Analyzing Wednesday's trades:

EUR/USD on 30M chart

The bullish shift in EUR/USD started on Wednesday after a three-day pause. Honestly, even now, it is very difficult to say why the euro has once again turned bullish. The only relatively important event for the pair was Federal Reserve Chairman Jerome Powell's speech to the US Congress. In this speech, Powell stated that interest rates will continue to rise as inflation is still far from the target level. Of course, Powell did not limit himself to just that statement. He also mentioned that the economy will face negative consequences from monetary tightening, but which country doesn't? He noted that unemployment may begin to rise, but he has been saying that for a while, and the indicator has not been increasing. In general, we can only say that Powell's speech cannot be considered dovish. And if that's the case, then in the worst-case scenario, the dollar simply should not have weakened. But once again, the market decided otherwise.

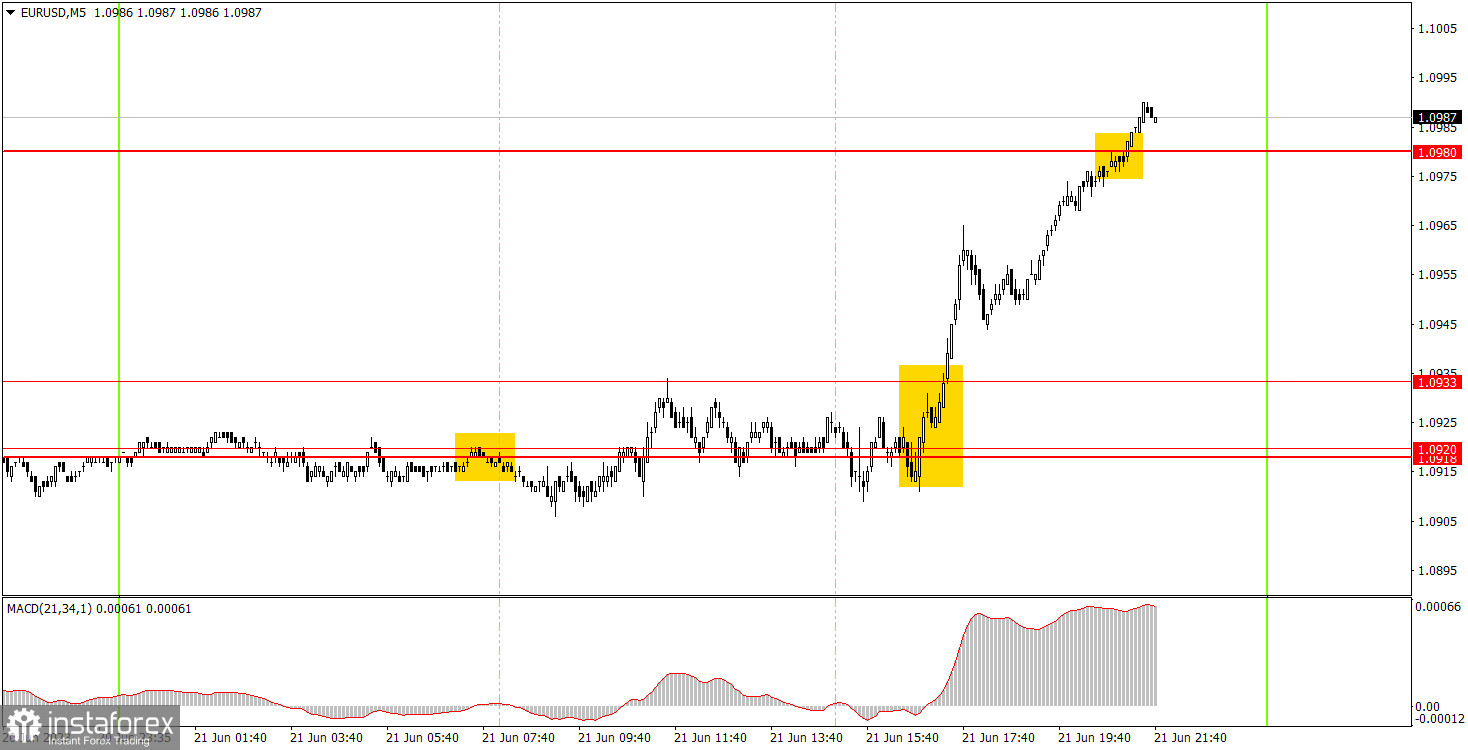

EUR/USD on 5M chart

On the 5-minute chart, the pair remained stagnant during the European trading session. The first trading signal formed at the session's opening and should not have been executed. At that time, everything was pointing to the pair going through low volatility and volume, and it was only in the second half of the day that a strong upward movement began. Therefore, the potential loss clearly outweighed the potential profit from a short position. During the US trading session, a buy signal formed, which could have been executed considering that the pair started to rise sharply, and the content of Powell's speech was not yet known. Profit should have been taken closer to the evening, which amounted to around 35 pips.

Trading tips on Thursday:

On the 30M chart, the pair continues to follow an uptrend. In the medium term, we expect the euro to fall again, but it may take quite a long time before the downtrend returns to the market. As long as the price does not consolidate below the channel, there is no point in expecting the euro's decline. The key levels on the 5M chart are 1.0733, 1.0761, 1.0803, 1.0857-1.0867, 1.0918-1.0933, 1.0980, 1.1038, 1.1070, 1.1132. A stop loss can be set at a breakeven point as soon as the price moves 15 pips in the right direction. On Thursday, there will be another speech by Luis de Guindos in the European Union, and Powell will have a second appearance in Congress in the United States. Additionally, a secondary report on unemployment claims will be published.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.