Overview :

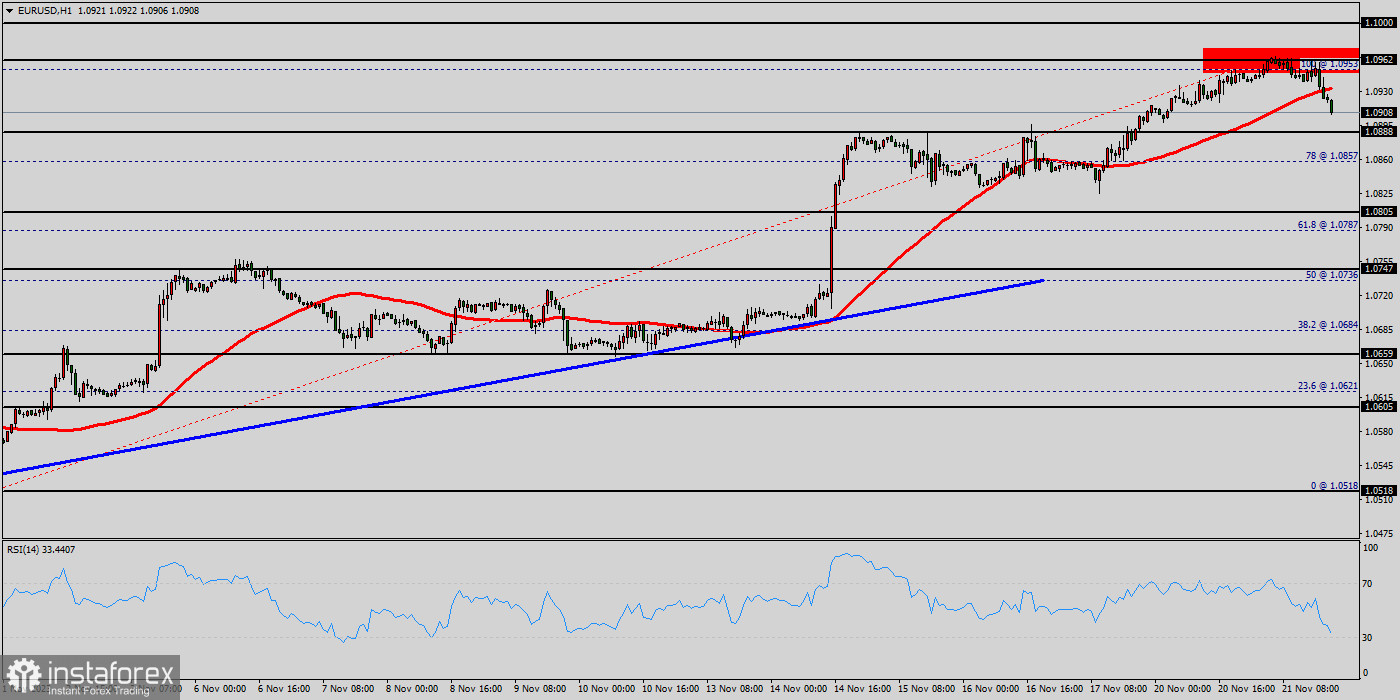

The EUR/USD pair dropped below 1.0953 reaching a fresh daily low during the American session on Tuesday as the US Dollar strengthened, on a relatively quiet session. Today, the Fed will release the minutes of the November 21 policy meeting.

The EUR/USD pair is likely to be among the more active currency pairs this week, which I am expecting to potentially rise to the 1.1000/1.0953 handle amid improved risk sentiment and recent falls in US yields and the US dollar. Although the economic situation in the eurozone remains far from convincing, the market may have gotten ahead of itself with regard to ECB rate cuts being priced in as early as November 2023.

The EUR/USD exchange rate has increased for the second consecutive day, surpassing the 1.0953 level. The upward trend continues as the price remains steady. The bias towards an upward movement persists due to the vulnerability of the US dollar.

Currently, market expectations suggest that the Federal Reserve has completed its interest rate hikes, which continue to weigh on the US dollar. Additionally, it is being driven by stock market gains on Wall Street. The US dollar index (DXY) has dropped by 0.28%, reaching its lowest level since last month. The greenback is still seeking support.

As long as the risk appetite remains strong, the EUR/USD pair has the potential for further gains. However, considering the superior performance of the US economy compared to the Eurozone, fundamental factors still support the US dollar.

Today's continuation of the bullish momentum means the path of least resistance remains to the upside for now, with support now being the area where the EUR/USD pair had struggled in mid-last week, namely around 1.0953 to 1.0805.

The line in the sand now is at 1.0905, today's low. If the EUR/USD pair were to go below that level now, I would then expect to see a correction towards the base of last week's breakout at 1.0805. But this is not my base-case scenario.

Given the growing bullish momentum and price action, a run towards 1.0990 handle looks the more likely scenario from here, than a drop below 1.0800. New targets 1.0747 and 1.0659.