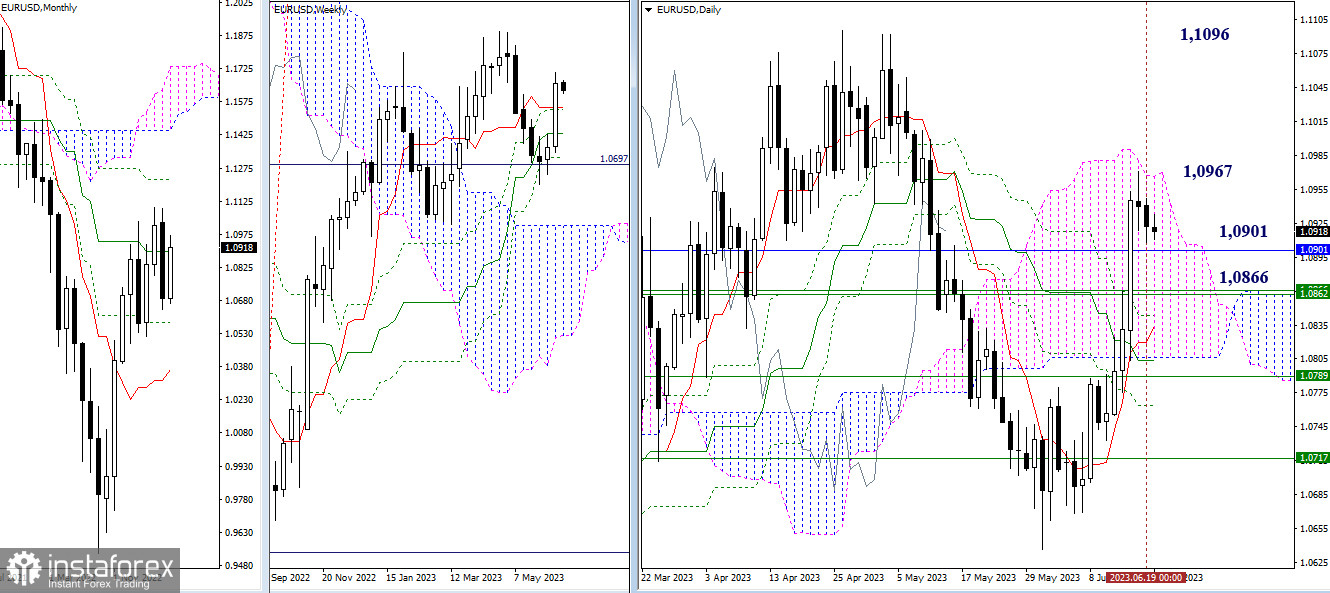

Over the past day, none of the opposing sides have achieved a convincing advantage in the market. The main objectives remain unfulfilled, and therefore, they have not lost their relevance so far. For bullish players, it is important to break above the Ichimoku cloud (1.0967) and reach the new high of the past months (1.1096), which would allow considering a recovery of the weekly upward trend. For bearish players, the nearest supports located at the levels of 1.0901 - 1.0866 (monthly medium-term trend + weekly short-term trend) still hold significance.

H4 - H1

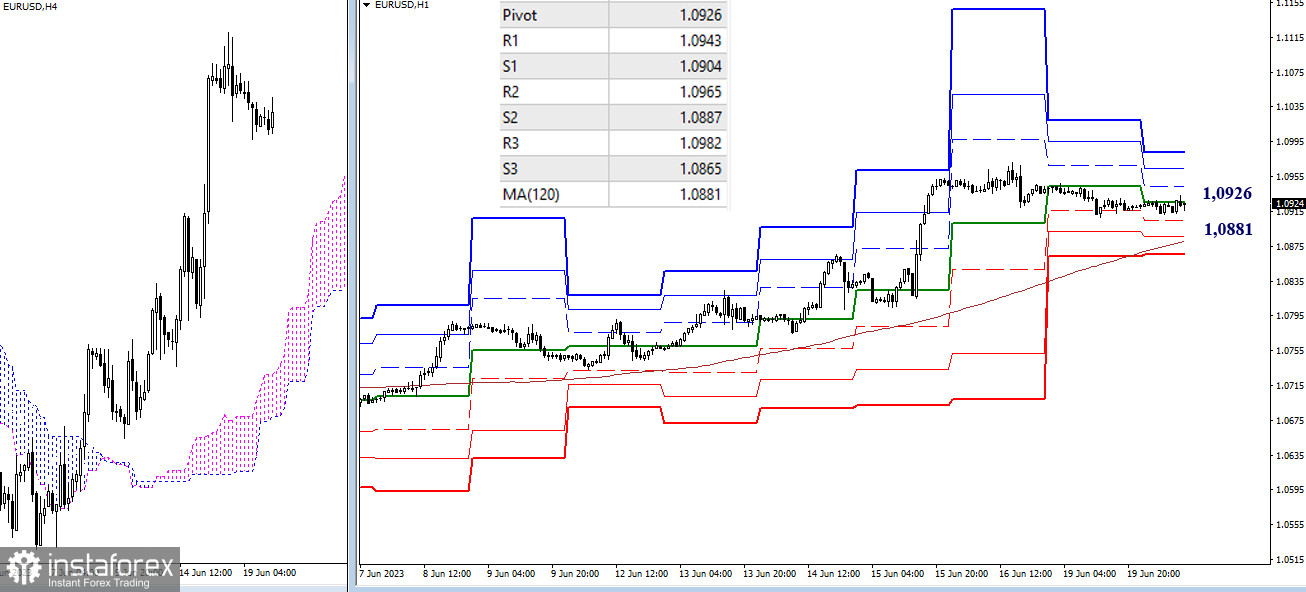

On the lower timeframes, the pair remains within the attraction and influence zone of the central pivot point of the day (1.0926). The main advantage is still on the side of the bulls. In the event of an upward movement, resistance from the classic pivot points (1.0943 - 1.0965 - 1.0982) may come into play within the day. In the case of bearish activity, the weekly long-term trend (1.0881) will hold the main value, as this level is responsible for the balance of power on lower timeframes. A stable performance above this level allows for strengthening the bullish advantage. A reliable consolidation below it and a reversal of the moving average will contribute to an increase in bearish activity and advantage.

***

GBP/USD

Higher timeframes

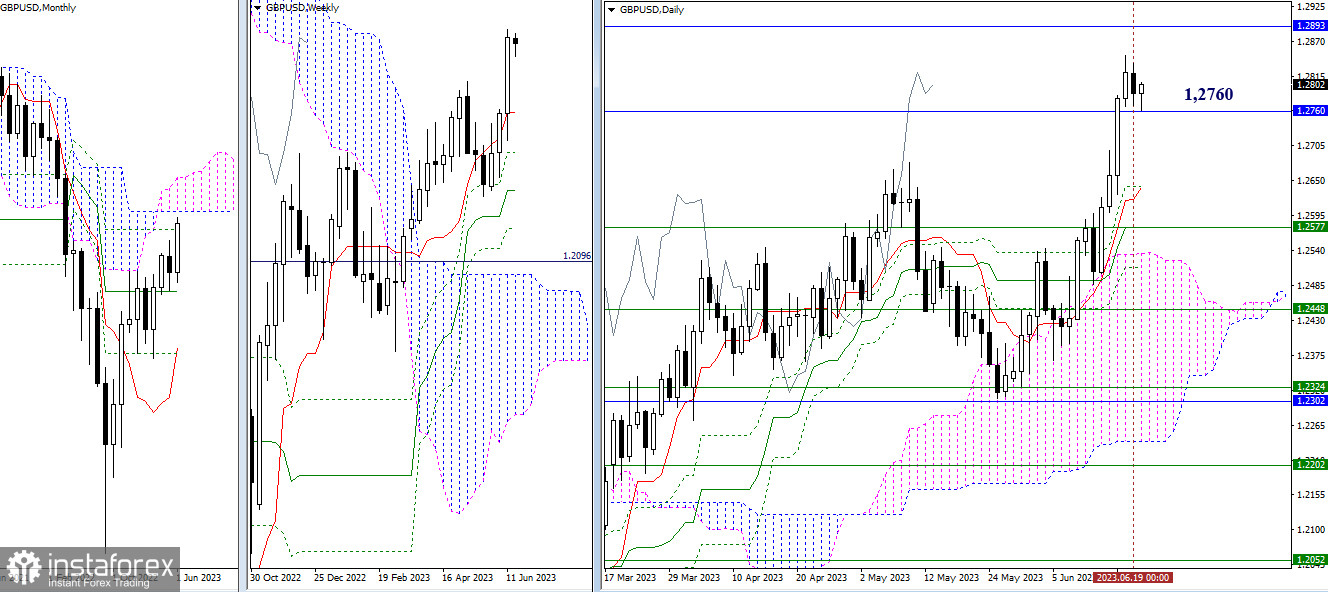

On the daily timeframe, a slowdown was observed yesterday. Bulls took a pause but maintained the monthly support at 1.2760. The next supports in case of further decline are currently the daily short-term trend (1.2639) and the level of 1.2577, where the daily medium-term trend and the weekly short-term trend have merged their efforts. The resistance of the monthly Ichimoku cloud (1.2893 - 1.3141) remains the main target for bullish players.

H4 - H1

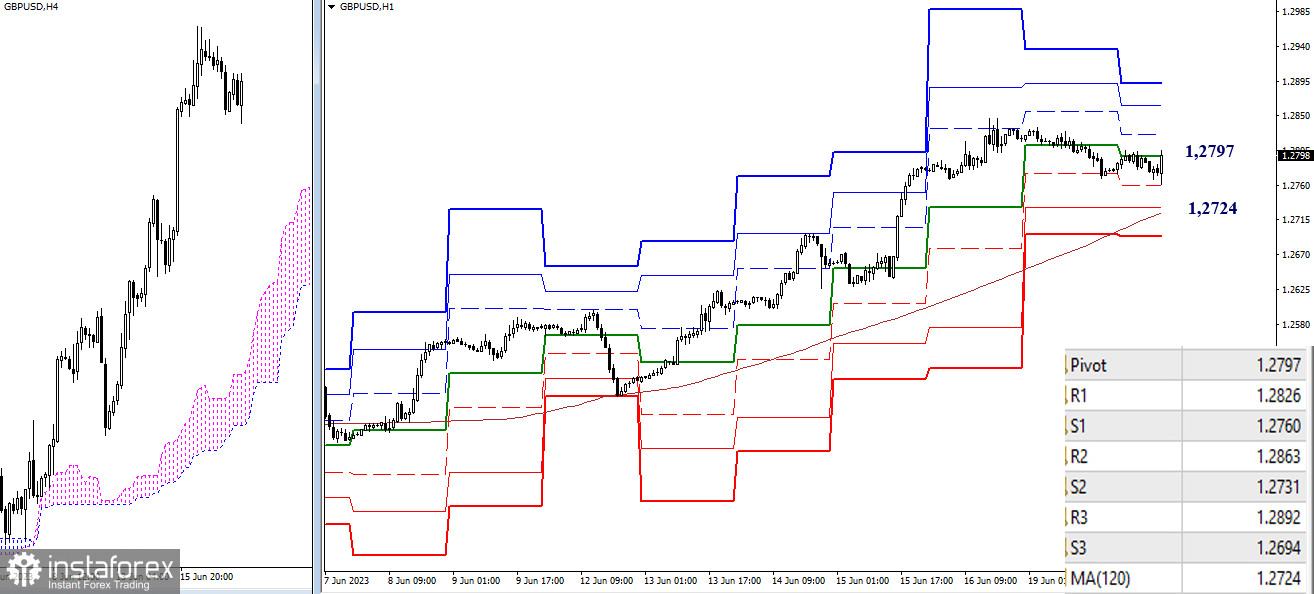

On the lower timeframes, the corrective decline continues. The weekly long-term trend (1.2724) still serves as a key support, and a change in the current balance of power is possible after its loss, while the central pivot point of the day (1.2797) remains the center of attraction for the current correction. In the event of a renewed upward movement, resistance from the classic pivot points (1.2826 - 1.2863 - 1.2892) may come into play within the day.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)