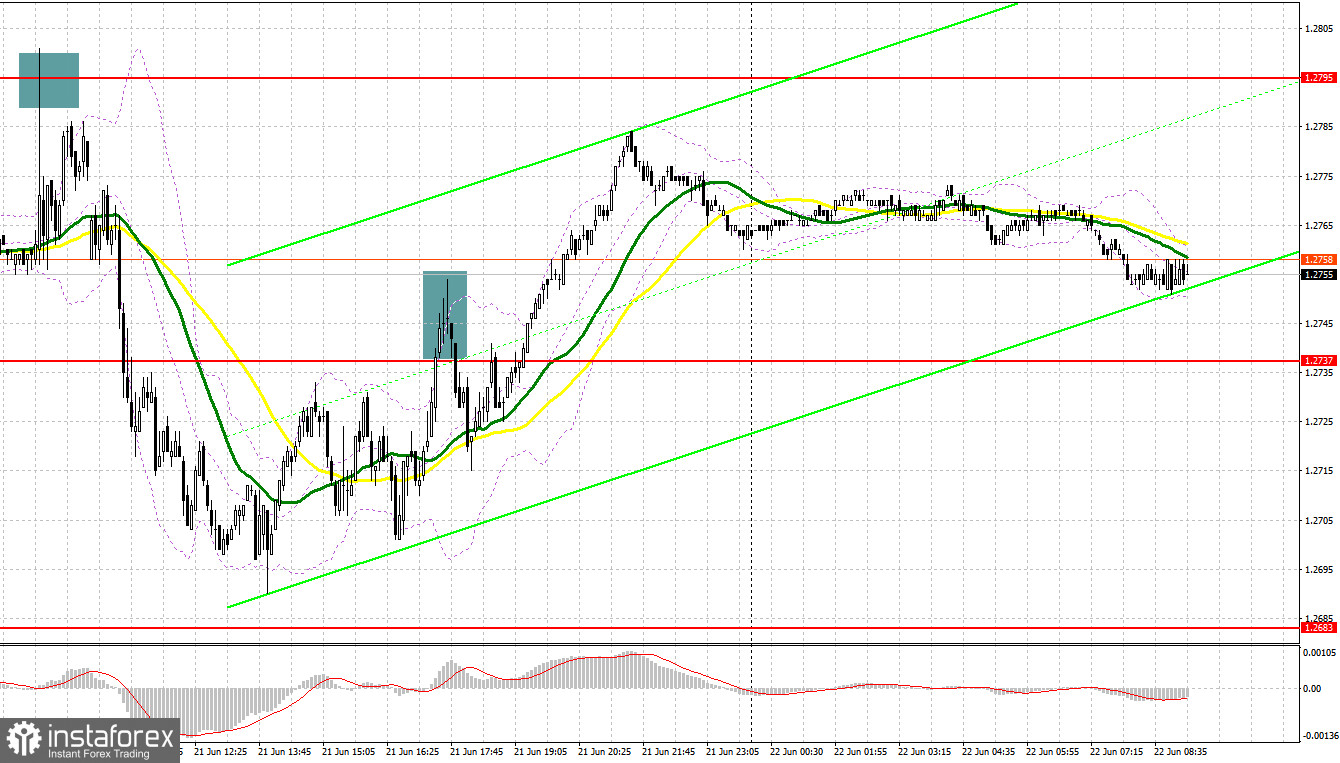

Yesterday, there were several trading signals. Now, let's look at the 5-minute chart and figure out what actually happened. In my morning article, I turned your attention to 1.2795 and recommended making decisions with this level in focus. A rise and a false breakout of this level led to a sell signal, which resulted in a drop of more than 90 pips. In the afternoon, an unsuccessful consolidation above 1.2737 triggered another sell signal, but the downward movement was only about 20 pips.

When to open long positions on GBP/USD:

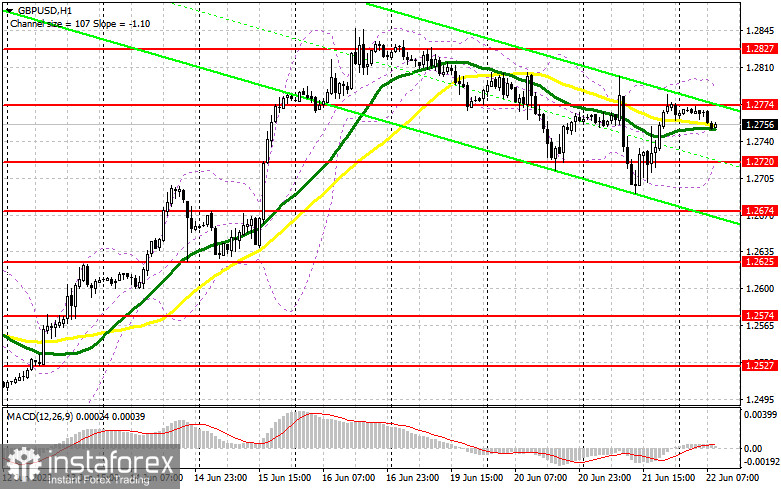

The inflation data boosted the pound sterling only for a short period of time. After that, the pair sank significantly. However, bulls took advantage of the moment and opened long positions on a decline expecting a rate hike by the Bank of England today. There are rumors that the regulator may raise the key rate by 0.5% at once, which will lead to a sharp rise. In the meantime, the pair is in the correction phase after yesterday's growth. One should pay attention to the support level of 1.2720. A false breakout of this level may take place, giving a buy signal. The pair is likely to recover to the resistance level of 1.2774, formed yesterday. The pound sterling needs to consolidate at this level. A breakout and consolidation above this level will provide an additional buy signal with a jump to a high of 1.2827, which could only bolster the uptrend. A more distant target will be the 1.2876 level where I recommend locking in profits.

If the pair declines to 1.2720 and bulls show no activity, the pressure on the pound will increase markedly which may lead to a strong downward movement to the weekly low of 1.2674. If bulls defend this level and there is a false breakout, it could create new positions for long positions. You could buy GBP/USD at a bounce from 1.2625, keeping in mind an upward intraday correction of 30-35 pips.

When to open short positions on GBP/USD:

Yesterday, bears failed to maintain control although the pair fell considerably in the morning. Now, the pair is flat before the Bank of England meeting. Today, the economic calendar for the UK is empty. Sellers need to defend 1.2774. A false breakout of this level may give a sell signal. However, a sharp decline from this level will depend on the results of the meeting. A breakout and an upward retest of 1.2720 will force bulls to close long positions, returning pressure on GBP/USD. It could also provide a sell signal with a correction to 1.2674. A more distant target will be a low of 1.2625 where I recommend locking in profits.

If GBP/USD rises and bears fail to protect 1.2774, the downward correction will end. Bulls will regain control of the market. the pair could climb to monthly highs. In this case, I would advise you to postpone short positions until a false breakout of the resistance level of 1.2827. A false breakout there will give an entry point into short positions. If there is no downward movement there, you could sell GBP/USD at a bounce from 1.2876, keeping in mind a downward intraday correction of 30-35 pips.

COT report

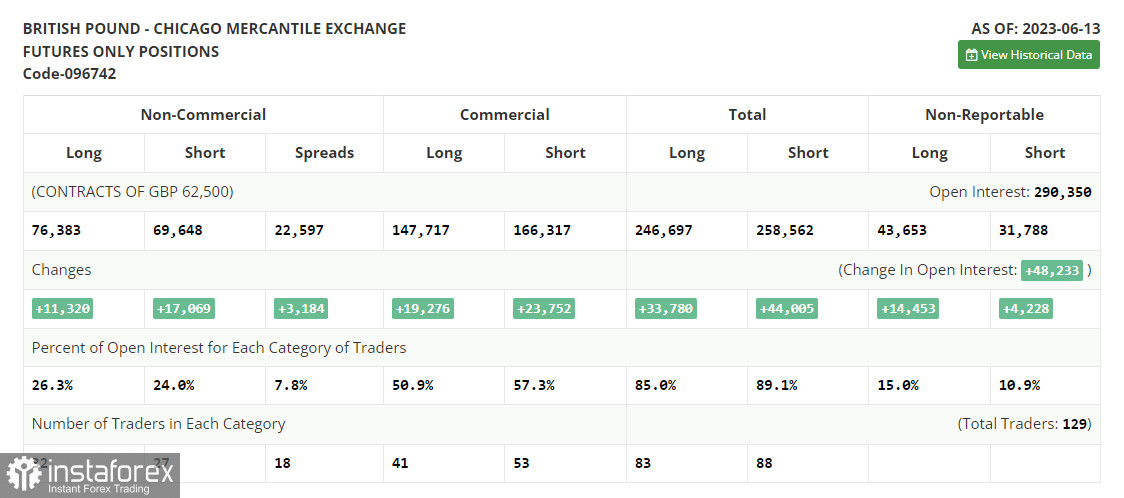

According to the COT report (Commitment of Traders) for June 13, there was a sharp increase in long and short positions. The pound sterling has grown markedly recently. As a rest, sellers began to enter the market. However, the BoE's aggressive tightening and the latest inflation data boosted an upward movement. Traders are betting on new rate hikes. The fact that the Fed skipped a rate hike in its tightening cycle. However, the Bank of England will hardly take a pause. It spurs demand for the pound sterling. The latest COT report showed that short non-profit positions rose by 17,069 to 69,648, while long non-profit positions jumped by 11,320 to 76,383. This led to a slight decrease in the non-commercial net position to 6,736 against 12,454 a week earlier. The weekly price climbed to 1.2605 against 1.2434.

Indicators' signals:

Trading is carried out near the 30 and 50 daily moving averages, which indicates market uncertainty.

Moving averages

Note: The period and prices of moving averages are considered by the author on the H1 (1-hour) chart and differ from the general definition of the classic daily moving averages on the daily D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border at 1.2720 will serve as support.

Description of indicators

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 50. It is marked yellow on the chart.

- Moving average (moving average, determines the current trend by smoothing out volatility and noise). Period 30. It is marked green on the chart.

- MACD indicator (Moving Average Convergence/Divergence - convergence/divergence of moving averages) Quick EMA period 12. Slow EMA period to 26. SMA period 9

- Bollinger Bands (Bollinger Bands). Period 20

- Non-commercial speculative traders, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between the short and long positions of non-commercial traders.