Once again, the EUR/USD currency pair failed to display any significant movements. Volatility remained minimal, as observed in recent days. While there was a slight downward correction after last week's local highs, the pair has been stagnant for the past three days. The euro still hovers above the moving average line, and we expect a substantial and prolonged downward trend in this currency. However, it remains uncertain whether the market requires a catalyst or if we are experiencing a temporary pause, as is occasionally witnessed. Regardless, the fact remains that market movements are very weak at the moment.

Trading under such conditions poses challenges and inconveniences. Our articles on lower time frames emphasized the importance of medium-term trading, holding each trade for several days or more to capture significant movements. However, the past three days have demonstrated that this trading approach does not yield profitable results even in a nonvolatile and motionless market, particularly when aiming for substantial profits rather than minor gains of 10 points. Consequently, the only course of action now is to wait for the movement to reemerge.

Considering the 24-hour time frame is currently futile since no changes have occurred. The pair briefly returned to the Ichimoku cloud but failed to establish a sustained position above it. The Senkou Span A line is less strong than Senkou Span B, so if the upward movement persists a little longer, surpassing it should pose no significant challenges. Given the euro's overbought condition, we anticipate a decline, at least within the framework of a downward correction, with a target range of 1.05-1.06.

The rhetoric from ECB representatives remains unchanged. Notably, the events on Tuesday, such as the report on approved construction permits in the United States or the speeches by Andrea Enria from the ECB and his colleague Makholm, did not influence market sentiment. On Monday, three speeches by ECB monetary committee members also failed to provide any noteworthy information. It's important to acknowledge that each monetary committee comprises numerous officials who deliver 3-5 speeches per month, amounting to at least 30 speeches collectively. Consequently, it is impractical to expect them to provide new market information in every speech or interview that the market needs to become familiar with. Furthermore, considering the recent ECB meeting, expecting impactful statements from officials would be unfounded.

Therefore, we can only observe that all ECB officials hold a similar view, believing that inflation is excessively high and declining too slowly, necessitating a continued tightening of monetary policy. These perspectives have been well-known to the market for over six months, with ample opportunities and time to incorporate them into the charts. Thus, new insights have yet to be gained.

Consequently, let us return to pair consolidation against a neutral fundamental backdrop, as already anticipated by the market. Essentially, the Fed and the ECB are expected to pursue similar actions for the remainder of the year. As a result, neither the dollar nor the euro holds a distinct advantage. Consolidation implies an extended period of the pair trading within a limited price range. It is not a flat market or characterized by sharp swings. Rather, the market lacks sufficient catalysts to foster a long-term upward or downward trend. Essentially, all movements in 2023 fall under the definition of "consolidation" since the pair has been trading between the levels of 1.05 and 1.11 during this period. Consequently, the pair will continue to remain within this range, with a likelihood of descending toward the lower boundary, given its current proximity to the upper border.

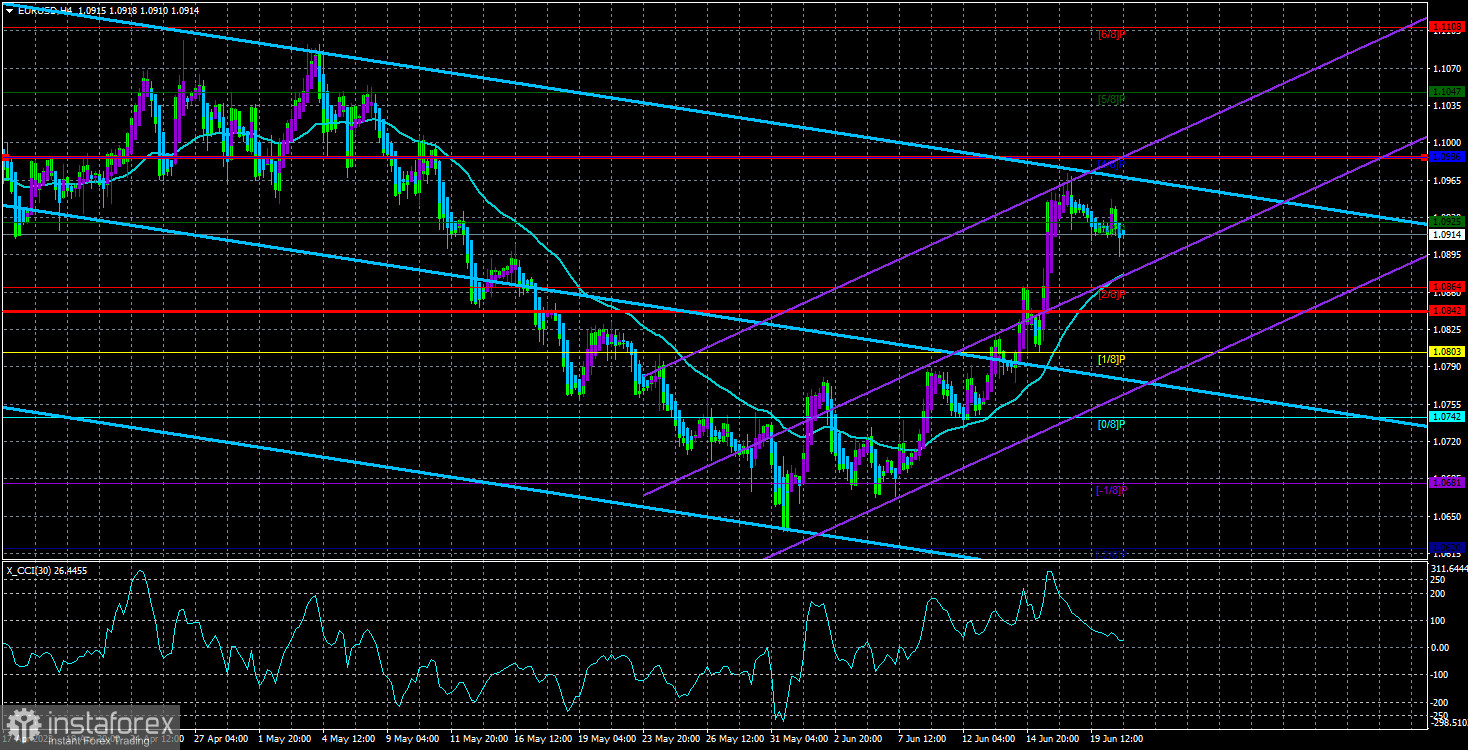

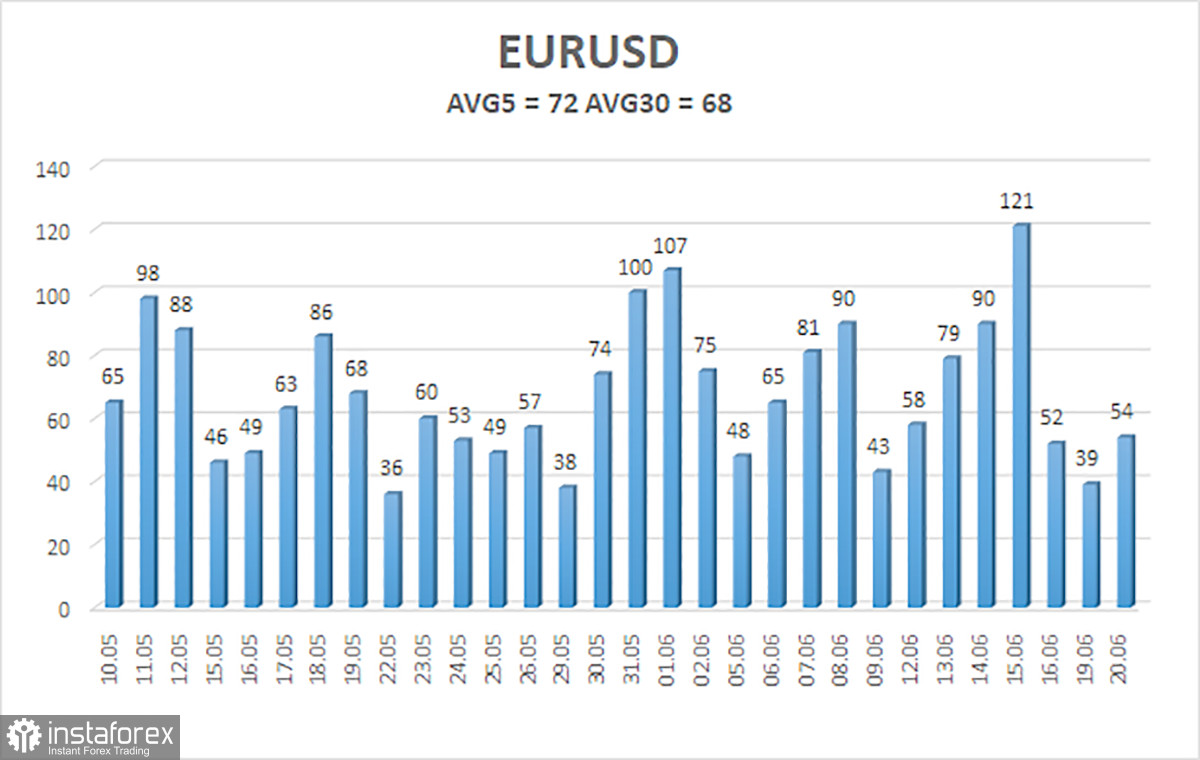

Based on the average volatility of the euro/dollar currency pair over the past five trading days as of June 21st, which stands at 72 points and is considered "average," we anticipate the pair to move between the levels of 1.0842 and 1.0986 on Wednesday. A reversal of the Heiken Ashi indicator upwards will indicate a resumption of the upward movement.

The nearest support levels are as follows:

S1 – 1.0864

S2 – 1.0803

S3 – 1.0742

The nearest resistance levels are as follows:

R1 – 1.0925

R2 – 1.0986

R3 – 1.1047

Trading recommendations:

The EUR/USD pair continues to remain above the moving average line. It is advisable to consider long positions with a target of 1.0986 in the event of a reversal of the Heiken Ashi indicator upwards. Short positions will only become relevant when the price drops below the moving average line, with targets at 1.0842 and 1.0803.

Explanation of illustrations:

Linear regression channels - help determine the current trend. If both channels are aligned in the same direction, it indicates a strong trend.

Moving average line (settings 20,0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair is expected to trade in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or overbought area (above +250) indicates an approaching trend reversal in the opposite direction.