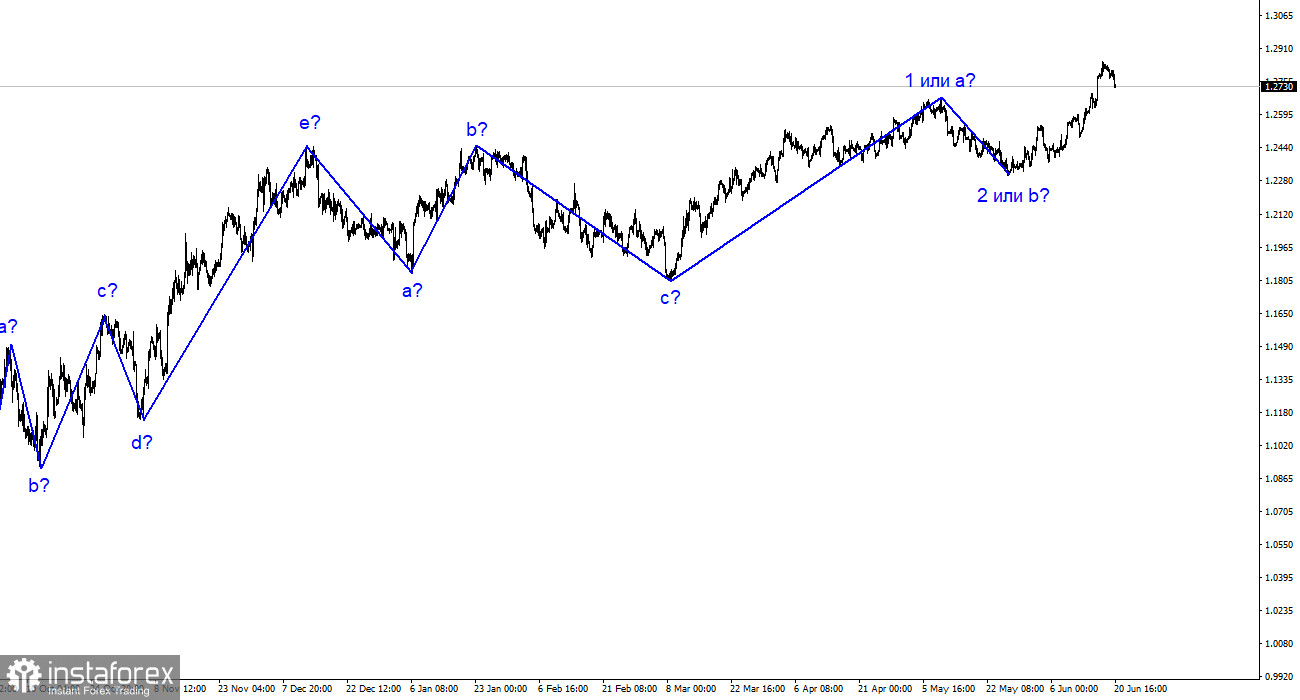

The wave analysis for GBP/USD has unexpectedly shifted to a simpler and more understandable pattern. Instead of a complex corrective trend, we now observe either an upward impulse or a simpler correction. An ongoing formation of an ascending wave 3 or C presents a favorable opportunity for the pound to rise toward the 1.30 level. It is up to individual judgment to determine if the current news background justifies this rise. There is no solid basis for the pound to continue its ascent to 1.30 or 1.35, which would be possible if it were an impulsive segment of the trend. The presumed wave 3 or C has already been completed. While wave analysis can always become more complex, I prefer to rely on its simpler manifestations as they are easier to work with.

Notably, the wave analysis for EUR/USD differs significantly from that of GBP/USD, which is unusual. The euro is expected to exhibit a descending wave structure, while a hypothetical complication of the ascending trend segment for GBP/USD is currently unlikely. Nonetheless, there are similarities between the two pairs as both could begin constructing descending waves.

Demand for the pound has begun to decline, as evidenced by the 40 basis points decrease in the pound/dollar pair on Tuesday. Although this change is minor, expecting further movements without significant news developments is challenging. News is expected to arrive early tomorrow morning, with the release of the UK's inflation report for May. This report can considerably disappoint buyers as inflation is anticipated to slow from 8.7% to 8.4%. Furthermore, the market has likely already factored in the Bank of England's rate hike from last Thursday. Based on these factors, demand for the pound may continue to decrease throughout the week. To generate new demand for the pound, the Bank of England would need to adopt a highly hawkish stance during their meeting on Thursday. However, it is challenging to anticipate stronger hawkish sentiments after 12 rate hikes. The signs point towards the pound, forming a new descending trend segment.

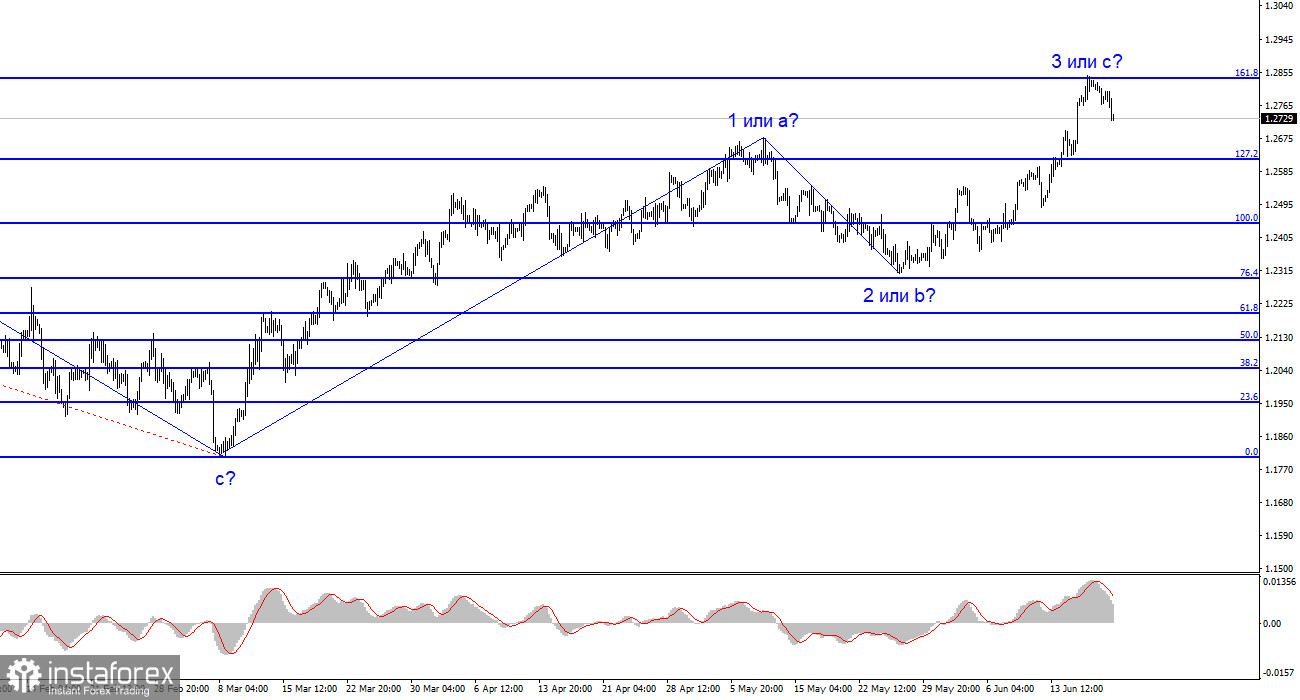

Supporting this scenario is the unsuccessful attempt to break through the 1.2842 level, corresponding to 161.8% according to Fibonacci. This level is quite strong, and the failure to break through indicates a weakening of buyer strength. I recommended considering this level yesterday, and today my hypothesis is confirmed. A new ascending wave can only be expected if a successful breakthrough of 1.2842 exists. At present, the ascending three-wave pattern appears convincing and complete. However, the news background for the pound is not strong enough to sustain the rising demand.

In summary, the wave pattern for the pound/dollar pair has changed, indicating the formation of an ascending wave that could conclude at any moment. Consider buying the pair, but only if there is a successful breakthrough of the 1.2842 level. Considering the previous unsuccessful attempt to break this level, selling is also an option, with a Stop Loss placed above it. However, caution should be exercised on Thursday due to potential market volatility following the Bank of England's meeting.

The pattern resembles the euro/dollar pair on a larger scale, but there are still some differences. The descending corrective segment of the trend has concluded, and there is an ongoing formation of a new ascending segment, which could be completed as early as tomorrow or form a complete five-wave pattern. The third wave could be extended or shortened even if it forms a three-wave pattern.