Over the past few days, we have witnessed a significant decrease in trading activity in the crypto market and a rise in bearish sentiment. Despite this, Bitcoin managed to recover locally to the $26.5k level and subsequently retest $27.5k. This process took place with growing volumes, which is always a sign of a sustainable upward movement.

Yesterday, trading opened on the U.S. financial markets, which allowed for a substantial increase in bullish volumes. As a result, in the second half of the day, the price of Bitcoin began a rapid and powerful upward movement towards the $28.4k level. After the close of the trading session, bullish volumes continued to grow, leading the asset to reach $29.2k.

Surge in Interest in BTC

The overall decrease in trading activity prior to the bullish impulse significantly exacerbated bearish sentiment in the Bitcoin market. The situation was further complicated by legal disputes between the SEC and crypto exchanges, as well as the classification of major digital assets from the top 15 in market capitalization as securities.

Despite the overall negative backdrop, the SEC's actions primarily targeted altcoins. This allowed BTC to attract investors and increase its dominance from 46% to 50% in the last five days. Considering such a sharp increase in Bitcoin dominance, it can be argued that investment interest in cryptocurrencies is gradually focusing on the BTC market. This enables the asset to reach local highs.

Bitcoin whales have also become significantly more active in the past week. It is reported that large addresses holding from 1,000 to 10,000 BTC have increased their reserves by 60,000 BTC. This process began simultaneously with the injection of over $250 million USDT into the crypto market.

Smaller investors also continue to actively accumulate BTC. Glassnode reports that "shrimps" and "fish" are acquiring over 2,200 BTC coins per day. As we can see, a phase of impulsive upward movement was preceded by an equally rapid campaign of BTC accumulation.

BTC\USD Outlook Analysis

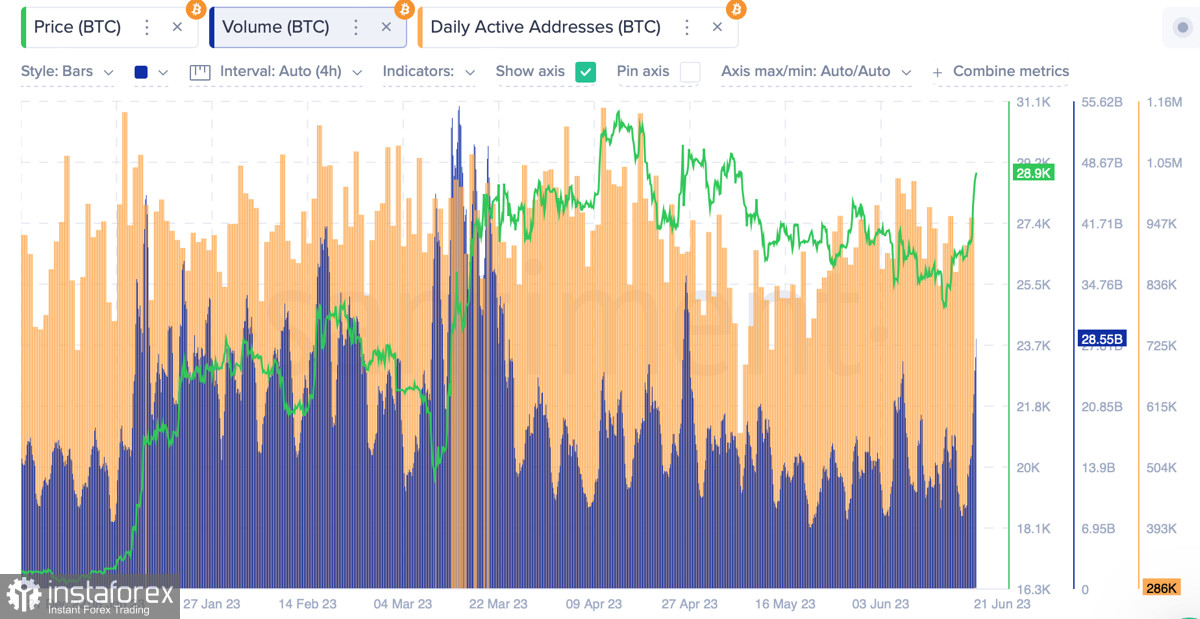

As of 12:00 UTC, Bitcoin is trading near the $28.9k level with a daily trading volume of $28 billion. Despite a significant increase in bearish activity, the price has come close to the $29k level. This indicates that buyers are able to absorb bearish volumes and sustain the bullish price movement.

With such dynamics maintained, BTC/USD will continue its upward movement and potentially break through the $29k level. By the end of today's trading day, the asset will likely test $29.5k. Despite the bullish sentiment, there are reasons to believe that near the $29.5k level, seller positions will significantly strengthen.

On the daily chart, we are already seeing a gradual decrease in buying activity. The stochastic oscillator is gradually moving flat, indicating a potential decrease in trading activity. Considering this, the main target for the bulls will be to establish a foothold above the $29k level to develop the bullish trend towards $30k.

Conclusion

Bitcoin has entered an active phase of upward movement after weeks of accumulating necessary volumes and two months of consolidation. Determining the medium-term targets for BTC is difficult, as in conditions of increased volatility, the bullish impulse can be fully or partially negated. It will all depend on the speed and success of achieving short-term targets, specifically the consolidation above the $29–$29.5k range.