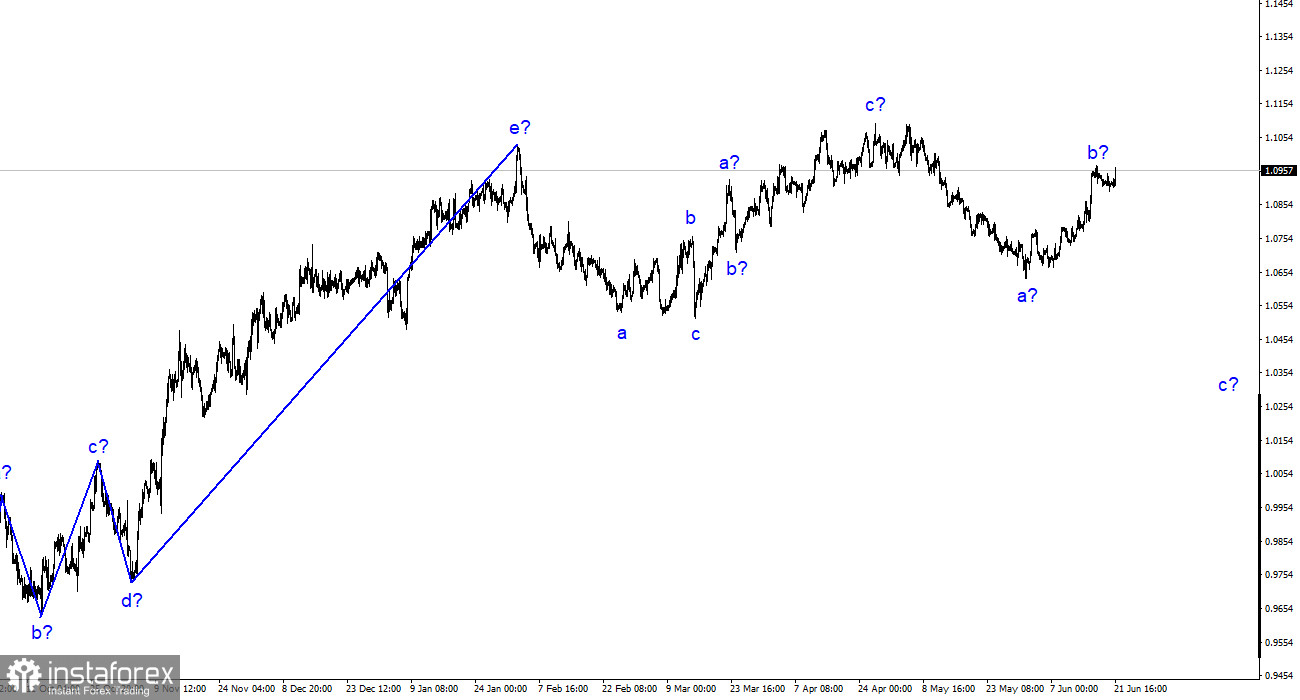

The wave analysis of the 4-hour chart for the euro/dollar pair remains somewhat unconventional but comprehensible. The quotes distance themselves from previous lows, indicating a potential wave b formation. While the overall upward trend initiated on March 15 could theoretically adopt a more complex structure, my current expectation is a three-wave downward segment within the trend. In recent weeks, I consistently mentioned the possibility of the pair hovering around the 1.5-figure, where the initial upward three-wave pattern commenced. This viewpoint remains unchanged.

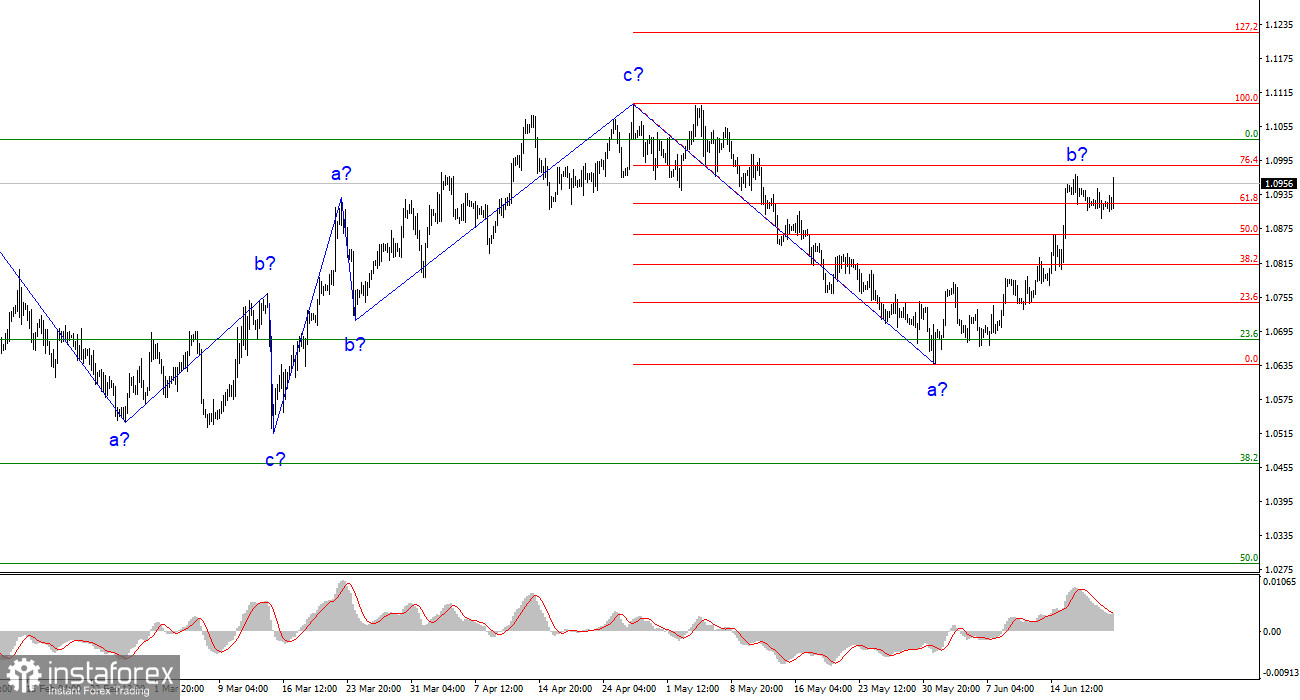

The recent peak of the trend segment was only slightly higher than the previous upward segment's peak. Since December of the preceding year, the pair's movement has been predominantly horizontal, and I anticipate this trend to persist. The presumed wave b, which may have been initiated on May 31, appears convincing and could conclude soon, given its clear display of three internal waves and elongated shape.

Peter Kazimir, a member of the ECB Governing Council, expressed doubt regarding a rate hike in September. On Wednesday, the euro/dollar pair recorded a 40 basis point increase, primarily influenced by Jerome Powell's speech in Congress. However, a detailed analysis of this event will be covered in subsequent articles due to the abundance of news requiring analysis. Kazimir's skepticism arises despite the rate's eighth consecutive 25 basis point increase the previous week. While the market expects another 25-point hike at the next meeting, significant uncertainties surround the September gathering.

It is worth recalling that the ECB embarked on a tightening path later than the Bank of England and the Federal Reserve, initially at a slower pace. The ECB's rate remains lower than its American and British counterparts. Many analysts, including myself, doubt the rate substantially surpassing 4.25%. The economic condition of the European Union is only conducive to further tightening with the risk of a recession. Kazimir mentioned that gaining control over core inflation is a prerequisite for completing the tightening process, though he did not elaborate on its specifics. He also noted that ending the sale of securities from the central bank's balance sheet is not currently under consideration. I interpret Kazimir's statements as cautionary signs for the European currency.

Based on the conducted analysis, it can be concluded that the formation of a new downward segment within the trend persists. The pair exhibits notable potential for further decline. Targets around 1.0500-1.0600 remain realistic, and I recommend selling the pair with these targets in mind. The completion of wave b appears probable, especially considering the "down" signal generated by the MACD indicator. Selling with a stop loss positioned above the current peak of the presumed wave b is a viable option.

On a broader scale, the wave analysis of the upward trend segment indicates an extended formation, likely reaching completion. Five upward waves, presumably forming an a-b-c-d-e structure, have been observed. The pair subsequently underwent two three-wave movements, one downward and the other upward. It is likely in the process of developing another descending three-wave structure.