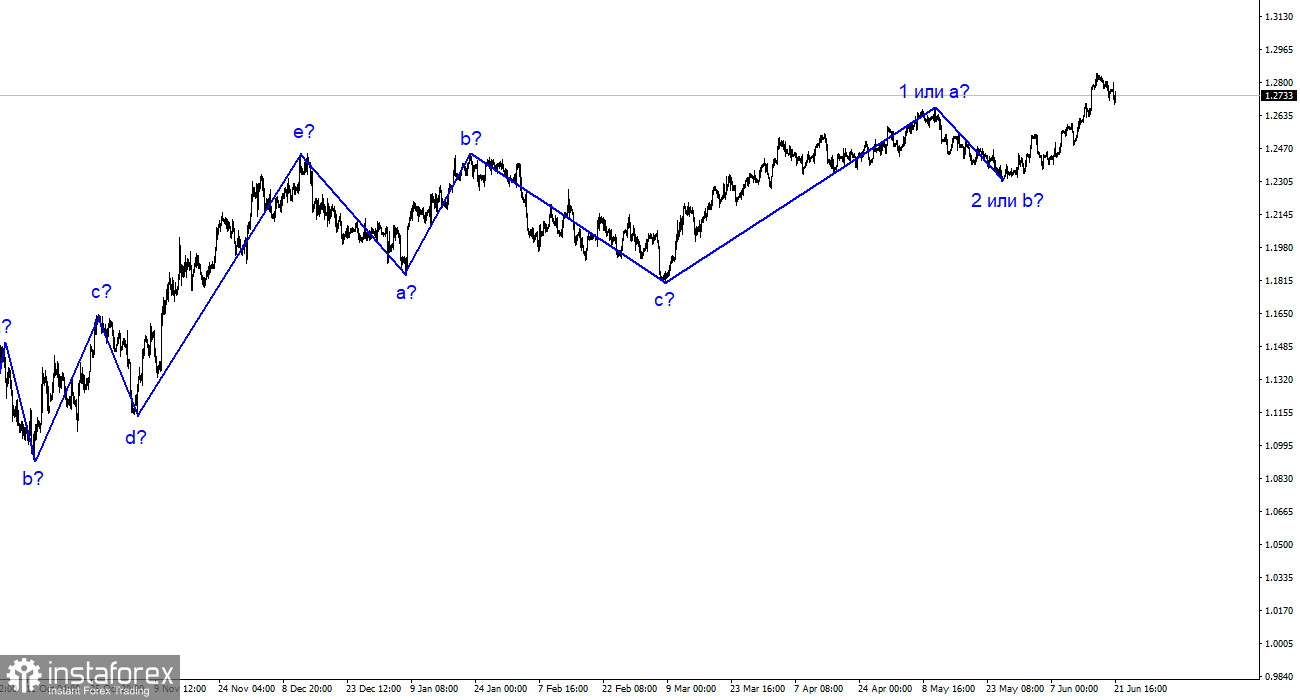

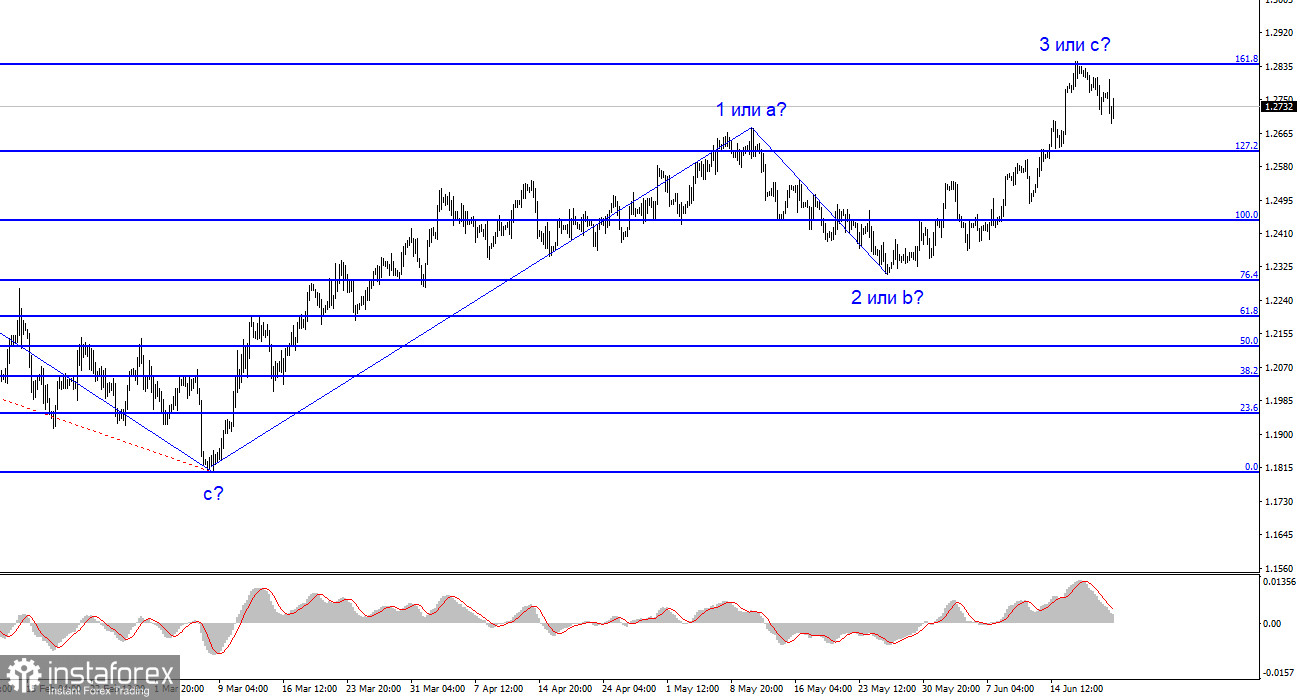

The wave analysis for GBP/USD has unexpectedly transformed into a simpler form. Instead of a complex corrective phase, there is a possibility of an impulsive upward wave or a simpler correction. Currently, an ascending wave 3 or c is being constructed, providing an opportunity for the British pound to rise towards the 1.30 level. However, whether this rise is justified by the current news background is subject to interpretation. From my perspective, there is no basis for the British pound to continue rising to the 1.30 or 1.35 level, unless it pertains to an impulsive phase of the trend. It is also possible that the presumed wave 3 or c has already concluded. Wave analysis can always become more complex, but I prefer to rely on simpler manifestations as they are easier to work with.

It is worth noting that the wave analysis for EUR/USD significantly differs from that of GBP/USD, which is a rare occurrence. The euro is expected to undergo a descending wave pattern, while the complication of the ascending phase of the trend for the British pound is currently unlikely. However, both pairs may start constructing descending waves.

The demand for the British pound continues to decline. Although it declined by 40 basis points on Wednesday, this drop is not significant. The British pound is consistently losing 20-40 points daily, making it uncertain whether wave 3 or c has been completed. The 161.8% Fibonacci level is the only reference point to consider, and since attempts to surpass it have been unsuccessful, there is a possibility that this wave has concluded.

The news background on the given day was not extensive but highly significant. The consumer price index in the UK confirmed the long-standing knowledge that inflation remains excessively high with minimal signs of deceleration, despite the efforts of the Bank of England. In May, inflation remained unchanged at 8.7% y/y, with a monthly increase of 0.7% compared to the market expectation of 0.5%. Core inflation accelerated to 7.1%, surpassing the market anticipation of 6.8%. On a monthly basis, this indicator reached 0.8% against lower forecasts.

While all four indicators essentially depict the same trend, I consider them disappointing reports. They are disappointing not only for the British pound but especially for the Bank of England, as their twelve rate hikes have failed to reduce inflation even by half. Inflation remains close to 10%. If at least core inflation showed a slowdown, these reports could be interpreted as moderately optimistic. However, tomorrow the Bank of England plans to raise the rate by another 25 basis points, and the hope is that inflation will finally begin to decelerate as expected by the central bank.

In summary, the wave pattern for GBP/USD has changed, indicating the construction of an ascending wave that could conclude soon. It is advisable to consider buying the pair only if it successfully breaks through the 1.2842 level. Selling is also an option since the first attempt to break through this level was unsuccessful, and the stop-loss should be set above it.

On a larger scale, the wave pattern resembles that of EUR/USD, but there are still some differences. The descending corrective phase of the trend has ended, and a new ascending phase is underway, which could conclude either tomorrow or develop into a complete five-wave structure. Even if it takes a three-wave form, the third wave could be extended or truncated.